Office Depot 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Office Depot, Inc.

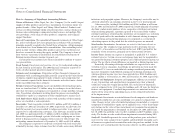

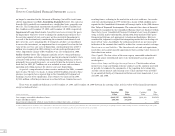

Cautionary Statements for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995

(continued)

on various initiatives to improve margin levels in this business segment, but

there is no assurance that these initiatives will prove successful. Some of our

competitors operate only in the contract and/or commercial channels and

therefore may be able to focus more attention on the business services segment,

thereby providing formidable competition. Our failure to adequately address

this segment of our business could put us at a competitive disadvantage rela-

tive to these competitors. In addition, we have reached maximum capacity in

some of our distribution centers that serve our contract and commercial cus-

tomers. In 2002, we plan to open new distribution facilities in Atlanta and

Baltimore. Failure to open these facilities as planned, or material delays in

construction and/or equipping these facilities, could have a material adverse

impact on our anticipated results in 2002.

Sources and Uses of Cash: We believe that our current level of cash and cash

equivalents, future operating cash flows, lease financing arrangements and

funds available under our credit facilities and term loan should be sufficient

to fund our planned expansion, integration and other operating cash needs

for at least the next year. However, there can be no assurance that additional

sources of financing will not be required during the next twelve months as a

result of unanticipated cash demands, opportunities for expansion, acqui-

sition or investment, changes in growth strategy, changes in our warehouse

integration plans or adverse operating results. We could attempt to meet our

financial needs through the capital markets in the form of either equity or

debt financing. Alternative financing will be considered if market conditions

make it financially attractive. There can be no assurance that any additional

funds required by us, whether within the next twelve months or thereafter,

will be available to us on satisfactory terms. Our inability to access needed

financial resources could have a material adverse effect on our financial

position or operating results.

Effects of Certain One-time Charges: During the fourth quarter of 2000, we

conducted a review of all aspects of our business, with particular attention

on our North American Retail Division and on our distribution and supply

chain activities (see the Charges and Credits section of our MD&A for further

details). We expect that these decisions will result in increasing our Company’s

profitability and efficiency in the future. However, this analysis involves many

variables and uncertainties; and, as a result, we may not achieve any of the

expected benefits. In 1999, we announced one-time charges against earnings

for slow-moving inventories in our warehouses and stores and for accelerated

store closings and relocations. There can be no assurance that additional

charges of this nature will not be required in the future as well. In particular,

we expect that a retail store chain, such as our North American Retail Division,

should expect to close a certain number of stores each year, remodel and/or

relocate other stores. We cannot be certain that our decisions to close, remodel

and/or relocate stores will have the desired favorable results on our financial

performance, nor can we anticipate the size and nature of non-recurring

charges associated with such matters. Such charges, if any, could have a

materially adverse impact on our financial position or operating results in

the future.

Economic Downturn: In the past decade, the favorable United States econ-

omy has contributed to the expansion and growth of retailers. Our country

has experienced low inflation, low interest rates, low unemployment and an

escalation of new businesses. The economy has recently begun to show signs

of a downturn. The Federal Reserve dramatically reduced interest rates

throughout 2001 in recognition of the economic downturn and in an effort

to address that downturn. The overall stock market has been in a period of

poor performance throughout 2001. The retail industry, in particular, continues

to display signs of a slowdown, with several specialty retailers, both in and

outside our industry segment, reporting earnings warnings throughout 2001.

One major discount retailer filed for bankruptcy protection earlier in 2002,

further indicating that the slow economy is having an impact on the retail

industry. This general economic slowdown may adversely impact our business

and the results of our operations.

Executive Management: Since the appointment of our new Chief Executive

Officer, we have evolved our management organization to better address the

future goals of our Company. This new organization continues to have vacan-

cies in certain key positions. Various searches are underway to identify the

best individuals to fill these positions; however, the process may be a protracted

one. Furthermore, the new management structure may not be ideal for our

Company and may not result in the benefits expected; and, as a result, may

materially and adversely affect our future operating results.

Disclaimer of Obligation to Update

We assume no obligation (and specifically disclaim any obligation) to update

these Cautionary Statements or any other forward-looking statements con-

tained in this Annual Report to reflect actual results, changes in assumptions

or other factors affecting such forward-looking statements, except as required

by laws and regulations.