Ingram Micro 2001 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2001 Ingram Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis (continued)

million to $290 million, net of tax benefits ranging from $7 million to $12 million, in the first quarter of 2002. Impairment is based on the valuation of individual

reporting units. The valuation methods used include estimated net present value of projected future cash flows of these reporting units. If actual results are

substantially lower, or if market discount rates increase, this could adversely affect our valuations and may result in additional future impairment charges.

•Income Taxes - As part of the process of preparing our consolidated financial statements, we have to estimate our income taxes in each of the taxing

jurisdictions in which we operate. This process involves estimating our actual current tax expense together with assessing any temporary differences

resulting from the different treatment of certain items, such as the timing for recognizing revenues and expenses, for tax and accounting purposes.

These differences may result in deferred tax assets and liabilities, which are included in our consolidated balance sheet. We are required to assess the

likelihood that our deferred tax assets, which include net operating loss carryforwards and temporary differences that are expected to be deductible in

future years, will be recoverable from future taxable income or other tax planning strategies. If recovery is not likely, we have to provide a valuation

allowance based on our estimates of future taxable income in the various taxing jurisdictions, and the amount of deferred taxes that are ultimately

realizable. The provision for current and deferred tax liabilities involves evaluations and judgments of uncertainties in the interpretation of complex tax

regulations by various taxing authorities. In situations involving tax related uncertainties, such as our gains on sales of Softbank common stock (see

Notes 2 and 8 to consolidated financial statements), we provide for deferred tax liabilities unless we consider it probable that additional taxes will not

be due. Actual results could differ from our estimates.

•Contingencies and Litigation - There are various claims, lawsuits and pending actions against us incident to our operations. If a loss arising from these

actions is probable and can be reasonably estimated, we record the amount of the loss, or the minimum estimated liability when the loss is estimated

using a range within which no point is more probable than another. Based on current available information, we believe that the ultimate resolution of

these actions will not have a material adverse effect on our consolidated financial statements. As additional information becomes available, we assess

any potential liability related to these actions and may need to revise our estimates. Future revisions of our estimates could materially impact the

results of our operations and financial position.

Results of Operations

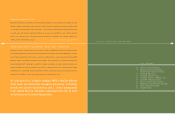

The following table sets forth our net sales by geographic region (excluding intercompany sales) and the percentage of total net sales represented thereby,

for each of the fiscal years indicated (in millions).

2001 2000 1999

Net sales by geographic region:

United States $ 13,507 53.6% $ 18,452 60.1% $ 16,814 59.9%

Europe 7,157 28.4 7,472 24.3 7,344 26.2

Other international 4,523 18.0 4,791 15.6 3,9 1 1 13.9

Total $ 25, 1 8 7 1 00.0% $ 30,715 100.0% $28,069 100.0%

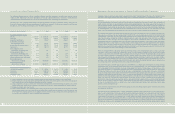

The following table sets forth certain items from our consolidated statement of income as a percentage of net sales, for each of the

fiscal years indicated.

2001 2000 1999

Net sales 100.0% 100.0% 100.0%

Cost of sales 94.7 94.9 95.2

Gross profit 5.3 5.1 4.8

Expenses:

SG&A expenses 4.7 3.9 4.0

Reorganization costs 0.2 - 0.0

Special items 0.0 - -

Income from operations 0.4 1.2 0.8

Other expense (income), net 0.3 (0.0) (0.3)

Income before income taxes

and extraordinary item 0.1 1.2 1.1

Provision for income taxes 0.1 0.5 0.4

Income before extraordinary item 0.0 0.7 0.7

Extraordinary item 0.0 0.0 0.0

Net income 0.0% 0.7% 0.7%

21

20

Management’s Discussion and Analysis (continued)

institutions, the effect of which was to swap our fixed rate obligation on our senior subordinated notes for a floating rate obligation based on 90-day LIBOR

plus 4.260%. We also have a revolving credit facility of $500 million, which expires in October 2002, as well as additional facilities of approximately $585

million. As of December 29, 2001, borrowings of $252.8 million were outstanding under the revolving credit and additional facilities. In addition, on June 9,

1998, we sold $1.3 billion aggregate principal amount at maturity of zero coupon convertible senior debentures due 2018. Gross proceeds from this offering

were $460.4 million. In the aggregate, we have repurchased more than 99% of our outstanding convertible debentures over the past three years. Our

interest expense for a substantial portion of our existing, as well as any future, indebtedness will be subject to fluctuations in interest rates which may

cause fluctuations in our net income.

