Dish Network 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

48

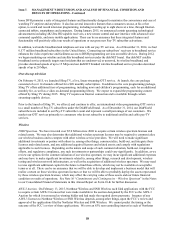

From time to time a portion of our investment portfolio may be invested in securities that have limited liquidity

and may not be immediately accessible to support our financing needs, including investments in public

companies that are highly speculative and have experienced and continue to experience volatility.

From time to time a portion of our investment portfolio may be invested in strategic investments, and as a result, a

portion of our portfolio may have restricted liquidity. If the credit ratings of these securities deteriorate or there is a

lack of liquidity in the marketplace, we may be required to record impairment charges. Moreover, the uncertainty of

domestic and global financial markets can greatly affect the volatility and value of our marketable investment

securities. In addition, a portion of our investment portfolio may include strategic and financial investments in debt

and equity securities of public companies that are highly speculative and experience volatility. Typically, these

investments are concentrated in a small number of companies. The fair value of these investments can be

significantly impacted by the risk of adverse changes in securities markets generally, as well as risks related to the

performance of the companies whose securities we have invested in, risks associated with specific industries, and

other factors. These investments are subject to significant fluctuations in fair value due to the volatility of the

securities markets and of the underlying businesses. The concentration of these investments as a percentage of our

overall investment portfolio fluctuates from time to time based on, among other things, the size of our investment

portfolio and our ability to liquidate these investments. In addition, because our portfolio may be concentrated in a

limited number of companies, we may experience a significant loss if any of these companies, among other things,

defaults on its obligations, performs poorly, does not generate adequate cash flow to fund its operations, is unable to

obtain necessary financing on acceptable terms, or at all, or files for bankruptcy, or if the sectors in which these

companies operate experience a market downturn. To the extent we require access to funds, we may need to sell

these securities under unfavorable market conditions, record impairment charges and fall short of our financing

needs.

We have substantial debt outstanding and may incur additional debt.

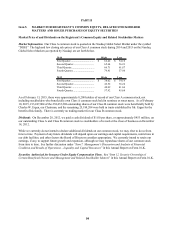

As of December 31, 2014, our total debt, including the debt of our subsidiaries, was $14.464 billion. Our debt levels

could have significant consequences, including:

requiring us to devote a substantial portion of our cash to make interest and principal payments on our debt,

thereby reducing the amount of cash available for other purposes. As a result, we would have limited

financial and operating flexibility in responding to changing economic and competitive conditions;

limiting our ability to raise additional debt because it may be more difficult for us to obtain debt financing

on attractive terms; and

placing us at a disadvantage compared to our competitors that are less leveraged.

In addition, we may incur substantial additional debt in the future. The terms of the indentures relating to our senior

notes permit us to incur additional debt. If new debt is added to our current debt levels, the risks we now face could

intensify.

It may be difficult for a third-party to acquire us, even if doing so may be beneficial to our shareholders,

because of our ownership structure.

Certain provisions of our certificate of incorporation and bylaws may discourage, delay or prevent a change in

control of our company that a shareholder may consider favorable. These provisions include the following:

a capital structure with multiple classes of common stock: a Class A that entitles the holders to one vote

per share, a Class B that entitles the holders to ten votes per share, a Class C that entitles the holders to one

vote per share, except upon a change in control of our company in which case the holders of Class C are

entitled to ten votes per share;

a provision that authorizes the issuance of “blank check” preferred stock, which could be issued by our

Board of Directors to increase the number of outstanding shares and thwart a takeover attempt;

a provision limiting who may call special meetings of shareholders; and