Loreal 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

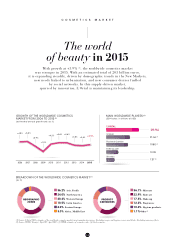

NEW MARKETS

India, South Africa and

Turkey are performing well

In 2015, the New Markets generated

more than two-thirds of beauty market growth (1).

Despite the slowdown in China and Brazil,

some growth-relay countries are

fulfilling their promise, as is the case

with India, South Africa and Turkey.

SECTORS

Luxury and dermocosmetics

Luxury remains the most dynamic sector

at +5.7% (1), thanks in particular to e-commerce sales.

Dermocosmetics meanwhile continues

to accelerate, driven by deep-rooted upward

aspirations for both beauty and health

in all parts of the world.

(1) Source: L’Oréal 2015 estimates of the worldwide cosmetics market in net

manufacturer prices. Excluding soaps, oral hygiene, razors and blades. Excluding

currency effects.

MAKE-UP

Lip colour

leads the way

Driven by the selfie generation, make-up

was the most dynamic category for the third year

running, and proved to be a growth driver. The success

of lip make-up was one of the 2015 highlights,

withgrowth at+10% in the mass-market channel,

and +16% in the selective channel (1).

The major trends of the year

DIGITAL

A tremendous

opportunity

forbeauty

Beauty, today, is synonymous

with personalised products

and services that enrich

theconsumer experience

and its relationship with

thebrands, in all distribution

sectors.

6%

E-COMMERCE SHARE

OF WORLDWIDE

BEAUTY MARKET (1)

+20%

GROWTH OF

WORLDWIDE ONLINE

BEAUTY SALES (1)

17