Ingram Micro 2001 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2001 Ingram Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

(Dollars in 000s, except per share data)

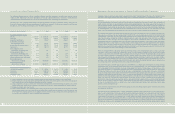

The components of accumulated other comprehensive income (loss) are as follows:

Foreign Unrealized Accumulated

Currency Gain (Loss) on Other

Translation Available-for- Comprehensive

Adjustment Sale Securities Income (Loss)

Balance at January 2, 1999 $ (11,580) $ 6,666 $ (4,914)

Change in foreign currency translation adjustment (17,071) - (17,071)

Unrealized holding gain arising during the period - 475,490 475,490

Reclassification adjustment for realized gain

included in net income - (125,220) (125,220)

Balance at January 1, 2000 (28,651) 356,936 328,285

Change in foreign currency translation adjustment (250) - (250)

Unrealized holding loss arising during the period - (270,644) (270,644)

Reclassification adjustment for realized gain

included in net income - (69,327) (69,327)

Balance at December 30, 2000 (28,901) 16,965 (11,936)

Change in foreign currency translation adjustment (23,843)-(23,843)

Unrealized holding loss arising during the period - (17,637) (17,637)

Balance at December 29, 2001 $ (52,744) $ (672) $ (53,416)

Accounting for Stock-Based Compensation

The Company has adopted the disclosure requirements of Statement of Financial Accounting Standards No. 123, “Accounting for Stock

Based Compensation” (“FAS 123”). As permitted by FAS 123, the Company continues to measure compensation cost in accordance with

Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees” (“APB 25”) and related interpretations, but

provides pro forma disclosures of net income and earnings per share as if the fair-value method had been applied.

Earnings Per Share

The Company reports a dual presentation of Basic Earnings Per Share (“Basic EPS”) and Diluted Earnings Per Share (“Diluted EPS”). Basic

EPS excludes dilution and is computed by dividing net income by the weighted average number of common shares outstanding during the

reported period. Diluted EPS reflects the potential dilution that could occur if stock options and warrants, and other commitments to issue

common stock were exercised using the treasury stock method or the if-converted method, where applicable.

The computation of Basic EPS and Diluted EPS is as follows:

2001 2000 1999

Income before extraordinary item $ 9,347 $ 223,753 $ 179,641

Weighted average shares 147,511,408 145,213,882 143,404,207

Basic earnings per share before

extraordinary item $ 0.06 $ 1.54 $ 1.25

Weighted average shares including the

dilutive effect of stock options and warrants

(2,536,399; 3,427,109; and 4,380,505

for Fiscal 2001, 2000, and 1999, respectively) 150,047,807 148,640,991 147,784,712

Diluted earnings per share before

extraordinary item $ 0.06 $ 1.51 $ 1.21

39

Notes to Consolidated Financial Statements

(Dollars in 000s, except per share data)

Foreign exchange risk is managed by using forward and option contracts to hedge receivables and payables. Written foreign currency

options are used to mitigate currency risk in conjunction with purchased options. Currency interest rate swaps are used to hedge foreign

currency denominated principal and interest payments related to intercompany and third-party loans.

Effective December 31, 2000, the Company adopted Statement of Financial Accounting Standards No. 133, “Accounting for Derivative

Instruments and Hedging Activities” (“FAS 133”) as amended by Statement of Financial Accounting Standards No. 138, “Accounting for

Certain Derivative Instruments and Certain Hedging Activities – an amendment of FASB No. 133.” The adoption of FAS 133 did not have a

material impact on the Company’s consolidated financial position or results of operations. The Company’s derivative financial instruments

under FAS 133 are discussed below.

All derivatives are recorded in the Company’s consolidated balance sheet at fair value. The estimated fair value of derivative financial

instruments represents the amount required to enter into similar offsetting contracts with similar remaining maturities based on

quoted market prices. As disclosed in Note 7, the Company has an interest rate swap that is designated as a fair value hedge.

Changes in the fair value of this derivative are recorded in current earnings and are offset by the like change in the fair value of

the hedged debt instrument. Changes in the fair value of derivatives not designated as hedges are recorded in current earnings.

Prior to the adoption of FAS 133, derivative financial instruments were accounted for on an accrual basis. Income and expense were

recorded in the same category as that arising from the related asset or liability being hedged. Gains and losses resulting from effective

hedges of existing assets, liabilities or firm commitments were deferred and recognized when the offsetting gains and losses were

recognized on the related hedged items. Gains or losses on written foreign currency options were adjusted to market value at the end of

each accounting period and were not material.

The notional amount of forward exchange contracts and options is the amount of foreign currency bought or sold at maturity. The notional

amount of interest rate swaps is the underlying principal amount used in determining the interest payments exchanged over the life of

the swap. Notional amounts are indicative of the extent of the Company’s involvement in the various types and uses of derivative financial

instruments and are not a measure of the Company’s exposure to credit or market risks through its use of derivatives.

Credit exposure for derivative financial instruments is limited to the amounts, if any, by which the counterparties’ obligations under the

contracts exceed the obligations of the Company to the counterparties. Potential credit losses are minimized through careful evaluation of

counterparty credit standing, selection of counterparties from a limited group of high-quality institutions and other contract provisions.

Derivative financial instruments comprise the following:

2001 2000

Notional Estimated Notional Estimated

Amounts Fair Value Amounts Fair Value

Foreign exchange forward contracts $ 1,049,323 $ 15,522 $ 1,141,702 $ (11,799)

Purchased foreign currency options 2,545 39 14,333 1 1 1

Written foreign currency options 3,838 (1) 18,837 (72)

Interest rate swaps 200,000 6,070 1 10,000 11,775

Comprehensive Income (Loss)

Statement of Financial Accounting Standards No. 130, “Reporting Comprehensive Income” (“FAS 130”) establishes standards for reporting

and displaying comprehensive income and its components in the Company’s consolidated financial statements. Comprehensive

income is defined in FAS 130 as the change in equity (net assets) of a business enterprise during a period from transactions and other

events and circumstances from nonowner sources and is comprised of net income and other comprehensive income (loss).

38