Loreal 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

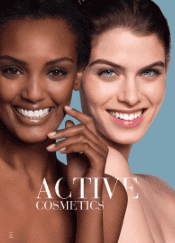

REVIEW & OUTLOOK

How would you describe

2013 for Active Cosmetics?

2013 was a year of acceleration

for both the division and

thedermocosmetics market

(+5.0%(1)). At +7.8%(2), we

arecontinuing to clearly

outperform the market, and we

contributed to some 40% of its

growth(1). Dynamism is being

driven by the vitality of Western

Europe, and the acceleration

of China, the Gulf states and

Saudi Arabia, along with the

boom in the Americas Zone,

particularly in Brazil with

+21.1%(2). Our brands are

recording strong performances:

VICHY’s new strategy is proving to

be a winner, LA ROCHE-POSAY

hasagain posted double-digit

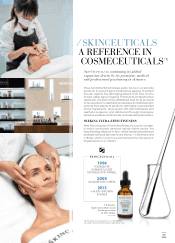

growth and SKINCEUTICALS is now

a reference in cosmeceuticals.

What are the trends in

the health and beauty

market?

Skincare is the flagship

category: growth of around

+6% peryear is expected over

thenext decade(3), with

growing demand for products

combining innovation and

efficacy with safety. This is

auniversal and persuasive

purchasing criterion for 65%

ofwomen(4). To respond to

thenew challenges of UV

protection, pollution and

allergies, the positioning of

ourbrands in the health-

beauty-safety territory is

crucial. Consumers are

seeking advice from

professionals, in sales outlets

as well as on the Internet.

Digitalisation is booming,

notably e-commerce.

Recommendations and skin

diagnostics are now available

through our mobile apps,

intensifying our relationship

with consumers and traffic

onour websites.

What will be the distribution

channels and medical

partnerships of tomorrow?

Pharmacies remain at the

heart of our business.

InWestern Europe, they

represent, with “para-

pharmacies”, some 25% of

skincare sales(1). More recently,

we have shown agility by

adapting our model to

theNew Markets’ realities.

Ourpresence is being

stepped up in drugstores,

shopping malls and

department stores where

weare creating dermacenters

which allow us to stage

ourbrands thanks to expert

dermo-advisors.

In the medical field,

dermatologists remain our

privileged partners. Butweare

convinced that ourmission is

broader-based and includes

new professionals:

paediatricians, general

practitioners, aesthetic

surgeons, nutritionists and

even oncologists.

+31.3%

INCREASE IN ACTIVE COSMETICS’

DIGITAL MEDIA INVESTMENTS (2)

(1) Source: 2013 L’Oréal estimates of the

worldwide cosmetics market in net

manufacturer prices. Excluding soap, oral

hygiene, razors and blades. Excluding currency

effects. (2)Like-for-like. (3)Source: L’Oréal/

McKinsey study 2012. (4)Source: Sensisurvey

IFOP, 8countries, March2013.

⁄ RESPONDING TO

THE QUEST FOR ADVICE,

EFFICACY AND SAFETY

BRIGITTE LIBERMAN

PRESIDENT

ACTIVE COSMETICS DIVISION

65