Office Depot 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

Office Depot, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations(continued)

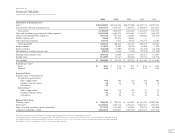

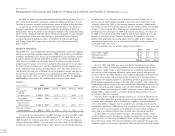

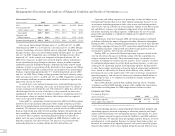

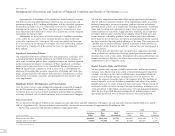

(Dollars in millions) 2001 2000 1999

Distribution of charges and credits by segment:

North American Retail Division $ 43.6 $201.1 $ 88.3

BSG —8.6 (12.2)

International Division (10.2) 18.7 29.1

Other—Corporate 30.0 32.2 —

Total $ 63.4 $260.6 $105.2

After considering the effect of income taxes, the impact of these net

charges on our net earnings was $41.0 million, $172.9 million and $69.3 mil-

lion for 2001, 2000, and 1999, respectively.

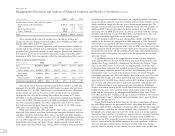

The components of segment operating profit presented below include the

charges and credits outlined above. Additionally, certain expenses, primarily

payroll-related, previously recorded in total company general and administra-

tive expenses have been reclassified to determine segment operating profit

beginning in 2001. Prior year amounts reflect the reclassification of these costs.

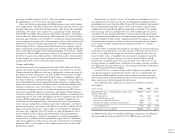

North American Retail Division

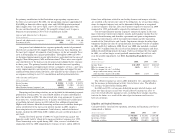

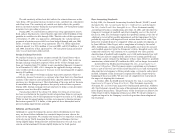

(Dollars in millions) 2001 2000 1999

Sales $5,842.6 100.0% $6,487.5 100.0% $5,893.4 100.0%

Cost of goods sold

and occupancy costs 4,479.1 76.7% 5,065.0 78.1% 4,556.5 77.3%

Gross profit 1,363.5 23.3% 1,422.5 21.9% 1,336.9 22.7%

Operating and

selling expenses 1,046.7 17.9% 1,101.7 17.0% 923.2 15.7%

Segment operating profit $ 316.8 5.4% $ 320.8 4.9% $ 413.7 7.0%

Sales in our North American Retail Division decreased 10% in 2001 and

increased 10% in 2000. Adjusting fiscal 2000 results to remove the 53rd week,

sales decreased 8% in 2001. The decrease was experienced across all regions

of the country and reflects the adverse effect of the weak U.S. economy.

Additionally, the sales decline during 2001 reflects the closing of 73 stores

identified as under-performing stores as part of the comprehensive business

review in late 2000. The sales increase in 2000 was primarily achieved through

our store expansion program. For 2001, comparable sales in the 816 stores

that had been open for more than one year were down 8%. In 2000, compa-

rable sales were essentially even with 1999.

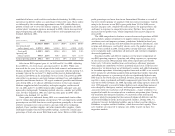

While sales decreased in 2001, gross profit expressed as a percent of sales

increased. Sales shifted away from lower-margin computer hardware, software

and office furniture and into products such as machine and office supplies,

as well as additional copy center services. Sales of computer products declined

26% in 2001 compared with an increase of 3% in 2000, reflecting declines in

both volume and average unit price. We are unable to predict when, and to

what extent, this trend will reverse. During 1999, we offered low priced units

and more aggressive promotional programs on computer products, including

an instant rebate program when the customer contracted for Internet service,

which resulted in strong sales for that year at lower margin percentages. The

Internet service provider instant rebate program was in effect for portions of

2000 and 2001. The sale of business furniture declined 16% in 2001, after

increasing 14% in 2000. The decrease in 2001 is consistent with the slowing

economy and decisions to cancel or defer office-related purchases. The sale

of business machine supplies increased in both periods.

Lower margins realized on paper and machine supplies contributed most

notably to the decrease in gross profit in 2000 compared to 1999. Increased

costs of these core products and decreased prices in response to competitive

pressures negatively impacted gross profit. Also in 2000, sales increases in the

North American Retail Division were not sufficient to leverage the additional

fixed expenses incurred with the addition of new stores. Gross profit includes

fixed costs such as occupancy and rental costs for equipment in our print

and copy centers.

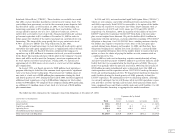

A significant portion of the comprehensive business review completed

at the end of 2000 was focused on the North American Retail Division and,

among other things, included a commitment to enhance the shoppers’ exper-

ience in our retail stores. To that end, we implemented a Division-wide

re-merchandising campaign that included personnel training, improved sign-

age and lighting, improved product adjacencies and additional private label

merchandise. Also, as a result of the business review, we closed 70 under-

performing stores in early 2001 and another three later in the year. The table

above includes charges and credits reported in line items through segment

operating profit. In 2000, these charges include $29.5 million to provide for

sales returns and allowances, $10.1 million for inventory adjustments and

$57.8 million relating to asset impairments and write-downs. Additional

charges and credits relating to the North American Retail Division, such as

facility closure costs, were reported on line items below segment operating

profit and are discussed in the Charges and Credits section above. Fiscal

year 2001 includes $35.2 million of charges relating to additional store closures

and impairments from 13 additional under-performing stores, three of which

were closed during the year.

In our North American Retail Division, the largest components of operat-

ing and selling expenses are personnel, facility, advertising and credit card

expenses. Each of these components declined in 2001; and total operating and

selling expenses, excluding the charges outlined above, decreased 3% in 2001.

Personnel costs, which represent over 50% of the total costs in this caption,

showed the largest decline as payroll was adjusted down in response to declin-

ing sales and from a net reduction in stores. Personnel costs in 2000 were

higher than in 1999, primarily because of competitive wage pressure and the

need to attract more highly skilled employees in certain positions. Addition-

ally, rent and depreciation expense decreased in 2001 from store closings,

partially offset by adding 44 stores during the year. Lower sales in 2001 also