Ingram Micro 2001 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2001 Ingram Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

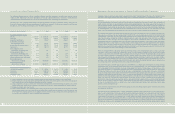

Ingram Micro Inc. Consolidated Statement of Stockholders’ Equity

Accumulated

Additional Other

Commons Stock Paid-in Retained Comprehensive Unearned

(Dollars in OOOs) Class A Class B Capital Earnings Income (Loss) Compensation Total

January 2, 1999 $ 665 $ 743 $ 591,235 $ 811,616 $ (4,914) $ (88) $ 1,399,257

Noncash compensation charge

related to stock options 1,978 1,978

Stock options exercised 17 7,387 7,404

Income tax benefit from

exercise of stock options 13,428 13,428

Vesting of Redeemable

Class B Common Stock 6 3,901 3,907

Conversion of Class B to Class

A Common Stock 22 (22) -

Grant of restricted Class A

Common Stock 3 3,455 (3,458) -

Issuance of Class A Common

Stock related to Employee

Stock Purchase Plan 5 12,534 12,539

Warrants issued 11,264 11,264

Amortization of unearned

compensation 450 450

Comprehensive income 183,419 333,199 516,618

January 1, 2000 712727 645,182 995,035 328,285 (3,096) 1,966,845

Noncash compensation charge

related to stock options 1,493 1,493

Stock options exercised 16 10,381 10,397

Income tax benefit from

exercise of stock options 2,671 2,671

Vesting of Redeemable

Class B Common Stock 6 3,705 3,71 1

Conversion of Class B to Class

A Common Stock 29 (29) -

Forfeiture of restricted Class A

Common Stock (485) 192 (293)

Issuance of Class A Common

Stock related to Employee

Stock Purchase Plan 1 1,893 1,894

Amortization of unearned

compensation 1,722 1,722

Comprehensive income (loss) 226,173 (340,221) (114,048)

December 30, 2000 758704 664,840 1,221,208 (11,936) (1,182) 1,874,392

Stock options exercised 26 19,886 19,912

Income tax benefit from

exercise of stock options 4,927 4,927

Conversion of Class B to Class A

Common Stock 704 (704) -

Grant of restricted Class A

Common Stock 1 789 (790) -

Issuance of Class A Common

Stock related to Employee

Stock Purchase Plan 1 1,516 1,517

Amortization of unearned

compensation 1,293 1,293

Comprehensive income (loss) 6,737 (41,480) (34,743)

December 29, 2001 $ 1,490 $ - $ 691,958 $ 1,227,945 $ (53,416) $ (679) $ 1,867,298

See accompanying notes to these consolidated financial statements.

33

Ingram Micro Inc. Consolidated Statement of Income

(Dollars in 000s, except per share data) Fiscal Year 2001 2000 1999

Net sales $ 25,186,933 $ 30,715,149 $ 28,068,642

Cost of sales 23,857,034 29,158,851 26,732,479

Gross profit 1,329,899 1,556,298 1,336,16 3

Expenses:

Selling, general and administrative 1,1 72,665 1,202,861 1,1 15,854

Reorganization costs 41,411 - 20,305

Special items 22,893 - -

1,236,969 1,202,861 1,136,159

Income from operations 92,930 353,437 200,004

Other expense (income):

Interest income (16,256) (8,527) (4,338)

Interest expense 55,624 88,726 101,691

Losses on sales of receivables 20,332 13,351 7,223

Gain on sale of available-for-sale securities - (111,458) (201,318)

Other 17,295 8,836 6,253

76,995 (9,072) (90,489)

Income before income taxes

and extraordinary item 15,935 362,509 290,493

Provision for income taxes 6,588 138,756 1 10,852

Income before extraordinary item 9,347 223,753 179,641

Extraordinary gain (loss) on repurchase of debentures,

net of ($1,634), $1,469 and $2,405 in income taxes (2,610) 2,420 3,778

Net income $ 6,737 $ 226,173 $ 183,419

Basic earnings per share:

Income before extraordinary item $ 0.06 $ 1.54 $ 1.25

Extraordinary gain (loss) on repurchase of debentures (0.01) 0.01 0.03

Net income $ 0.05 $ 1.55 $ 1.28

Diluted earnings per share:

Income before extraordinary item $ 0.06 $ 1.51 $ 1.21

Extraordinary gain (loss) on repurchase of debentures (0.02) 0.01 0.03

Net income $ 0.04 $ 1.52 $ 1.24

See accompanying notes to these consolidated financial statements.

32