Ingram Micro 2001 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2001 Ingram Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

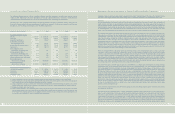

Ingram Micro Inc. Consolidated Balance Sheet

(Dollars in 000s, except per share data) Fiscal Year End 2001 2000

Assets

Current assets:

Cash and cash equivalents $ 273,059 $ 150,560

Investment in available-for-sale securities 24,031 52,897

Accounts receivable:

Trade accounts receivable 1,760,581 1,945,496

Retained interest in securitized receivables 537,376 407,176

Total accounts receivable (less allowances of $79,927 and $96,994) 2,297,957 2,352,672

Inventories 1,623,628 2,919,117

Other current assets 238,171 294,838

Total current assets 4,456,846 5,770,084

Property and equipment, net 303,833 350,829

Goodwill, net 508,227 430,853

Other 33,101 57,216

Total assets $ 5,302,007 $ 6,608,982

Liabilities And Stockholders’ Equity

Current liabilities:

Accounts payable $ 2,607,145 $ 3,725,080

Accrued expenses 279,669 350,1 1 1

Current maturities of long-term debt 252,803 42,774

Total current liabilities 3,139,617 4,117,965

Convertible debentures 405 220,035

Revolving credit facilities and other long-term debt - 282,809

Senior subordinated notes 204,899 -

Deferred income taxes and other liabilities 89,788 113,78 1

Total liabilities 3,434,709 4,734,590

Commitments and contingencies (Note 10)

Stockholders’ equity:

Preferred Stock, $0.01 par value, 25,000,000 shares

authorized; no shares issued and outstanding - -

Class A Common Stock, $0.01 par value, 500,000,000 shares

authorized; 149,024,793 and 75,798,115 shares issued

and outstanding in 2001 and 2000, respectively 1,490 758

Class B Common Stock, $0.01 par value, 135,000,000 shares

authorized; 0 and 70,409,806 shares issued

and outstanding in 2001 and 2000, respectively - 704

Additional paid-in capital 691,958 664,840

Retained earnings 1,227,945 1,221,208

Accumulated other comprehensive loss (53,416) (11,936)

Unearned compensation (679) (1,182)

Total stockholders’ equity 1,867,298 1,874,392

Total liabilities and stockholders’ equity $ 5,302,007 $ 6,608,982

See accompanying notes to these consolidated financial statements.

31

Management’s Discussion and Analysis (continued)

The value of foreign currency options does not change on a one-to-one basis with changes in the underlying currency rate. The potential

loss in option value was adjusted for the estimated sensitivity (the “delta” and “gamma”) to changes in the underlying currency rate. The

model includes all of our forwards, options, cross-currency swaps and nonfunctional currency denominated debt (i.e., our market-

sensitive derivative and other financial instruments as defined by the SEC). The accounts receivable and accounts payable denominated

in foreign currencies, which certain of these instruments are intended to hedge, were excluded from the model.

The VaR model is a risk analysis tool and does not purport to represent actual losses in fair value that will be incurred by us, nor does it

consider the potential effect of favorable changes in market rates. It also does not represent the maximum possible loss that may occur.

Actual future gains and losses will likely differ from those estimated because of changes or differences in market rates and

interrelationships, hedging instruments and hedge percentages, timing and other factors.

The following table sets forth the estimated maximum potential one-day loss in fair value, calculated using the VaR model (in millions).

The decrease in VaR from interest rate sensitive financial instruments reflects a change in the composition of our portfolio from

December 31, 2000 to December 29, 2001. We believe that the hypothetical loss in fair value of our derivatives would be offset by gains in

the value of the underlying transactions being hedged.

Interest Rate Currency Sensitive

Sensitive Financial Financial Combined

Instruments Instruments Portfolio

VaR as of December 29, 2001 $ 6.3 $ 0.2 $ 6.1

VaR as of December 30, 2000 11 .7 0.1 10.2

Euro Conversion

On January 1, 1999, twelve of the 15 member countries of the European Union adopted the euro as their common legal currency. As

of December 29, 2001, we had fully converted all systems and processes in the nine euro-zone countries where we have operations. No

material adverse effect on our financial position or results of operations has arisen as a result of the conversions and costs associated

with the euro conversion were not material. Since the implementation of the euro, we have experienced improved efficiencies in our cash

management program in Europe as all intracompany transactions within participating countries are conducted in euros.

Cautionary Statements for Purposes of the Safe Harbor Provisions of the Private Securities Litigation Reform

Act of 1995

The matters in this Annual Report that are forward-looking statements are based on our current expectations that involve certain risks,

including, without limitation: intense competition in the U.S., Europe and Other International; the severe downturn in economic

conditions (particularly purchases of technology products) may continue or worsen; future terrorist or military actions; continued

pricing and margin pressures; failure to adjust costs in a timely fashion in response to a sudden decrease in demand; the potential

for declines in inventory values and continued restrictive vendor terms and conditions; the potential decline as well as seasonal variations

in demand for our products and services; unavailability of adequate capital; inability to manage future adverse industry trends; failure of

information systems; significant credit loss resulting from significant credit exposure to reseller customers and negative trends in their

businesses; interest rate and foreign currency fluctuations; adverse impact of governmental controls and political or economic instability

on foreign operations; changes in local, regional, and global economic conditions and practices; dependency on key individuals and inability

to retain personnel; product supply shortages; the potential termination of a supply agreement with a major supplier; difficulties and

risks associated with integrating operations and personnel in acquisitions; disruption due to reorganization activities; rapid product

improvement and technological change and resulting obsolescence risks; and dependency on independent shipping companies.

We have instituted in the past and continue to institute changes to our strategies, operations and processes to address these risk factors

and to mitigate their impact on our results of operations and financial position. However, no assurances can be given that we will be

successful in these efforts. For a further discussion of these and other significant factors to consider in connection with forward-looking

statements concerning us, reference is made to Exhibit 99.01 of our Annual Report on Form 10-K for the fiscal year ended December 29,

2001; other risks or uncertainties may be detailed from time to time in our future SEC filings.

30