Dish Network 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-18

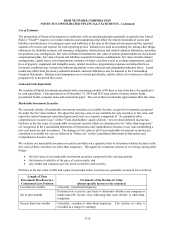

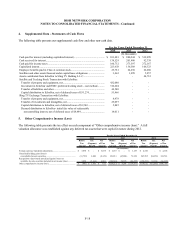

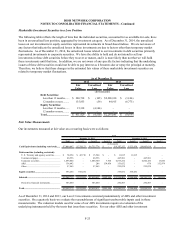

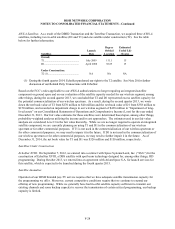

4. Supplemental Data - Statements of Cash Flows

The following table presents our supplemental cash flow and other non-cash data.

2014 2013 2012

Cash paid for interest (including capitalized interest)............................................... 833,483$ $ 880,244 $ 539,070

Cash received for interest......................................................................................... 138,529 201,480 92,339

Cash paid for income taxes....................................................................................... 160,732 273,597 272,167

Capitalized interest................................................................................................... 223,658 136,508 106,323

Employee benefits paid in Class A common stock................................................... 25,781 24,230 22,280

Satellites and other assets financed under capital lease obligations.......................... 3,462 1,070 5,857

Assets contributed from EchoStar to Sling TV Holding L.L.C................................ - - 44,712

Satellite and Tracking Stock Transaction with EchoStar:

Transfer of property and equipment, net................................................................ 432,080 - -

Investment in EchoStar and HSSC preferred tracking stock - cost method........... 316,204 - -

Transfer of liabilities and other.............................................................................. 44,540 - -

Capital distribution to EchoStar, net of deferred taxes of $31,274........................ 51,466 - -

Sling TV Exchange Transaction with EchoStar:

Transfer of property and equipment, net................................................................ 8,978 - -

Transfer of investments and intangibles, net.......................................................... 25,097 - -

Capital distribution to EchoStar, net of deferred taxes of $3,542.......................... 5,845 - -

Deemed distribution to EchoStar- initial fair value of redeemable - -

noncontrolling interest, net of deferred taxes of $8,489.................................... 14,011 - -

For the Years Ended December 31,

(In thousands)

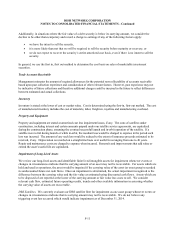

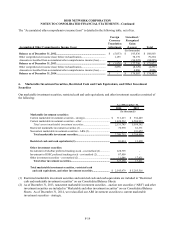

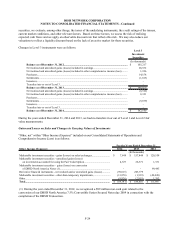

5. Other Comprehensive Income (Loss)

The following table presents the tax effect on each component of “Other comprehensive income (loss).” A full

valuation allowance was established against any deferred tax assets that were capital in nature during 2012.

Before Tax Net Before Tax Net Before Tax Net

Tax (Expense) of Tax Tax (Expense) of Tax Tax (Expense) of Tax

Amount Benefit Amount Amount Benefit Amount Amount Benefit Amount

Foreign currency translation adjustments............................................ 3,878$ -$ 3,878$ 1,155$ -$ 1,155$ 4,106$ - 4,106$

Unrealized holding gains (losses)

on available-for-sale securities......................................................... (11,729) 3,600 (8,129) 123,233 (45,094) 78,139 265,785 (96,252) 169,533

Recognition of previously unrealized (gains) losses on

available-for-sale securities included in net income (loss)............... 7,050 (2,164) 4,886 (148,603) 54,378 (94,225) (150,239) 83,360 (66,879)

Other comprehensive income (loss).................................................... (801)$ 1,436$ 635$ (24,215)$ 9,284$ (14,931)$ 119,652$ (12,892)$106,760$

2012

For the Years Ended December 31,

(In thousands)

2014 2013