Office Depot 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

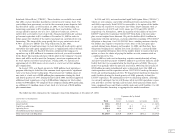

The risk sensitivity of fixed rate debt reflects the estimated increase in fair

value from a 50 basis point decrease in interest rates, calculated on a discounted

cash flow basis. The sensitivity of variable rate debt reflects the possible

increase in interest expense during the next period from a 50 basis point change

in interest rates prevailing at year end.

During 2001, we entered into an interest rate swap agreement to receive

fixed and pay floating rates, converting the equivalent of $250 million of this

portfolio to variable rate debt through 2008. The fair value of this agreement

at December 29, 2001 was immaterial. Additionally, the variable interest

payments of certain overseas debt have been hedged through mid-year 2002

under a variable to fixed rate swap agreement. The U.S. dollar equivalent

notional amount was $18.6 million at year end 2001 and $21.0 million at year

end 2000. Sensitivity of this agreement to a 50 basis point change in interest

rates was not material in either period.

Foreign Exchange Rate Risk

We conduct business in various countries outside the United States where

the functional currency of the country is not the U.S. dollar. This results in

foreign exchange translation exposure when results of these foreign opera-

tions are translated into U.S. dollars in our consolidated financial statements.

As of December 29, 2001, a 10% change in the applicable foreign exchange

rates would result in an increase or decrease in our operating profit of approx-

imately $11 million.

We are also subject to foreign exchange transaction exposure when our

subsidiaries transact business in a currency other than their own functional

currency. This exposure arises primarily from a limited amount of inventory

purchases in a foreign currency. The introduction of the euro and our decision

to consolidate our European purchases has greatly reduced these exposures.

During 2001, foreign exchange forward contracts to hedge certain inventory

exposures were less than $16.4 million.

One practical effect of the strong U.S. dollar over the past several years

has been a reduction in the reported results of operations from our extensive

overseas operations, due to the requirement to report our results in U.S. dollars.

While we look for opportunities to reduce our exposure to foreign currency

fluctuation against the U.S. dollar, at this point we have determined not to

pursue hedging opportunities generally.

Inflation and Seasonality

Although we cannot determine the precise effects of inflation on our busi-

ness, we do not believe inflation has a material impact on our sales or the

results of our operations. We consider our business to be somewhat seasonal,

with sales in our North American Retail Division and Business Services

Group slightly higher during the first and fourth quarters of each year, and

sales in our International Division slightly higher in the third quarter.

New Accounting Standards

In July 2001, the Financial Accounting Standards Board (“FASB”) issued

Statement No. 141, Accounting for Business Combinations, and Statement

No. 142, Goodwill and Other Intangible Assets. These Statements modify

accounting for business combinations after June 30, 2001 and will affect the

Company’s treatment of goodwill and other intangible assets at the start of

fiscal year 2002. The Statements require that goodwill existing at the date of

adoption be reviewed for possible impairment and that impairment tests be

periodically repeated, with impaired assets written down to fair value. The

initial test of goodwill must be completed within six months of adoption, or

by June 2002 for Office Depot, with a completion of testing by the end of

2002. Additionally, existing goodwill and intangible assets must be assessed

and classified consistent with the Statements’ criteria. Intangible assets with

estimated useful lives will continue to be amortized over those periods.

Amortization of goodwill and intangible assets with indeterminate lives will

cease. We have not yet completed the initial test of existing goodwill and,

accordingly, cannot estimate the full impact of these rules. However, goodwill

amortization, which totaled $7.0 million for 2001, will no longer be recorded.

In July 2001, the FASB issued Statement No. 143, Accounting for Asset

Retirement Obligations. This Statement requires capitalizing any retirement

costs as part of the total cost of the related long-lived asset and subsequently

allocating the total expense to future periods using a systematic and rational

method. Adoption of this Statement is required for Office Depot with the

beginning of fiscal year 2003. We have not yet completed our evaluation of

the impact of adopting this Statement.

In October 2001, the FASB issued Statement No. 144, Accounting for the

Impairment or Disposal of Long-Lived Assets. This Statement supersedes

Statement No. 121 but retains many of its fundamental provisions. Addition-

ally, this Statement expands the scope of discontinued operations to include

more disposal transactions. The provisions of this Statement are effective for

Office Depot with the beginning of fiscal year 2002. We do not anticipate a

significant impact to the Company’s results of operations from adoption of

this Statement.