Pentax 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

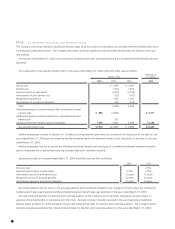

No»1BASIS OF PRESENTING CONSOLIDATED

FINANCIAL STATEMENTS

The accompanying consolidated financial statements have been

prepared in accordance with the provisions set forth in the

Japanese Securities and Exchange Law and its related accounting

regulations, and in conformity with accounting principles generally

accepted in Japan, which are different in certain respects as to

application and disclosure requirements of International Financial

Reporting Standards.

In preparing these consolidated financial statements, certain

reclassifications and rearrangements have been made to the

consolidated financial statements issued domestically in order to

present them in a form which is more familiar to readers outside

Japan.

The consolidated financial statements are stated in Japanese

yen, the currency of the country in which Hoya Corporation (the

"Company") is incorporated and operates. The translations of

Japanese yen amounts into U.S. dollar amounts are included solely

for the convenience of readers outside Japan and have been made

at the rate of ¥106 to U.S.$1, the approximate rate of exchange at

March 31, 2004. Such translation should not be construed as

representations that the Japanese yen amounts could be converted

into U.S. dollars at that or any other rate.

Certain reclassifications have been made in the 2003 and

2002 consolidated financial statements to conform to the classifi-

cations used in 2004. These reclassifications had no effect on

previously reported net income.

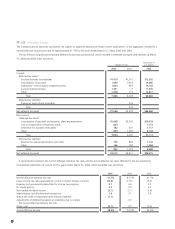

No»2SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a. Consolidation—The consolidated financial statements as of

March 31, 2004 include the accounts of the Company and its 55

(52 in 2003 and 51 in 2002) subsidiaries (together, the "Group").

Under the control or influence concept, those companies in

which the Company, directly or indirectly, is able to exercise control

over operations are fully consolidated, and those companies over

which the Group has the ability to exercise significant influence are

accounted for by the equity method.

Investment in one (two in 2003 and 2002) associated

company in 2004 is accounted for by the equity method. Invest-

ments in the remaining associated companies are stated at cost. If

the equity method of accounting had been applied to the invest-

ments in these companies, the effect on the accompanying

consolidated financial statements would not be material.

The differences between the cost and underlying net equity of

investment in consolidated subsidiaries and associated companies

accounted for by the equity method are charged to income when

incurred.

All significant intercompany balances and transactions have

been eliminated in consolidation. All material unrealized profits

included in assets resulting from transactions within the Group are

eliminated.

b. Cash Equivalents—Cash equivalents are short-term invest-

ments that are readily convertible into cash and that are exposed

to insignificant risk of changes in value. Cash equivalents include

time deposits, certificate of deposits, commercial paper and mutual

funds investing in bonds, all of which mature or become due

within three months of the date of acquisition.

c. Inventories—Inventories are primarily stated at cost, cost

being determined principally by the average method.

d. Investment Securities—Investment securities are classified as

available-for-sale securities and are reported at fair value, with

unrealized gains and losses, net of applicable taxes, reported in a

separate component of shareholders' equity. The cost of securities

sold is determined based on the moving-average method.

Non-marketable available-for-sale securities are stated at cost

determined by the moving-average method. For other than

temporary declines in fair value, investment securities are reduced

to net realizable value by a charge to income.

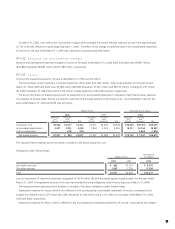

e. Property, Plant and Equipment—Property, plant and equip-

ment are stated at cost. Depreciation of property, plant and

equipment of the Company and its domestic subsidiaries is

computed substantially by the declining-balance method at rates

based on the estimated useful lives of the assets, while the

straight-line method is applied to buildings of the Company and its

domestic subsidiaries, and to all property, plant and equipment of

consolidated foreign subsidiaries. The net book value of tangible

fixed assets depreciated by the straight-line method was approxi-

mately 45.1% of total tangible fixed assets in 2004 and 44.6% in

2003. The ranges of useful lives are from 10 to 50 years for

buildings and structures and from 5 to 10 years for machinery and

vehicles.

f. Long-Lived Assets—In August 2002, the Business Accounting

Council issued a Statement of Opinion, "Accounting for Impairment

of Fixed Assets", and in October 2003 the Accounting Standards

Board of Japan ("ASB") issued ASB "Guidance No.6, Guidance for

Accounting Standard for Impairment of Fixed Assets". These new

Notes to Consolidated Financial Statements

Hoya Corporation and Subsidiaries