Office Depot 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Office Depot, Inc.

Notes to Consolidated Financial Statements (continued)

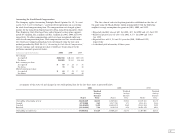

As of December 29, 2001, the weighted average fair values of options granted during 2001, 2000 and 1999 were $3.92, $4.18, and $8.24, respectively.

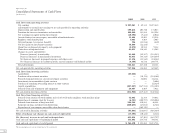

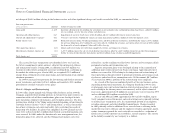

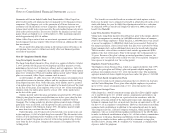

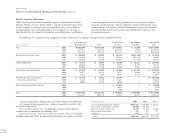

The following table summarizes information about options outstanding at December 29, 2001.

Options Outstanding Options Exercisable

Weighted

Average Remaining Weighted Weighted

Range of Number Contractual Life Average Number Average

Exercise Prices Outstanding (in years) Exercise Price Exercisable Exercise Price

$ 0.17–$ 1.95 25,840 4.3 $ 0.55 25,840 $ 0.55

1.96– 2.94 32,186 0.6 2.55 32,186 2.55

2.95– 4.42 7,200 0.7 3.67 7,200 3.67

4.43– 6.64 588,921 6.5 6.11 292,706 5.80

6.65– 9.97 11,510,448 7.7 8.52 3,568,083 8.52

9.98– 14.96 9,974,697 6.3 11.52 6,408,944 11.93

14.97– 22.45 10,604,500 6.1 18.30 9,173,244 18.52

22.46– 25.00 2,256,729 6.6 24.19 1,384,143 24.17

$ 0.17–$25.00 35,000,521 6.7 $13.29 20,892,346 $14.94

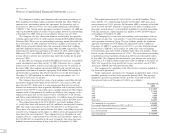

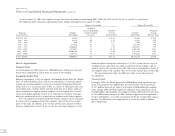

Note I—Capital Stock

Preferred Stock

As of December 29, 2001, there were 1,000,000 shares of $.01 par value pre-

ferred stock authorized of which none are issued or outstanding.

Stockholder Rights Plan

Effective September 4, 1996, we adopted a Stockholder Rights Plan (the “Rights

Plan”). Under this Rights Plan, each of our stockholders is issued one right to

acquire one one-thousandth of a share of our Junior Participating Preferred

Stock, Series A at an exercise price of $63.33, subject to adjustment, for each

outstanding share of Office Depot common stock they own. These rights are

only exercisable if a single person or company were to acquire 20% or more

of our outstanding common stock or if we announced a tender or exchange

offer that would result in 20% or more of our common stock being acquired.

If we are acquired, each right, except those of the acquirer, can be exchanged

for shares of our common stock with a market value of twice the exercise

price of the right. In addition, if we become involved in a merger or other

business combination where (1) we are not the surviving company, (2) our

common stock is changed or exchanged, or (3) 50% or more of our assets or

earning power is sold, then each right, except those of the acquirer, and an

amount equal to the exercise price of the right can be exchanged for shares of

our common stock with a market value of twice the exercise price of the right.

We may redeem the rights for $0.01 per right at any time prior to

an acquisition.

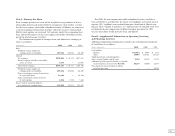

Treasury Stock

In August 1999, the Board approved a $500 million stock repurchase pro-

gram. This program was completed by the end of 1999, with the purchase

of 46.7 million shares of our stock at a total cost of $500 million plus commis-

sions. During 2000, the Board approved additional stock repurchases of up

to $300 million. This program was completed during 2000 with the repurchase

of 35.4 million shares of stock. In 2001, the Board approved stock repurchases

of up to $50 million a year until cancelled by the Board. During 2001, approx-

imately 252,000 shares were repurchased at a total cost of $4.2 million

plus commissions.