Louis Vuitton 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Louis Vuitton annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The

LVMH

share

12

ment in September and October following rate

cuts decided by the US Federal Reserve, poor

earnings from financial institutions again crea-

ted a climate of mistrust in the markets. In this

environment marked by uncertainty and an

increase in the price of risk, the European markets

closed the year up 1.3% for the CAC 40 and 6.8%

for the DJ-Eurostoxx 50.

The LVMH share resisted the tensions in the

second half well thanks to solid activity conside-

red to be less sensitive to the slowdown in US

consumption. Thus, LVMH ended the year up 3.4%

at 82.68 euros.

As of December 31, 2007, the market capitaliza-

tion of LVMH was 40.5 billion euros, ranking it

eleventh in the CAC 40.

LVMH is included in the major French and

European indices used by fund managers:

CAC 40, DJ-EuroStoxx 50, MSCI Euro, FTSE-

Eurotop 100.

The LVMH share is listed for trading on Euronext

Paris (Reuters Code: LVMH.PA, Bloomberg Code:

MC FP, ISIN Code: FR0000121014). In addition,

negotiable options on LVMH shares are traded

on Euronext.liffe.

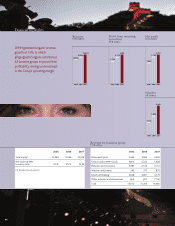

Total return for shareholders

An LVMH shareholder who invested 1,000 euros

on January 1, 2003 would have 2,260 euros as of

December 31, 2007, on the basis of dividend rein-

vestment in stocks. In five years, the investment

would have offered an average annual return of

about 18%.

10

20

30

40

50

60

70

80

90

DNOSAJJMAMFJDNOSAJJMAMFJDNOSAJJMAMFJDNOSAJJMAMFJDNOSAJJMAMFJ

0

2,000,000

4,000,000

6,000,000

Changes in LVMH share price

After a positive first half, the stock markets were

heavily impacted in the summer by the financial

crisis that started in the United States. Higher

interest rates and declining housing values in this

country generated a progression of payment

defaults on high-risk residential mortgage loans

(known as “subprime” loans), triggering a crisis

of confidence that extended to the credit markets,

the money markets and the equity markets in

the United States and Europe. After an improve-

AGENDA

Thursday, February 6, 2008 Publication of 2007 revenue and annual results

April 2008 Publication of 2008 first quarter revenue

Thursday, May 15, 2008 Annual Shareholders’ Meeting

Friday, May 23, 2008 Payment of the balance of the dividend for 2007

(last trading day with dividend rights: May 19, 2008)

July 2008 Publication of 2008 half year revenue and results

October 2008 Publication of 2008 third quarter revenue

2003 2004 2005 2006 2007

Comparison of LVMH share price and the CAC 40 since January 1, 2003

Trading Volume LVMH CAC 40 Average monthly volume