Office Depot 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

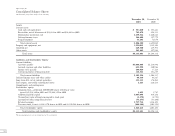

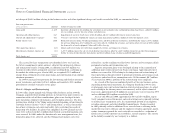

38

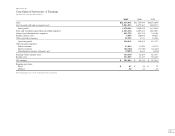

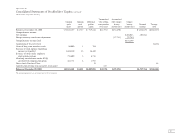

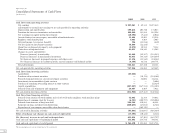

Office Depot, Inc.

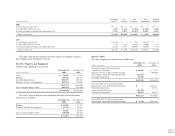

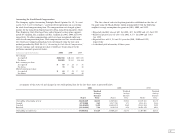

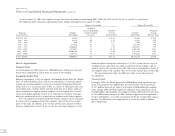

Consolidated Statements of Cash Flows

(In thousands)

2001 2000 1999

Cash flows from operating activities:

Net earnings $ 201,043 $ 49,332 $ 257,638

Adjustments to reconcile net earnings to net cash provided by operating activities:

Depreciation and amortization 199,434 205,710 171,083

Provision for losses on inventories and receivables 109,560 121,226 145,996

Net (earnings) on equity method investments (10,892) (9,436) (2,041)

Accreted interest on zero coupon, convertible subordinated notes 11,308 19,203 19,534

Employee stock benefit plans 5,001 6,469 5,905

Deferred income tax expense (benefit) 196 (81,814) (430)

Net loss (gain) on investment securities 14,100 (12,414) —

(Gain) loss on disposal of property and equipment (5,275) 10,585 9,882

Write-down of impaired assets 43,623 114,343 13,965

Changes in assets and liabilities:

Decrease (increase) in receivables 93,849 (85,327) (152,523)

Decrease (increase) in merchandise inventories 81,651 (66,348) (284,489)

Net decrease (increase) in prepaid expenses and other assets 13,156 (21,561) (24,862)

Net (decrease) increase in accounts payable, accrued expenses and deferred credits (9,588) 66,514 209,791

Total adjustments 546,123 267,150 111,811

Net cash provided by operating activities 747,166 316,482 369,449

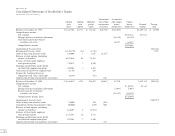

Cash flows from investing activities:

Acquisitions (45,604) ——

Purchases of investment securities —(30,112) (154,364)

Proceeds from maturities or sales of investment securities —54,006 114,141

Investments in unconsolidated joint ventures —— (1,606)

Purchase of remaining ownership interest in joint ventures —— (21,629)

Capital expenditures (207,287) (267,728) (392,305)

Proceeds from sale of property and equipment 20,947 4,469 7,922

Net cash used in investing activities (231,944) (239,365) (447,841)

Cash flows from financing activities:

Proceeds from exercise of stock options and sale of stock under employee stock purchase plans 52,962 12,388 59,082

Repurchase of common stock for treasury (4,193) (300,797) (501,006)

Proceeds from issuance of long-term debt 266,286 430,522 42,841

Payments on long- and short-term borrowings (400,458) (27,015) (6,766)

Repurchase of zero coupon, convertible subordinated notes —(249,191) —

Net cash used in financing activities (85,403) (134,093) (405,849)

Effect of exchange rate changes on cash and cash equivalents (17,891) (10,326) (1,516)

Net (decrease) increase in cash and cash equivalents 411,928 (67,302) (485,757)

Cash and cash equivalents at beginning of period 151,482 218,784 704,541

Cash and cash equivalents at end of period $ 563,410 $ 151,482 $ 218,784

The accompanying notes are an integral part of these statements.