JVC 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Targeting sustainable “Profitable Growth” in a rapidly changing business environment, JVC KENWOOD Corporation

(JVCKENWOOD) reviewed its Mid-term Business Plan through the fiscal year ending March 2014 (the previous Mid-term Business

Plan), which had been formulated on September 16, 2011. The review resulted in JVCKENWOOD drawing up a new mid-term

business plan with the fiscal year ending March 2016 as the final year (the new Mid-term Business Plan) under the new business

execution system established in June 2012.

1. Outline of New Mid-term Business Plan

(1) Mid-term vision “Re Design”- Redesigning the lifestyles of people around the world

Under its corporate vision of “Creating excitement and peace of mind for the people of the world,” JVCKENWOOD generates

excitement and creates peace of mind for its customers as a global specialty manufacturer, while endeavoring to achieve

“Profitable Growth” in three ways: by concentrating on strong businesses, providing stakeholders with new value, and remaining

a company that is widely trusted by society.

A mid-term vision—“Re Design”—has been established under the Groupʼs new Mid-term Business Plan as the first step of a

long-term strategy toward sustainable “Profitable Growth.” The entire Group and each business segment will focus on

reorganizing business models as well as head office and business divisions, and on redesigning peopleʼs lifestyles around the

world to make them more comfortable and exciting, while continuing to create peace of mind.

The Group will utilize the cash and profits these efforts generate to invest in sustainable “Profitable Growth,” strengthen its

financial base, and provide stable returns to its shareholders.

(2) Key mid-term strategies

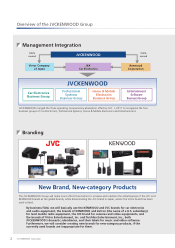

JVCKENWOOD is now utilizing funds totaling approximately 13.9 billion yen, which were procured in January 2011, to promote

M&As and a partnership strategy, including strategic alliances, as well as to plan and implement strategic investments in R&D and

capital expenditures.

Under its partnership strategy, the Group is promoting growth centering on its Car Electronics business, its Professional

Systems business, and on optical-related businesses that contribute to those two businesses. As part of these activities, the

Group formed capital and business alliances with Shinwa International Holdings Limited (Shinwa, which the Group plans to make

a subsidiary by April 2015), a car-mounted equipment company based in Hong Kong, and Syndiant, Inc. (“Syndiant”), a U.S. firm

engaged in developing and designing microminiature LCOS devices, while adding to its subsidiaries AltaSens, Inc. (“AltaSens”), a

U.S. company specializing in the development and design of CMOS image sensors.

During the new Mid-term Business Plan, the Group will reap the benefits from these enterprising investments and

strengthen its existing cooperative relationships with Garmin Ltd. (“Garmin”), a leading U.S. manufacturer of portable/personnel

navigation devices (PNDs), and the leading Japanese automotive components manufacturer DENSO Corporation (“DENSO,” in

which the Group held 3.0% shareholding as of September 30, 2012). The Group will also strive to enhance and expand its Car

Electronics and Professional Systems businesses, improve the sales contribution of the business-to-business (BtoB) segment, on

which there will be an

ongoing focus, and

increase the sales

contribution of emerging

markets, where there is

considerable room for

growth.

