Ingram Micro 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 Ingram Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis (continued)

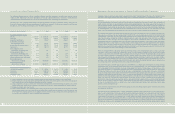

Income from operations, including reorganization costs and special items, as a percentage of net sales decreased to 0.4% in 2001 compared

to 1.2% in 2000. Income from operations, excluding reorganization costs and special items, decreased as a percentage of net sales to 0.6%

in 2001 from 1.2% in 2000. The decrease in our income from operations, excluding reorganization costs and special items, as a percentage of

net sales, was primarily due to the increase in SG&A expenses as a percentage of net sales, partially offset by our improvement in gross margin,

both of which are discussed above. Our U.S. income from operations, excluding reorganization costs and special items, as a percentage of

net sales decreased to 1.0% in 2001 from 1.5% in 2000. Our European income from operations, excluding reorganization costs and special

items, as a percentage of net sales decreased to 0.4% in 2001 from 0.7% in 2000. Our Other International, income from operations, excluding

reorganization costs and special items, as a percentage of net sales decreased to less than 0.1% in 2001 from 0.5% in 2000.

Other expense (income) consisted primarily of interest, foreign currency exchange losses, losses on sales of receivables under our ongoing

accounts receivable facilities, and other non-operating gains and losses. In 2001, we recorded $77.0 million of net other expense, or 0.3% as

a percentage of net sales, compared to net other income of $9.1 million in 2000, or less than 0.1% as a percentage of net sales. The income

in 2000 primarily resulted from our sale of approximately 15% of our original holdings of Softbank common stock for a pre-tax gain of

approximately $111.5 million, net of related costs. No such transaction occurred in 2001. Excluding the gain realized on the sale of Softbank

common stock, our net other expense in 2001 decreased by $25.4 million or 24.8% compared to 2000. The decrease in net other expense was

attributable to lower interest rates in the first half of the year and lower average borrowings, including off-balance sheet debt resulting from

utilization of our accounts receivable facilities, in 2001 compared to 2000. The decrease in our average borrowings outstanding compared to

the prior period primarily reflects our continued focus on managing working capital as well as the overall lower volume of business.

Our provision for income taxes decreased 95.3% to $6.6 million in 2001 from $138.8 million in 2000, reflecting the 95.6% decrease in our

income before income taxes and extraordinary item. Our effective tax rate was 41.3% in 2001 compared to 38.3% in 2000. The increase in

the 2001 effective tax rate was primarily attributable to the change in the proportion of income earned within the various taxing jurisdictions

and/or tax rates applicable to such taxing jurisdictions.

In 2001, we repurchased more than 99% of our outstanding convertible debentures with a total carrying value of $220.8 million for $225.0 million

in cash, resulting in an extraordinary loss of $2.6 million, net of tax benefits of $1.6 million. In 2000, we repurchased convertible debentures with

carrying values of $235.2 million for $231.3 million in cash, resulting in an extraordinary gain of $2.4 million, net of taxes of $1.5 million.

Year Ended December 30, 2000 Compared to Year Ended January 1, 2000

Our consolidated net sales increased 9.4% to $30.7 billion in 2000 from $28.1 billion in 1999. The increase in worldwide net sales was

primarily attributable to growth in overall demand for technology products, the addition of new customers, increased sales to our existing

customer base, and expansion of our product and service offerings.

Net sales from our U.S. operations increased 9.7% to $18.5 billion in 2000 from $16.8 billion in 1999 primarily due to growth in demand for

technology products and expansion of our product and service offerings. The sales growth in our U.S. operations, however, was moderated,

especially in the second quarter of 2000, compared to historical sales growth primarily due to pricing policy changes we implemented in

the same quarter and our decision to eliminate certain vendor programs. Both decisions were geared towards the improvement of our gross

margin. In addition, towards the end of 2000, the demand for IT products and services softened in the U.S. consistent with the slowing of

the U.S. economy. This softness in U.S. sales continued throughout 2001 and may continue and/or worsen for the next several quarters. Net

sales from our European operations grew approximately 16.1% in local currencies in 2000, but when converted to U.S. dollars, our net sales

only increased by 1.7% to $7.5 billion in 2000 from $7.3 billion in 1999 as a result of weaker European currencies compared to the U.S. dollar.

The sales growth, in local currency, reflects overall growth in our European operations. For our Other International operations, net sales

increased 22.5% to $4.8 billion in 2000 from $3.9 billion in 1999 primarily due to the growth in our Asia-Pacific and Latin American operations.

Our Canadian operations, however, experienced only moderate sales growth in 2000 as compared to the Asia-Pacific and Latin American

operations, primarily due to the overall softness in demand for technology products and services in the Canadian market in the first half

of the year, and lower than anticipated purchases by the Canadian government in the first quarter of 2000. The Canadian government

purchases are generally strong in the first quarter of each year as this coincides with the Canadian government’s fiscal year-end.

