Dish Network 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-20

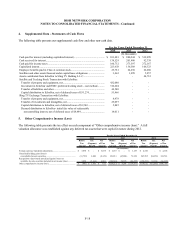

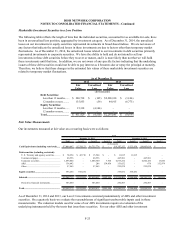

Marketable Investment Securities

Our marketable investment securities portfolio consists of various debt and equity instruments, all of which are

classified as available-for-sale, except as specified below. See Note 2 for further discussion.

Current Marketable Investment Securities – Strategic

Our current strategic marketable investment securities include strategic and financial debt and equity investments in

public companies that are highly speculative and have experienced and continue to experience volatility. As of

December 31, 2014, our strategic investment portfolio consisted of securities of a small number of issuers, and as a

result the value of that portfolio depends, among other things, on the performance of those issuers. The fair value of

certain of the debt and equity securities in our investment portfolio can be adversely impacted by, among other

things, the issuers’ respective performance and ability to obtain any necessary additional financing on acceptable

terms, or at all.

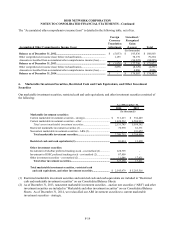

We have investments in ARS which are classified as available-for-sale securities. We generally recognize the

changes in fair value of these securities as a separate component of “Accumulated other comprehensive income

(loss)” within “Total stockholders’ equity (deficit).” However, for certain of our ARS, we have elected to recognize

the changes in fair value through “Other, net” within “Other Income (Expense)” on our Consolidated Statements of

Operations and Comprehensive Income (Loss) (the “Fair Value Option”). Previous events in the credit markets

reduced or eliminated liquidity for these securities. As a result, we historically classified these investments as

noncurrent assets, as we intended to hold these investments until they recovered or matured. As of the fourth

quarter 2014, we intend to sell our investments in our ARS and as a result, as of December 31, 2014, we reclassified

these investments to current marketable investment securities-strategic.

The valuation of our ARS and other investment securities investments portfolio is subject to uncertainties that are

difficult to estimate. Due to the lack of observable market quotes for identical assets, we utilize analyses that rely

on Level 2 and/or Level 3 inputs, as defined in “Fair Value Measurements.” These inputs include, among other

things, observed prices on similar assets as well as our assumptions and estimates related to the counterparty credit

quality, default risk underlying the security and overall capital market liquidity. These securities were also

compared, when possible, to other observable market data for financial instruments with similar characteristics.

Fair Value Option. As of December 31, 2014, our ARS and other noncurrent marketable investment securities

portfolio of $135 million included $93 million of securities accounted for under the Fair Value Option.

Current Marketable Investment Securities - Other

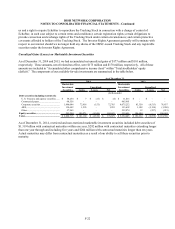

Our current marketable investment securities portfolio includes investments in various debt instruments including,

among others, commercial paper, corporate securities and U.S. treasury and agency securities.

Commercial paper consists mainly of unsecured short-term, promissory notes issued primarily by corporations with

maturities ranging up to 365 days. Corporate securities consist of debt instruments issued by corporations with

various maturities normally less than 18 months. U. S. Treasury and agency securities consist of debt instruments

issued by the federal government and other government agencies.