Office Depot 2001 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

Office Depot, Inc.

Notes to Consolidated Financial Statements (continued)

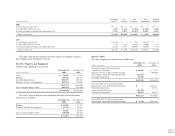

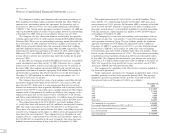

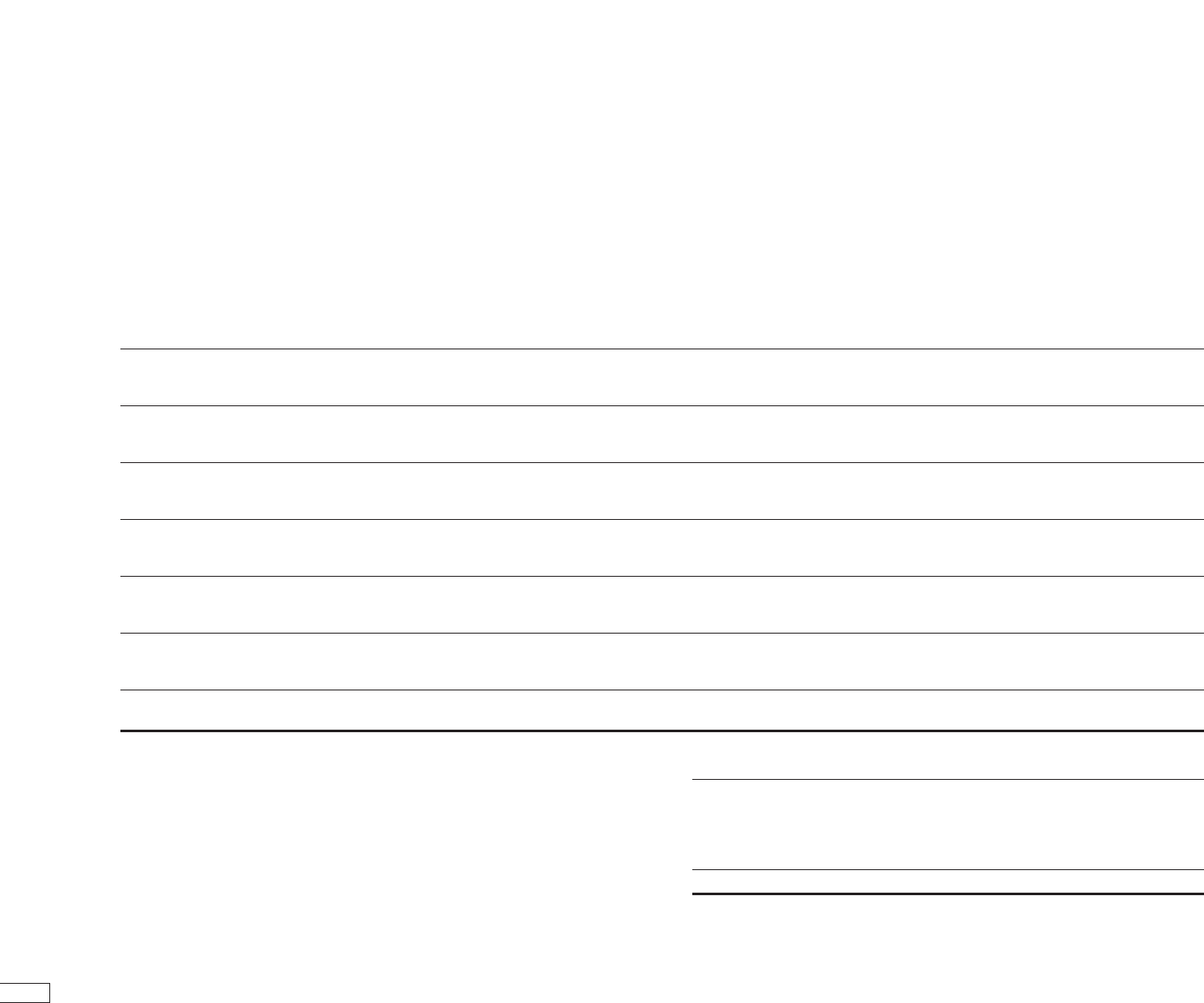

Note L—Segment Information

Office Depot operates in three reportable segments: North American Retail

Division, Business Services Group (“BSG”), and International Division. Each

of these segments is managed separately primarily because it serves different

customer groups. The accounting policies of our segments are the same as

those described in the summary of significant accounting policies (see Note A).

Senior management evaluates the performance of each business segment

based on operating income, which is defined as income before income taxes,

interest income and expense, goodwill amortization, merger and restructur-

ing costs, facility closure costs, general and administrative expenses, and

pre-opening expenses.

The following is a summary of our significant accounts and balances by segment, reconciled to our consolidated totals.

North American International Eliminations Consolidated

(Dollars in thousands) Retail Division BSG Division and Other* Total

Sales 2001 $5,842,648 $3,763,006 $1,552,072 $ (3,645) $11,154,081

2000 6,487,522 3,618,768 1,467,357 (3,951) 11,569,696

1999 5,893,385 3,057,187 1,325,372 (3,884) 10,272,060

Earnings Before Income Taxes 2001 $ 300,082 $ 285,101 $ 227,336 $(498,389) $ 314,130

2000 239,284 191,996 173,438 (512,259) 92,459

1999 399,120 256,045 136,488 (377,766) 413,887

Capital Expenditures 2001 $ 76,337 $ 44,087 $ 56,740 $ 30,123 $ 207,287

2000 106,646 55,690 32,994 72,398 267,728

1999 195,048 71,810 35,766 89,681 392,305

Depreciation and Amortization 2001 $ 88,227 $ 45,699 $ 16,866 $ 48,642 $ 199,434

2000 92,276 42,588 18,797 52,049 205,710

1999 76,982 35,093 15,619 43,389 171,083

Provision for Losses on Accounts 2001 $ 35,739 $ 53,712 $ 20,109 — $ 109,560

Receivable and Inventory 2000 30,121 57,628 33,477 — 121,226

1999 60,003 65,053 20,940 — 145,996

Equity in Earnings of Joint Ventures 2001 —— $ 10,892 — $ 10,892

2000 —— 9,436 — 9,436

1999 —— 2,041 — 2,041

Assets 2001 $1,803,042 $1,198,355 $ 864,201 $ 466,045 $ 4,331,643

2000 2,184,976 1,105,936 736,229 169,193 4,196,334

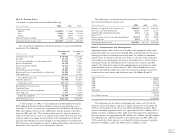

*Amounts included in ‘Eliminations and Other’ consist of the following:

Sales consist of inter-segment sales, which are generally recorded at the

cost to the selling entity.

Earnings Before Income Taxes are primarily associated with corporate

activities and are detailed in the following table:

Capital Expenditures, Depreciation and Amortization, and Assets included

in

‘

Eliminations and Other’ are also related primarily to our corporate activities.

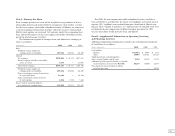

(Dollars in thousands) 2001 2000 1999

General and administrative expenses $451,722 $501,700 $381,611

Loss (gain) on investment securities 14,100 (12,414) —

Interest (income) expense, net 31,199 22,399 (4,028)

Intersegment transactions 711 257 183

Other, net 657 317 —

Total $498,389 $512,259 $377,766