JVC 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

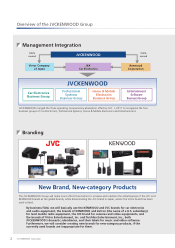

* Integrating overseas sales companies

We have been promoting the integration of overseas sales companies and operating offices to improve overseas sales efficiency

and enhance competitiveness, for example by integrating the sales companies in emerging markets, as well as the sales

subsidiaries of the former Victor and the former Kenwood in North America, Europe, and Asia.

* Innovating consolidated value chain

The four business groups and a company-wide task force will promote innovation of the consolidated value chain—consisting of

production/procurement, sales/marketing, logistics/services—which will be reconstructed with an emergency response capability.

By doing so, the Group will also reduce inventories and waste, shorten lead times from sales division order placement to factory

shipment, cut procurement costs, and minimize market defect rates.

Furthermore, a system will be established to enable the rapid commencement of production at alternative facilities in the

event of disasters that could disrupt supply chains, which occurred as a result of the Great East Japan Earthquake and the floods

in Thailand.

d. Establishment of JVCKENWOOD brand

Centering on the corporate brands of JVC and KENWOOD as well as the business and product brands of JVC, Kenwood, Victor

Entertainment, Inc., and Teichiku Entertainment, Inc., the Group will make brand strategy investments. These will involve

stepping up sponsorship activities and the promotion of joint brands in collaboration with other companies, and conducting

activities to increase awareness of our business and product brands. These brand investments will also raise the JVCKENWOOD

profile as a worldwide brand.

(3) Policy for distributing profits

JVCKENWOOD regards the provision of stable returns to shareholders as one of its most important managerial issues. Decisions

on the distribution and appropriation of retained earnings are made by comprehensively taking into account profitability and

financial conditions.

To combine both sustainable, continued growth and the provision of stable returns under the new Mid-term Business Plan,

the Group will adhere to the basic policy of using the cash and profits generated to invest in “Profitable Growth,” strengthen its

financial base, and provide shareholders with stable returns. The plan sets the target of achieving a consolidated dividend payout

ratio of 25% for the fiscal year ending in March 2016.

(4) Management targets

In addition to the appreciation of the yen to historic levels, the outlook for the global economy remains uncertain due to

deterioration of the European economy caused by financial uncertainty, the sluggishness of the Middle Eastern economy, and the

slow economic growth in emerging markets. In the electrical equipment industry, among others, the consumer-use AV

equipment sector in particular continued to face a difficult business climate amid intensified international competition in the

progress of digitization and commoditization.

Under such circumstances, JVCKENWOOD has incorporated growth measures, based on its established corporate base and

business structure, to make up for delays resulting from the effects of the Great East Japan Earthquake and floods in Thailand.

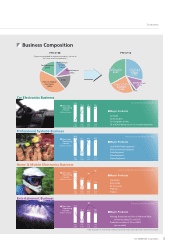

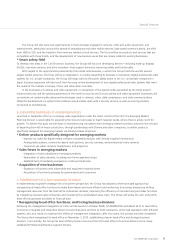

B to B 売上構成比 40%→50%

ʼ12 ʼ 1 ( )

B to B

40%

B to B

50%

08/3期売上構成比 12/3期売上構成比

()

(1)

(1)

()

カーエレクトロニクス

(33%)

業務用システム

(29%)

エンタテインメント

(11%)

ホーム&モバイル

エレクトロニクス

(24%) その他

新興国売上構成比 11%→25%

ʼ12 ʼ 1 ( )

新興国

11% 新興国

25%

新しいモノづくりの考え方「下から上へ」

顧 客のニーズ、地 域 ニーズにマッチした

付加価値をつける利益率大幅改善

普及価格帯

中級機

高級機

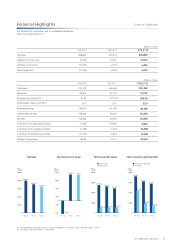

Net sales

Profit

(Billion yen) (Billion yen)

500

0

100

200

300

400

25

0

5

10

15

20

FYE 3/ ’12 FYE 3/ ’16

(Target)

320.9

12.8

6.4

6.0

20.0

17.0

13.5

400.0

SE

HM

PS

CE

Operating income

Ordinary income

Net income

Net sales

Mid-term numerical targets (consolidated)

- Net sales: 400.0 billion yen

- Operating income: 20.0 billion yen

(operating margin: 5%)

- Ordinary income: 17.0 billion yen; net

income: 13.5 billion yen

- Shareholdersʼ equity ratio: 35%

- Net-debt: zero

- ROE: 10%

- Net income per share: 81 yen

- Dividend payout ratio: 25%

(Reference) Earnings trends (consolidated) (Unit: Billion yen)

(For reference)

FYE 3/’12

New Mid-term Business Plan

FYE 3/’16 Target

(Announced in September 2011)

Previous Mid-term Business Plan

FYE 3/’14 Target (Previous)

Net sales 320.9 400 430

Operating income 12.8 20 20

Ordinary income 6.4 17 14

Net income 6.0 13.5 11

10 JVC KENWOOD Corporation

Special Feature: New Mid-term Business Plan