Critical Accounting Policies and Estimates

The discussions and analyses of our consolidated financial condition and results of operations were based on our consolidated financial statements, which

have been prepared in conformity with generally accepted accounting principles in the U.S. The preparation of these financial statements requires us to

make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of any contingent assets and liabilities at the financial

statement date, and reported amounts of revenue and expenses during the reporting period. On an ongoing basis, we review and evaluate our estimates

and assumptions, including those that relate to accounts receivable; vendor programs; inventories; goodwill, intangible assets and other long-lived assets;

income taxes; and contingencies and litigation. Our estimates were based on our historical experience and a variety of other assumptions that we believe

to be reasonable under the circumstances, the results of which form the basis for making our judgment about the carrying values of assets and liabilities

that are not readily available from other sources. Actual results could differ from these estimates under different assumptions or conditions.

We believe the following critical accounting policies are affected by our judgment, estimates and/or assumptions used in the preparation of our consolidated

financial statements.

•Accounts Receivable - We provide allowances for doubtful accounts on our accounts receivable, including retained interest in securitized receivables,

for estimated losses resulting from the inability of our customers to make required payments. If the financial condition of our customers were to

deteriorate, which may result in the impairment of their ability to make payments, additional allowances may be required. Our estimates are influenced

by the following considerations: the large number of customers and their dispersion across wide geographic areas, the fact that no single customer

accounts for 10% or more of our net sales, our continuing credit evaluation of our customers’ financial conditions, our credit insurance coverage and

collateral requirements from our customers in certain circumstances.

• Vendor Programs - We receive funds from vendors for price protection, product rebates, marketing and training, and promotion programs which are

generally recorded, net of direct costs, as adjustments to product costs, revenue, or selling, general and administrative expenses according to the nature

of the program. We accrue rebates based on the terms of the program and sales of qualifying products. Some of these programs may extend over one

or more quarterly reporting periods. Actual rebates may vary based on volume or other sales achievement levels, which could result in an increase or

reduction in the estimated amounts previously accrued. In addition, if market conditions were to deteriorate due to an economic downturn, vendors may

change the terms of some or all of these programs. Such change could lower our gross margins on products we sell or revenues earned. We also provide

reserves for receivables on vendor programs for estimated losses resulting from vendors’ inability to pay, or rejections of such claims by vendors.

•Inventories - Our inventory levels are based on our projections of future demand and market conditions. Any sudden decline in demand and/or rapid product

improvements and technological changes can cause us to have excess and/or obsolete inventories. On an ongoing basis, we review for estimated obsolete

or unmarketable inventories and write down our inventories to their estimated net realizable value based upon our forecasts of future demand and market

conditions. If actual market conditions are less favorable than our forecasts, additional inventory reserves may be required. Our estimates are influenced

by the following considerations: sudden decline in demand due to economic downturn, rapid product improvements and technological changes, our ability

to return to vendors a certain percentage of our purchases, and protection from loss in value of inventory under our vendor agreements.

•Goodwill, Intangible Assets and Other Long-Lived Assets - We assess potential impairment of our goodwill, intangible assets and other long-lived

assets when there is evidence that recent events or changes in circumstances have made recovery of an asset’s carrying value unlikely. When the sum

of the expected, undiscounted future net cash flows is less than the carrying value of an asset, an impairment loss will be recognized. The amount of

an impairment loss would be recognized as the excess of the asset’s carrying value over its fair value. Factors we consider important, which may cause

an impairment include: significant changes in the manner of use of the acquired asset, negative industry or economic trends, and significant underperformance

relative to historical or projected future operating results.

In accordance with Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets” (“FAS 142”) (see Note 2 to consolidated financial

statements), we will no longer amortize goodwill or indefinite-lived intangible assets effective the beginning of fiscal 2002. Instead, these assets will be

reviewed for impairment at least annually. Amortization expense was $21.0 million, $22.0 million, and $22.9 million in 2001, 2000, and 1999, respectively. We

are currently evaluating the effect that the adoption of FAS 142 may have on our consolidated financial position. It is expected that, as a result of the

implementation of FAS 142, we will record a non-cash charge for the cumulative effect of the change in accounting principle upon adoption ranging from $260