Dish Network 2014 Annual Report Download - page 70

Download and view the complete annual report

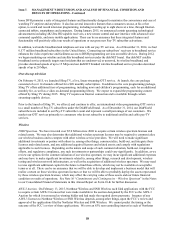

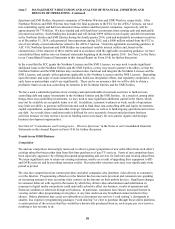

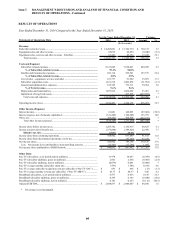

Please find page 70 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

60

60

Programming

Our ability to compete successfully will depend, among other things, on our ability to continue to obtain desirable

programming and deliver it to our subscribers at competitive prices. Programming costs represent a large percentage of

our “Subscriber-related expenses” and the largest component of our total expense. We expect these costs to continue to

increase, especially for local broadcast channels and sports programming. Going forward, our margins may face

pressure if we are unable to renew our long-term programming contracts on favorable pricing and other economic

terms.

Increases in programming costs could cause us to increase the rates that we charge to our subscribers, which could in

turn cause our existing Pay-TV subscribers to disconnect our service or cause potential new Pay-TV subscribers to

choose not to subscribe to our service. Additionally, even if our subscribers do not disconnect our services, they may

purchase through new and existing online platforms a certain portion of the services that they would have

historically purchased from us, such as pay-per-view movies, resulting in less revenue to us.

Furthermore, our gross new Pay-TV subscriber activations and Pay-TV churn rate may be negatively impacted if we

are unable to renew our long-term programming contracts before they expire. Our gross new Pay-TV subscriber

activations, net Pay-TV subscriber additions and Pay-TV churn rate have been negatively impacted as a result of

multiple programming interruptions and threatened programming interruptions in connection with the scheduled

expiration of programming carriage contracts with several content providers, including, among others, Turner

Networks, 21st Century Fox and certain local network affiliates. In particular, we suffered from lower gross new

Pay-TV subscriber activations, lower net Pay-TV subscriber additions and higher Pay-TV churn rate beginning in

the fourth quarter 2014 and continuing in the first quarter 2015, when, among others, certain programming from 21st

Century Fox, including Fox entertainment and news channels, was not available on our service. Although we believe

that the impact of the programming interruptions that occurred beginning in the fourth quarter 2014 and continued in

the first quarter 2015 has now subsided, we cannot predict with any certainty the impact to our gross new Pay-TV

subscriber activations, net Pay-TV subscriber additions and Pay-TV churn rate resulting from similar programming

interruptions that may occur in the future. As a result, we may at times suffer from periods of lower gross new Pay-

TV subscriber activations, lower net Pay-TV subscriber additions and higher Pay-TV churn rates as we did

beginning in the fourth quarter 2014 and continuing in the first quarter 2015.

Operations and Customer Service

While economic factors have impacted the entire pay-TV industry, our relative performance has also been driven by

issues specific to DISH. In the past, our Pay-TV subscriber growth has been adversely affected by signal theft and

other forms of fraud and by operational inefficiencies at DISH. To combat signal theft and improve the security of

our broadcast system, we use microchips embedded in credit card sized access cards, called “smart cards,” or

security chips in our receiver systems to control access to authorized programming content (“Security Access

Devices”). We expect that future replacements of these devices will be necessary to keep our system secure. To

combat other forms of fraud, we monitor our third-party distributors’ and retailers’ adherence to our business rules.

While we have made improvements in responding to and dealing with customer service issues, we continue to focus

on the prevention of these issues, which is critical to our business, financial condition and results of operations. To

improve our operational performance, we continue to make investments in staffing, training, information systems,

and other initiatives, primarily in our call center and in-home service operations. These investments are intended to

help combat inefficiencies introduced by the increasing complexity of our business, improve customer satisfaction,

reduce churn, increase productivity, and allow us to scale better over the long run. We cannot be certain, however,

that our spending will ultimately be successful in improving our operational performance.

Changes in our Technology

We have been deploying receivers that utilize 8PSK modulation technology with MPEG-4 compression technology

for several years. These technologies, when fully deployed, will allow more programming channels to be carried

over our existing satellites. Many of our customers today, however, do not have receivers that use MPEG-4

compression technology and a smaller but still significant number of our customers have receivers that use QPSK

modulation technology. In addition, given that all of our HD content is broadcast in MPEG-4, any growth in HD