Hyundai 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 HYUNDAI MOTOR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2007 AND 2006

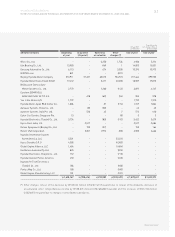

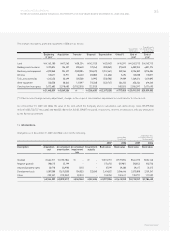

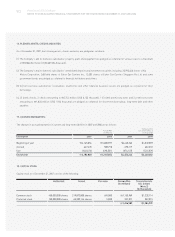

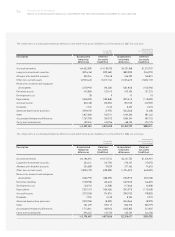

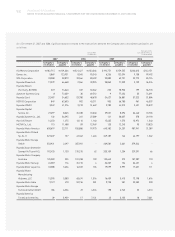

16. PLEDGED ASSETS, CHECKS AND NOTES:

As of December 31, 2007, the following assets, checks and notes are pledged as collateral:

(1) The Company’s and its domestic subsidiaries' property, plant and equipment are pledged as collateral for various loans to a maximum

of 3,386,204 million (US$3,609,256 thousand).

(2) The Company’s and its domestic subsidiaries’ certain bank deposits and investment securities, including 23,993,466 shares of Kia

Motors Corporation, 2,681,646 shares of Eukor Car Carriers Inc., 12,005 shares of Eukor Car Carriers Singapore Pte Ltd. and some

government bonds are pledged as collateral to financial institutions and others.

(3) Certain overseas subsidiaries’ receivables, inventories and other financial business assets are pledged as collateral for their

borrowings.

(4) 45 blank checks, 2 checks amounting to 5,754 million (US$ 6,133 thousand), 115 blank promissory notes and 2 promissory notes

amounting to 1,820 million (US$ 1,940 thousand) are pledged as collateral for short-term borrowings, long-term debt and other

payables.

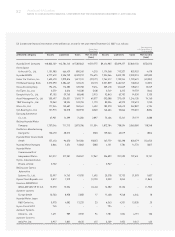

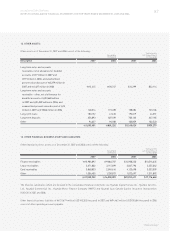

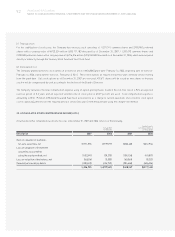

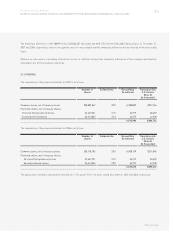

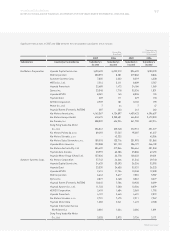

17. ACCRUED WARRANTIES:

The changes in accrued warranties in current and long-term liabilities in 2007 and 2006 are as follows:

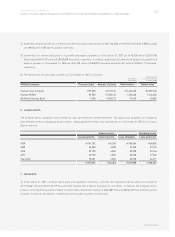

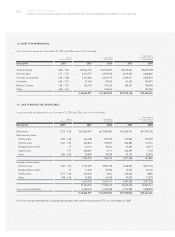

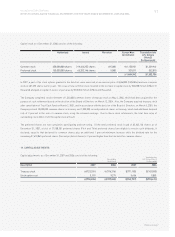

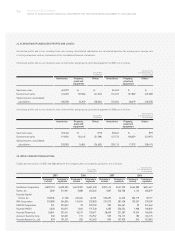

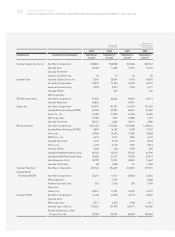

Authorized Issued Par value Korean Won Translation into

(In millions) U.S. Dollars

(Note 2)

(In thousands)

Common stock 450,000,000 shares 219,873,808 shares 5,000 1,155,969 $1,232,114

Preferred stock 150,000,000 shares 65,202,146 shares 5,000 331,011 352,815

1,486,980 $1,584,929

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Description 2007 2006 2007 2006

Beginning of year 4,165,854 4,080,597 $4,440,262 $4,349,389

Accrual 647,470 583,778 690,119 622,232

Use (632,476) (498,521) (674,137) (531,359)

End of year 4,180,848 4,165,854 $4,456,244 $4,440,262

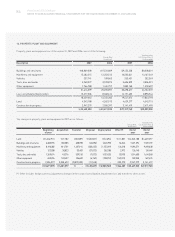

18. CAPITAL STOCK:

Capital stock as of December 31, 2007 consists of the following: