Loreal 2013 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2013 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

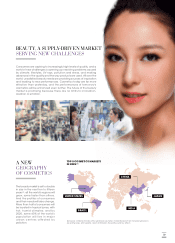

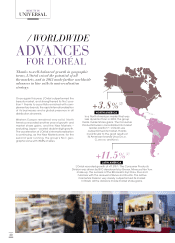

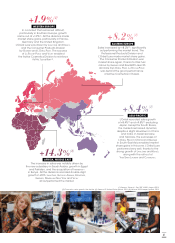

EASTERN EUROPE

Sales increased by +8.2%(2), significantly

outperforming the market trend. The

Professional Products Division and

L’Oréal Luxe made market share gains.

The Consumer Products Division won

market share again, thanks to Olia hair

colour by GARNIER and Revitalift Laser X3

skincare by L’ORÉAL PARIS. LA ROCHE-POSAY

was behind the good performance

ofActive Cosmetics in Russia.

ASIA-PACIFIC

L’Oréal recorded sales growth

of +8.4%(2) and +9.5%(2) excluding

Japan. Except for South Korea,

the markets remained dynamic,

despite a slight slowdown in China

and India. In facial skincare

and haircare, the successes of

L’ORÉAL PARIS in China and GARNIER

in South-East Asia enabled market

share gains in this zone. L’Oréal Luxe

performed very well, thanks to the

strong growth of LANCÔME and KIEHL’S,

along with the roll-out of

YVES SAINT LAURENT and CLARISONIC.

WESTERN EUROPE

In a context that remained difficult,

particularly in Southern Europe, growth

came out at +1.9%(2). All the divisions made

market share gains, particularly in France,

Germany and the United Kingdom.

L’OréalLuxe was driven by LANCÔME and KIEHL’S,

and the Consumer Products Division

byGARNIER and L’ORÉAL PARIS. The success

of LA ROCHE-POSAY and VICHY enabled

theActive Cosmetics Division to reinforce

its No.1 position(4).

AFRICA, MIDDLE EAST

The increase in sales was notably driven by

the new subsidiary in Saudi Arabia, growth in Egypt

and Pakistan, and the acquisition of INTERBEAUTY

inKenya. All the divisions recorded double-digit

growth in 2013. LANCÔME, GIORGIO ARMANI, KÉRASTASE,

GARNIER, MAYBELLINE NEW YORK and VICHY

all outperformed themarket.

+1.9%(2)

+8.2%(2)

+8.4%(2)

+14.3%(2)

(1) Source: “Beauty’s Top 100” WWD, August 2013.

(2) Cosmetics sales growth, like-for-like. (3) Source: IRI United States panel, 2013. (4) Source: IMS Europe 8 panel, 2013.

21