Dish Network 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-35

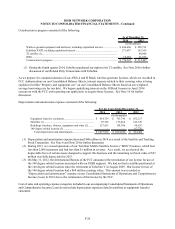

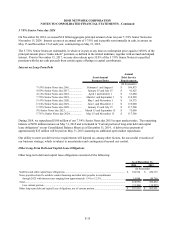

5 7/8% Senior Notes due 2024

On November 20, 2014, we issued $2.0 billion aggregate principal amount of our ten-year 5 7/8% Senior Notes due

November 15, 2024. Interest accrues at an annual rate of 5 7/8% and is payable semi-annually in cash, in arrears on

May 15 and November 15 of each year, commencing on May 15, 2015.

The 5 7/8% Senior Notes are redeemable, in whole or in part, at any time at a redemption price equal to 100.0% of the

principal amount plus a “make-whole” premium, as defined in the related indenture, together with accrued and unpaid

interest. Prior to November 15, 2017, we may also redeem up to 35.0% of the 5 7/8% Senior Notes at a specified

premium with the net cash proceeds from certain equity offerings or capital contributions.

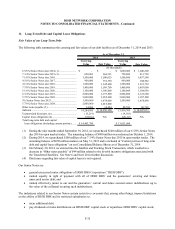

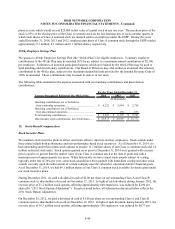

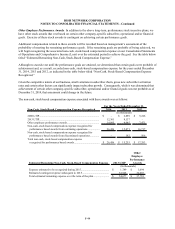

Interest on Long-Term Debt

Annual

Semi-Annual Debt Service

Payment Dates Requirements

(In thousands)

7 1/8% Senior Notes due 2016................... February 1 and August 1 106,875$

4 5/8% Senior Notes due 2017................... January 15 and July 15 41,625$

4 1/4% Senior Notes due 2018................... April 1 and October 1 51,000$

7 7/8% Senior Notes due 2019................... March 1 and September 1 110,250$

5 1/8% Senior Notes due 2020................... May 1 and November 1 56,375$

6 3/4% Senior Notes due 2021................... June 1 and December 1 135,000$

5 7/8% Senior Notes due 2022................... January 15 and July 15 117,500$

5% Senior Notes due 2023......................... March 15 and September 15 75,000$

5 7/8 % Senior Notes due 2024.................. May 15 and November 15 117,500$

During 2014, we repurchased $100 million of our 7 3/4% Senior Notes due 2015 in open market trades. The remaining

balance of $650 million matures on May 31, 2015 and is included in “Current portion of long-term debt and capital

lease obligations” on our Consolidated Balance Sheets as of December 31, 2014. A debt service payment of

approximately $25 million will be paid on May 31, 2015 assuming no additional open market repurchases.

Our ability to meet our debt service requirements will depend on, among other factors, the successful execution of

our business strategy, which is subject to uncertainties and contingencies beyond our control.

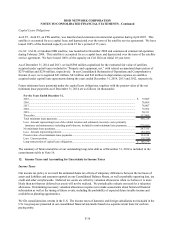

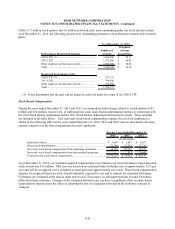

Other Long-Term Debt and Capital Lease Obligations

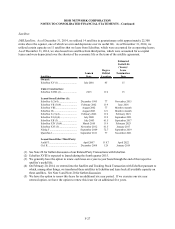

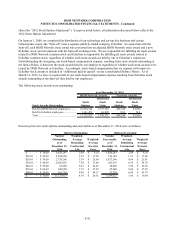

Other long-term debt and capital lease obligations consisted of the following:

2014 2013

Satellites and other capital lease obligations............................................................................................. 194,914$ 220,115$

Notes payable related to satellite vendor financing and other debt payable in installments

through 2025 with interest rates ranging from approximately 1.9% to 12.5%..................................... 34,084 80,769

Total.......................................................................................................................................................... 228,998 300,884

Less current portion............................................................................................................................. (31,466) (34,893)

Other long-term debt and capital lease obligations, net of current portion............................................... $ 197,532 $ 265,991

As of December 31,

(In thousands)