Hyundai 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

HYUNDAI MOTOR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2007 AND 2006

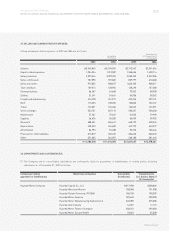

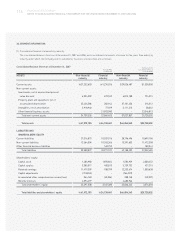

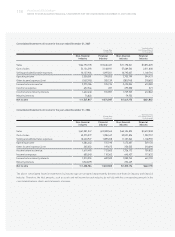

(2) Regional Results of Operations and Total Assets

Results of operations and total assets, by region where the Company and its subsidiaries for the year ended and as of December 31, 2007

are located, are as follows:

Korean Won(In millions)

Domestic North Asia Europe Consolidation Consolidated

America adjustments amounts

Total sales 63,772,038 19,575,201 6,264,741 15,414,457 (35,424,921) 69,601,516

Inter-company sales (25,709,493) (4,600,949) (143,529) (4,970,950) 35,424,921 -

Net sales 38,062,545 14,974,252 6,121,212 10,443,507 - 69,601,516

Operating income 2,531,080 143,893 57,482 (219,059) 334,626 2,848,022

Total assets 72,455,687 15,008,890 4,234,227 10,293,461 (18,144,739) 83,847,526

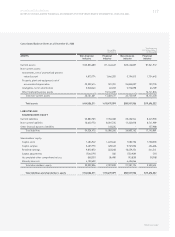

Results of operations and total assets, by region where the Company and its subsidiaries for the year ended and as of December 31, 2006

are located, are as follows:

Korean Won(In millions)

Domestic North Asia Europe Consolidation Consolidated

America adjustments amounts

Total sales 59,453,876 19,363,992 4,537,222 11,418,514 (31,125,579) 63,648,025

Inter-company sales (24,247,624) (3,950,211) (40,754) (2,886,990) 31,125,579 -

Net sales 35,206,252 15,413,781 4,496,468 8,531,524 - 63,648,025

Operating income 1,984,375 227,411 165,833 (419,745) (161,184) 1,796,690

Total assets 63,552,839 12,317,483 2,903,920 6,810,376 (14,875,133) 70,709,485

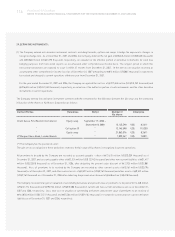

31.DISPOSAL OF RECEIVABLES IN FINANCIAL SUBSIDIARIES:

Hyundai Capital Service Inc. sold receivables to the SPCs for the purpose of raising its operating capital in accordance with the Act on Asset

Backed Securities. The amounts of disposal for the years ended December 31, 2007 and 2006 are 619,474 million (US$ 660,279 thousand)

and 1,733,002 million (US$1,847,156 thousand), respectively. The amounts of money receivable trust purchased at the disposal of

receivables to the SPCs are 248,754 million (US$ 265,140 thousand) and 502,633 million (US$ 535,742 thousand) in 2007 and 2006,

respectively. Also, Hyundai Card Co., Ltd. sold its card assets of 728,060 million (US$ 776,018 thousand) for 724,868 million (US$

772,616 thousand) before 2006 in accordance with the Act on Asset Backed Securities. The target loan principal of the related assets is

839,276 million (US$ 894,560 thousand) as of December 31, 2007. The principle of the trust assets varies according to the amount used by

the credit card members as they are comprehensive transferred assets of the member. It recognized assets in trust as net of asset-backed

senior series beneficial trust certificates amount to 400,300 million (US$ 426,668 thousand) as of December 31, 2007.

In addition, Hyundai Card Co., Ltd. sold its accounts written-off and overdue card assets of 135,890 million (US$ 144,841 thousand) and

417,464 million (US$ 444,963 thousand) to Hyundai Capital Service Inc. in 2007 and 2006, respectively. It recognizes the difference

between book value and sales value as bad debt provisions.