Loreal 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

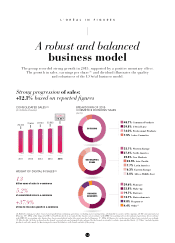

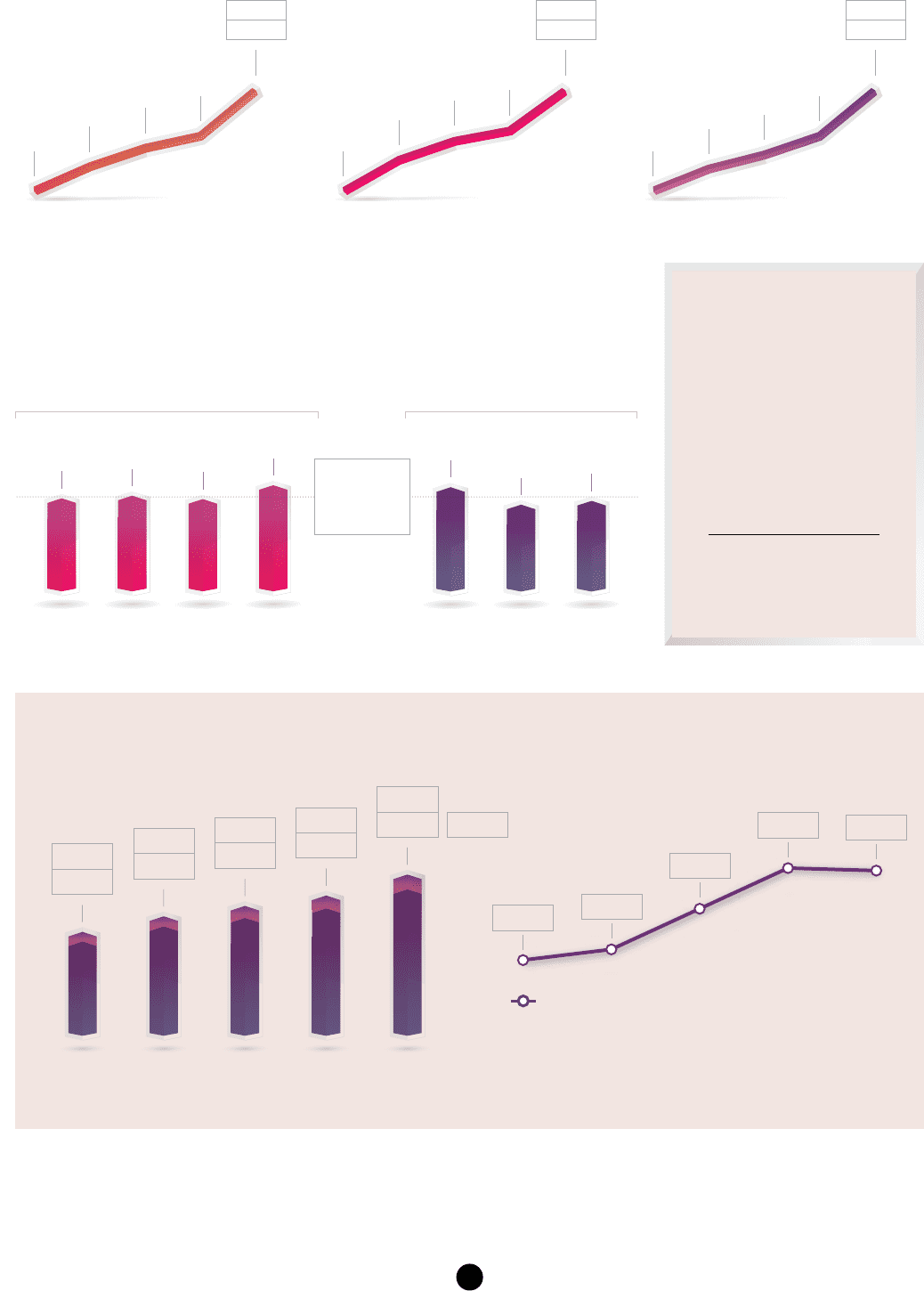

A dynamic shareholder return policy

(1) Net profit excluding non-recurring items after non-controlling interests does not include impairment of assets, restructuring costs, tax effects or non-controlling interests.

(2) Diluted earnings per share, based on net profit from continuing operations, excluding non-recurring items, attributable to owners of the company. (3) For shareholders who

continuously hold their shares in registered form for a minimum of two full calendar years, up to a maximum of 0.5% of the capital for the same shareholder. (4) Dividend proposed at

the Annual General Meeting of April 20th, 2016. (5) Based on the dividend proposed at the Annual General Meeting of April 20th, 2016. (6) Pay-out ratio based on diluted net profit

excluding non-recurring items, after non-controlling interests, per share. (7) At December 31st, 2015. (8) On the number of shares at December 31st, 2015, i.e. 562,983,348 shares.

DIVIDEND PER SHARE

(in euros)

e155.30

Share price (7)

e87.43 Bn

Market capitalisation (8)

A new increase in earnings per share

OPERATING PROFIT

(in millions of euros)

EARNINGS PER SHARE (2)

(in euros)

NET PROFIT EXCLUDING

NON-RECURRING ITEMS

AFTER NON-CONTROLLING

INTERESTS (1)

(in millions of euros)

2011 2012 2013 2014 2015

E2.00

E2.20 E2.30

E2.53

E2.50

E2.75

E2.70

E2.97 E3.10 (4)

E3.41

(3)

Pay-out ratio as %

(6)

2011 2012 2013 2014 2015

46.3% 46.8%

48.7%

50.6% 50.2%

(5)

BY DIVISION

(as % of Division sales)

Consumer

Products

L’Oréal

Luxe

Professional

Products

Active

Cosmetics

20.1% 20.7% 20.0% 22.8%

BY ZONE

(as % of Zone sales)

Western

Europe

North

America

New

Markets

22.7% 19.7%

18.9%

E3.41 = Preferential dividend of +10% for shareholders who have

held shares in registered form for two years

(3)

20152011 2012 2013 2014

2,583

2,861

3,032 3,125

3,490

+11.7%

20152011 2012 2013 2014

4.32

4.73 4.99

5.34

6.18

+15.7%

20152011 2012 2013 2014

3,293

3,558

3,760 3,891

4,388

+12.8%

Cosmetics

Divisions’

profitability

20.5%

+14.8%

Balance of operating profitability A solid

balance sheet

Capital expenditure

4.6%

of sales

Shareholders’ Equity

70%

of total assets

Net cash surplus of

618

million euros

15