Pfizer 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

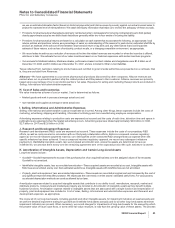

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

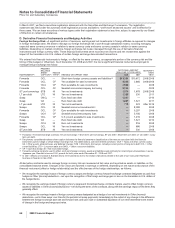

From the beginning of the cost-reduction and transformation initiatives in 2005 through December 31, 2008, the restructuring

charges primarily relate to our supply network transformation efforts and the restructuring of our worldwide marketing and research

and development operations, and the implementation costs primarily relate to accelerated depreciation of certain assets, as well as

system and process standardization and the expansion of shared services.

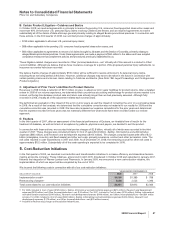

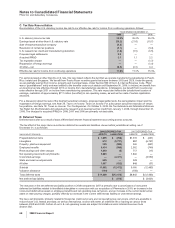

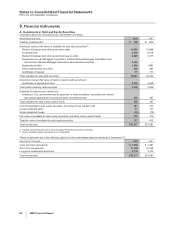

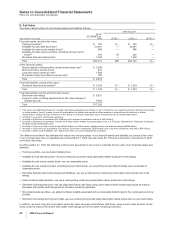

The components of restructuring charges associated with all of our cost-reduction initiatives follow:

COSTS INCURRED

ACTIVITY

THROUGH

DECEMBER 31,

ACCRUAL

AS OF

DECEMBER 31,

(MILLIONS OF DOLLARS) 2008 2007 2006 2005-2008 2008(a) 2008(b)

Employee termination costs $2,004 $2,034 $ 809 $5,150 $3,045 $2,105

Asset impairments 543 260 368 1,293 1,293 —

Other 79 229 119 440 390 50

Total $2,626 $2,523 $1,296 $6,883 $4,728 $2,155

(a) Includes adjustments for foreign currency translation.

(b) Included in Other current liabilities ($1.5 billion) and Other noncurrent liabilities ($636 million).

From the beginning of the cost-reduction and transformation initiatives in 2005 through December 31, 2008, Employee termination

costs represent the expected reduction of the workforce by approximately 30,700 employees, mainly in manufacturing, sales and

research; and approximately 19,500 of these employees have been terminated. Employee termination costs are recorded when the

actions are probable and estimable and include accrued severance benefits, pension and postretirement benefits. Asset

impairments primarily include charges to write down property, plant and equipment. Other primarily includes costs to exit certain

activities.

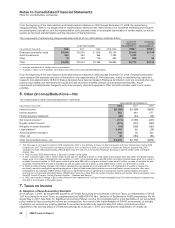

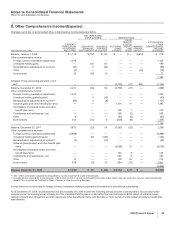

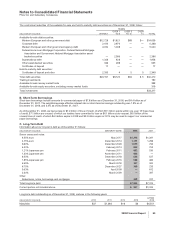

6. Other (Income)/Deductions—Net

The components of Other (income)/deductions—net follow:

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2008 2007 2006

Interest income $(1,288) $(1,496) $(925)

Interest expense 562 440 517

Interest expense capitalized (46) (43) (29)

Net interest income(a) (772) (1,099) (437)

Royalty-related income(b) (673) (224) (395)

Net gains on asset disposals(c) (14) (326) (280)

Legal matters(d) 3,300 46 (29)

Asset impairment charges(e) 143 28 320

Other, net 48 (184) (83)

Other (income)/deductions—net $ 2,032 $(1,759) $(904)

(a) The decrease in net interest income in 2008 compared to 2007 is due primarily to lower net financial assets and lower interest rates during 2008

compared to 2007. The increase in net interest income in 2007 compared to 2006 is due primarily to higher net financial assets during 2007

compared to 2006, reflecting proceeds of $16.6 billion from the sale of our Consumer Healthcare business in late December 2006, and higher

interest rates.

(b) In 2008, includes $425 million related to the sale of certain royalty rights.

(c) In 2007, includes a gain of $211 million related to the sale of a building in Korea. In 2008, gross realized gains were $20 million and gross realized

losses were nil on sales of available-for-sale securities. In 2007, gross realized gains were $8 million and gross realized losses were nil on sales of

available-for-sale securities. In 2006, gross realized gains were $65 million and gross realized losses were $1 million on sales of available-for-sale

securities. Proceeds from the sale of available-for-sale securities were $2.2 billion in 2008, $663 million in 2007 and $79 million in 2006.

(d) In 2008, primarily includes charges of $2.3 billion resulting from an agreement in principle with the U.S. Department of Justice to resolve the

previously reported investigation regarding allegations of past off-label promotional practices concerning Bextra, as well as certain other open

investigations, and charges of $900 million related to our agreements and our agreements in principle to resolve certain litigation and claims

involving our non-steroidal anti-inflammatory (NSAID) pain medicines. (See Note 4A. Certain Charges: Bextra and Certain Other Investigations and

Note 4B. Certain Charges: Certain Product Litigation – Celebrex and Bextra.)

(e) In 2006, we recorded a charge of $320 million related to the impairment of our Depo-Provera intangible asset, for which amortization expense was

included in Amortization of intangible assets.

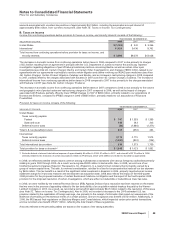

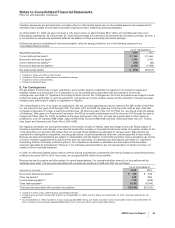

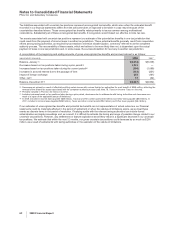

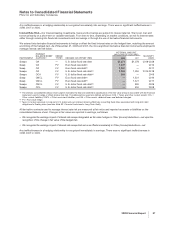

7. Taxes on Income

A. Adoption of New Accounting Standard

As of January 1, 2007, we adopted the provisions of FIN 48, Accounting for Uncertainty in Income Taxes, an interpretation of SFAS

109, Accounting for Income Taxes, as supplemented by FASB FSP FIN 48-1, Definition of Settlement in FASB Interpretation No. 48,

issued May 2, 2007. See Note 1O. Significant Accounting Policies: Income Tax Contingencies for a full description of our accounting

policy related to the accounting for income tax contingencies. As a result of the implementation of FIN 48, as amended, at the date

of adoption, we reduced our existing liabilities for uncertain tax positions by approximately $11 million, recorded as a direct

adjustment to the opening balance of Retained earnings as of January 1, 2007, and changed the classification of virtually all

58 2008 Financial Report