Hyundai 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

HYUNDAI MOTOR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2007 AND 2006

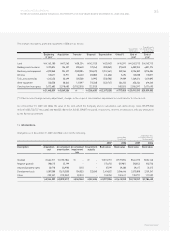

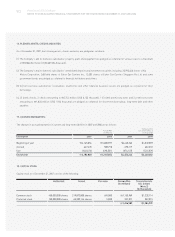

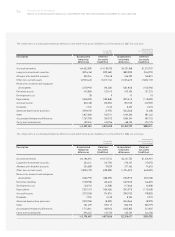

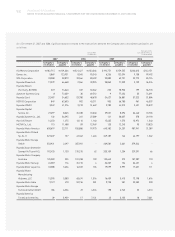

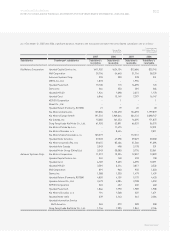

The temporary differences of 218,889 million (US$233,307 thousand) and 317,555 million (US$ 338,473thousand) as of December 31,

2007 and 2006, respectively, were not recognized since it is not probable that the temporary difference will be reversed in the foreseeable

future.

Effective tax rate used in calculating deferred tax assets or liabilities arising from temporary differences of the company and domestic

subsidiaries are 27.5% including resident tax.

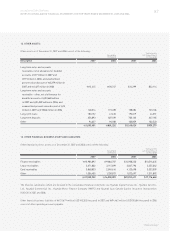

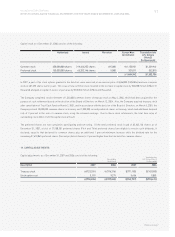

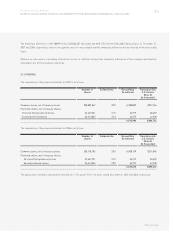

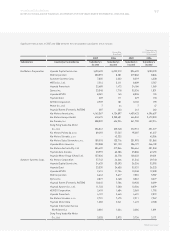

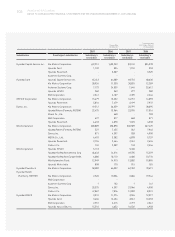

23. DIVIDENDS:

The computation of the proposed dividends for 2007 is as follows:

Number of Dividend rate Korean Won Translation into

shares (In millions) U.S. Dollars

(Note 2)

(In thousands)

Common shares, net of treasury shares 208,802,067 20% 208,802 $222,556

Preferred shares, net of treasury shares:

First and Third preferred shares 25,637,321 21% 26,919 28,692

Second preferred shares 36,613,865 22% 40,275 42,928

275,996 $294,176

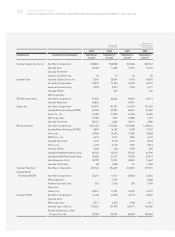

The computation of the proposed dividends for 2006 is as follows:

Number of Dividend rate Korean Won Translation into

shares (In millions) U.S. Dollars

(Note 2)

(In thousands)

Common shares, net of treasury shares 208,178,785 20% 208,179 $221,892

Preferred shares, net of treasury shares:

First and Third preferred shares 25,637,321 21% 26,919 28,692

Second preferred shares 36,613,865 22% 40,275 42,928

275,373 $293,512

The payout ratios (dividends declared/net income) are 17.2% and 21.9% for the years ended December 31, 2007 and 2006, respectively.