23

Management’s Discussion and Analysis (continued)

Year Ended December 29, 2001 Compared to Year Ended December 30, 2000

Our consolidated net sales decreased 18.0% to $25.2 billion in 2001 from $30.7 billion in 2000. The decrease in worldwide net sales was

primarily attributable to the decline in demand for technology products and services throughout the world. This decline in demand

initially surfaced in the U.S. in the fourth quarter of 2000, but spread to all of our regions of operations during 2001. This sluggish demand

for technology products and services is expected to continue, and may worsen, over the near term.

Net sales from our U.S. operations decreased 26.8% to $13.5 billion in 2001 from $18.5 billion in 2000 primarily due to the continued

sluggish demand for IT products and services, consistent with the continued softening of the U.S. economy. Net sales from our European

operations were flat in local currencies in 2001, reflecting the soft demand for technology products and services in most countries in

Europe, but when converted to U.S. dollars, our net sales decreased 4.2% to $7.2 billion in 2001 from $7.5 billion in 2000 as a result of

weaker European currencies as compared to the U.S. dollar. For our geographic regions outside the U.S. and Europe, our Other

International operations, net sales decreased 5.6% to $4.5 billion in 2001 from $4.8 billion in 2000, primarily due to the overall softness

in demand for technology products and services in our Canadian and Asia-Pacific operations. Our Latin American operations, however,

experienced moderate sales growth in 2001 compared to 2000 primarily due to the continued growth of our customer base in the region.

Gross margin increased to 5.3% in 2001 from 5.1% in 2000. The improvement in our gross margin was primarily due to pricing policy

changes we initiated during 2000 to more appropriately reflect the value and related costs of services we provide to our customers,

complemented by improvements in vendor rebates, discounts and fee-based revenues. We have implemented and continue to refine

changes to our pricing strategies, inventory management processes, and administration of vendor subsidized programs. In addition, we

continue to change certain of the terms and conditions offered to our customers to reflect those being imposed by our vendors. As we

evaluate our pricing policy changes made to date, and make future pricing policy changes, if any, we may experience moderated or negative

sales growth in the near term. The softness in the U.S. and other international economies, as well as increased competition, partially resulting

from the economic slowdown, may hinder our ability to maintain and/or improve gross margins from the levels realized in 2001.

Total SG&A expenses decreased 2.5% or $30.2 million to $1.2 billion in 2001. The decrease in our SG&A expenses was attributable primarily

to the savings that resulted from our reorganization efforts during fiscal year 2001 as discussed below, our continued cost control

measures, and the lower volume of business. However, as a result of the significant decline in our revenues, SG&A expenses as a percentage

of net sales increased to 4.7% in 2001 from 3.9% in 2000. We continue to pursue and implement business process improvements and

organizational changes to create sustained cost reductions without sacrificing customer service over the long-term. However, because of

the decline in our sales, SG&A expenses as a percentage of net revenues are expected to remain above 4.0% over the near term.

We initiated a broad-based reorganization plan in the first half of 2001 with detailed actions implemented primarily in the U.S. and, to a limited

extent, in Europe and Other International to streamline operations and reorganize resources to increase flexibility, improve service and

generate cost savings and operational efficiencies. These actions included restructuring of several functions, consolidation of facilities, and

reductions of headcount. We continue to develop this broad-based plan and expect to implement additional detailed actions in 2002.

In connection with this reorganization effort, we recorded a charge of $41.4 million in fiscal year 2001 ($25.5 million, $13.6 million and $2.3

million in the U.S., Europe, and Other International, respectively). The reorganization charges represented costs of facility consolidations

in the U.S. and Europe and headcount reductions in the U.S., Europe and Other International operations. The reorganization charges

included $16.7 million in employee termination benefits for approximately 2,150 employees ($10.2 million for approximately 1,550 employees

in the U.S., $4.4 million for approximately 390 employees in Europe, and $2.1 million for approximately 210 employees in Other

International); $21.4 million for closing, downsizing and consolidating facilities ($14.8 million, $6.4 million and $0.2 million in the U.S.,

Europe, and Other International, respectively); and $3.3 million of other costs associated with the reorganization ($0.5 million and $2.8

million in the U.S. and Europe, respectively). We anticipate that these initiatives will be substantially completed within twelve months from

each of the respective commitment dates of the detailed restructuring actions (see Note 3 to consolidated financial statements). We

expect to save approximately $55 million to $70 million of costs annually after these initiatives are complete.

During 2001, we recorded charges of $22.9 million related to the following special items: $10.2 million for the write-off of electronic store-

front technologies software, which were replaced with a more efficient solution during 2001, and inventory management software, which

was no longer required because of our business process and systems improvements; an impairment charge of $3.5 million to reduce our

minority equity investment in an internet-related company to estimated net realizable value; and $9.2 million to reserve fully for our

outstanding insurance claims with an independent and unrelated former credit insurer, which went into liquidation on October 3, 2001. As

of December 29, 2001, approximately $7.6 million of insurance claims were written-off against the reserve. The remaining claims are

expected to be written-off against the balance of the reserve in 2002.

22