Pfizer 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc and Subsidiary Companies

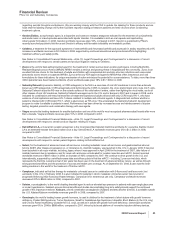

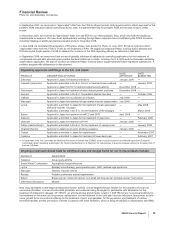

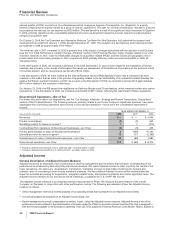

Adjusted income as shown above excludes the following items:

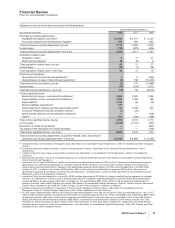

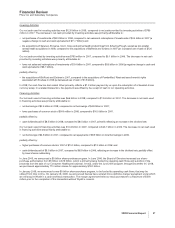

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2008 2007 2006

Purchase accounting adjustments:

Intangible amortization and other(a) $ 2,546 $ 3,101 $ 3,220

In-process research and development charges(b) 633 283 835

Total purchase accounting adjustments, pre-tax 3,179 3,384 4,055

Income taxes (740) (873) (924)

Total purchase accounting adjustments—net of tax 2,439 2,511 3,131

Acquisition-related costs:

Integration costs(c) 617 21

Restructuring charges(c) 43 (6) 6

Total acquisition-related costs, pre-tax 49 11 27

Income taxes (10) (1) (13)

Total acquisition-related costs—net of tax 39 10 14

Discontinued operations:

(Income)/loss from discontinued operations(d) 35 (643)

(Gains)/losses on sales of discontinued operations(d) (6) 168 (10,243)

Total discontinued operations, pre-tax (3) 173 (10,886)

Income taxes (75) (104) 2,573

Total discontinued operations—net of tax (78) 69 (8,313)

Certain significant items:

Restructuring charges—cost-reduction initiatives(c) 2,626 2,523 1,296

Implementation costs—cost-reduction initiatives(e) 1,605 1,389 788

Legal matters(f) 3,249 56 (15)

Returns liabilities adjustment(g) 217 ——

Asset impairment charges and other associated costs(h) 213 2,798 320

Consumer Healthcare business transition activity(i) (7) (26) —

sanofi-aventis research and development milestone(j) —— (118)

Other(k) 187 (230) (158)

Total certain significant items, pre-tax 8,090 6,510 2,113

Income taxes (2,228) (2,131) (735)

Resolution of certain tax positions(l) —— (441)

Tax impact of the repatriation of foreign earnings(l) —— (124)

Total certain significant items—net of tax 5,862 4,379 813

Total purchase accounting adjustments, acquisition-related costs, discontinued

operations and certain significant items—net of tax $ 8,262 $ 6,969 $ (4,355)

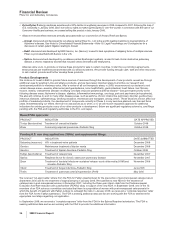

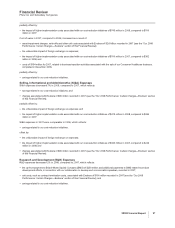

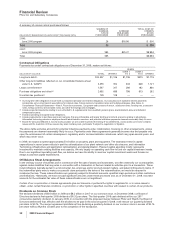

(a) Included primarily in Amortization of intangible assets. (See Notes to Consolidated Financial Statements—Note 12. Goodwill and Other Intangible

Assets.)

(b) Included in Acquisition-related in-process research and development charges. (See Notes to Consolidated Financial Statements—Note 2.

Acquisitions.)

(c) Included in Restructuring charges and acquisition-related costs. (See Notes to Consolidated Financial Statements—Note 5. Cost-Reduction

Initiatives.)

(d) Discontinued operations—net of tax is primarily related to our Consumer Healthcare business. (See Notes to Consolidated Financial Statements—

Note 3. Discontinued Operations.)

(e) Included in Cost of sales ($745 million), Selling, informational and administrative expenses ($413 million), Research and development expenses

($433 million) and Other (income)/deductions—net ($14 million) for 2008. Included in Cost of sales ($700 million), Selling, informational and

administrative expenses ($334 million), Research and development expenses ($416 million) and Other (income)/deductions—net ($61 million

income) for 2007. Included in Cost of sales ($392 million), Selling, informational and administrative expenses ($243 million), Research and

development expenses ($176 million) and Other (income)/deductions—net ($23 million income) for 2006. (See Notes to Consolidated Financial

Statements—Note 5. Cost-Reduction Initiatives.)

(f) Included in Other (income)/deductions—net and for 2008, includes approximately $2.3 billion in charges resulting from an agreement in principle

with the U.S. Department of Justice to resolve the previously reported investigation regarding allegations of past off-label promotional practices

concerning Bextra, as well as certain other open investigations, and approximately $900 million related to the agreements and agreements in

principle to resolve certain NSAID litigation and claims. (See Notes to Consolidated Financial Statements—Note 4A. Certain Charges: Bextra and

Certain Other Investigations and Note 4B. Certain Charges: Certain Product Litigation—Celebrex and Bextra.)

(g) Included in Revenues and reflects an adjustment to the prior years’ liabilities for product returns. (See Notes to Consolidated Financial

Statements—Note 4C. Certain Charges: Adjustment to Prior Years’ Liabilities for Product Returns.)

(h) In 2008, these charges primarily relate to the closing of a manufacturing plant in Italy and are included in Other (income)/deductions— net. In 2007,

these charges primarily related to the decision to exit Exubera and comprise approximately $1.1 billion of intangible asset impairments, $661 million

of inventory write-offs, $454 million of fixed asset impairments and $578 million of other exit costs and are included in Cost of sales ($2.6 billion),

Selling, informational and administrative expenses ($85 million), and Research and development expenses ($100 million). See the “Our 2008

Performance: Certain Charges—Exubera” section of this Financial Review. In 2006, $320 million related to the impairment of the Depo-Provera

intangible asset is included in Other (income)/deductions—net. (See Notes to Consolidated Financial Statements—Note 12B. Goodwill and Other

Intangible Assets: Other Intangible Assets.)

2008 Financial Report 33