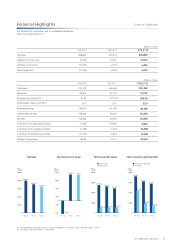

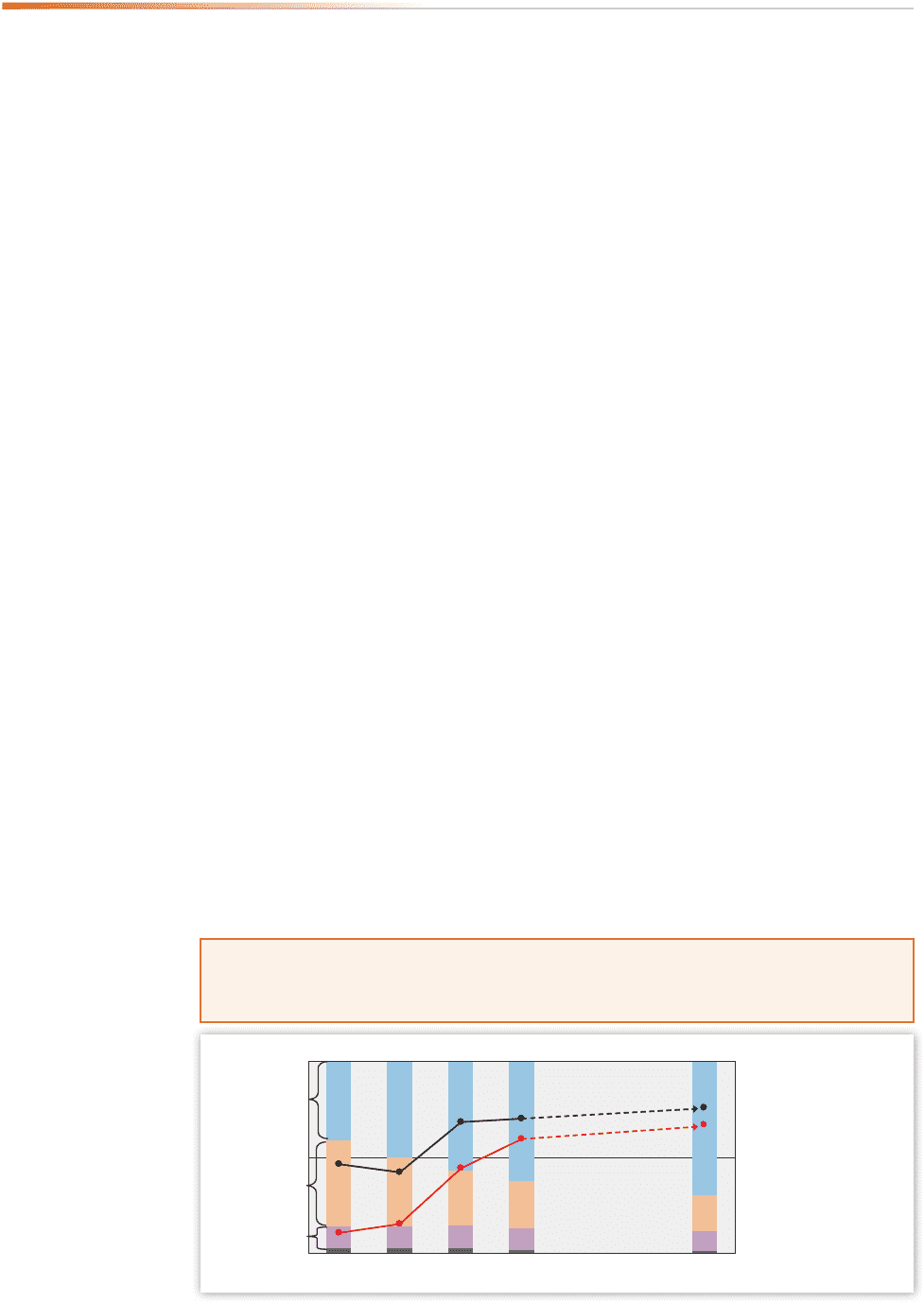

Business portfolio mid-term sales composition targets

- Car Electronics and Professional Systems: from 63% in FYE 3/ʼ12 to 70% in FYE 3/ʼ16

43%

44%

11%

63%

24%

11%

70%

19%

10%

FYE 3/’09 FYE 3/’10 FYE 3/’11 FYE 3/’12 FYE 3/’16

(Target)

-10%

0%

10%

Profit margin

CE+PS

HM

SE

100%

Sales composition

50%

0%

Company-wide

net profit margin

Company-wide

operating margin

CE: Car Electronics business

PS: Professional Systems business

HM: Home & Mobile Electronics business

SE: Entertainment business

7

JVC KENWOOD Corporation

Special Feature: New Mid-term Business Plan Special Feature