Pfizer 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

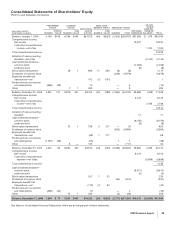

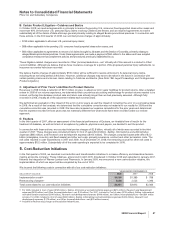

Consolidated Statements of Shareholders’ Equity

Pfizer Inc and Subsidiary Companies

PREFERRED

STOCK

COMMON

STOCK ADDITIONAL

PAID-IN

CAPITAL

EMPLOYEE

BENEFIT TRUST TREASURY STOCK

RETAINED

EARNINGS

ACCUM.

OTHER

COMPRE-

HENSIVE

INC./(EXP.) TOTAL

(MILLIONS, EXCEPT

PREFERRED SHARES) SHARES

STATED

VALUE SHARES

PAR

VALUE SHARES

FAIR

VALUE SHARES COST

Balance, January 1, 2006 4,193 $169 8,784 $439 $67,759 (40) $(923) (1,423) $(39,767) $37,608 $ 479 $65,764

Comprehensive income:

Net income 19,337 19,337

Total other comprehensive

income—net of tax 1,192 1,192

Total comprehensive income 20,529

Adoption of new accounting

standard—net of tax (2,140) (2,140)

Cash dividends declared—

common stock (7,268) (7,268)

preferred stock (8) (8)

Stock option transactions 28 1 896 11 286 (6) (8) 1,175

Purchases of common stock (266) (6,979) (6,979)

Employee benefit trust

transactions—net 152 (1) (151) 1

Preferred stock conversions

and redemptions (696) (28) 12 — 6 (10)

Other 7 1 285 — 8 294

Balance, December 31, 2006 3,497 141 8,819 441 69,104 (30) (788) (1,695) (46,740) 49,669 (469) 71,358

Comprehensive income:

Net income 8,144 8,144

Total other comprehensive

income—net of tax 2,768 2,768

Total comprehensive income 10,912

Adoption of new accounting

standard 11 11

Cash dividends declared—

common stock (8,156) (8,156)

preferred stock (8) (8)

Stock option transactions 23 1 738 5 121 — (7) 853

Purchases of common stock (395) (9,994) (9,994)

Employee benefit trust

transactions—net (49) 1 117 68

Preferred stock conversions

and redemptions (1,195) (48) (25) 1 5 (68)

Other 8 — 145 — (111) 34

Balance, December 31, 2007 2,302 93 8,850 442 69,913 (24) (550) (2,089) (56,847) 49,660 2,299 65,010

Comprehensive income:

Net income 8,104 8,104

Total other comprehensive

expense—net of tax (6,868) (6,868)

Total comprehensive income 1,236

Cash dividends declared—

common stock (8,617) (8,617)

preferred stock (5) (5)

Stock option transactions 207 1 32 239

Purchases of common stock (26) (500) (500)

Employee benefit trust

transactions—net (113) (1) 93 (20)

Preferred stock conversions

and redemptions (498) (20) (7) — 2 (25)

Other 13 1 283 (2) (46) 238

Balance, December 31, 2008 1,804 $ 73 8,863 $443 $70,283 (24) $(425) (2,117) $(57,391) $49,142 $(4,569) $57,556

See Notes to Consolidated Financial Statements, which are an integral part of these statements.

2008 Financial Report 49