Dish Network 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

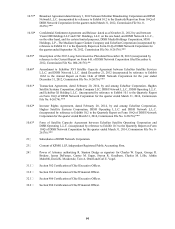

F-5

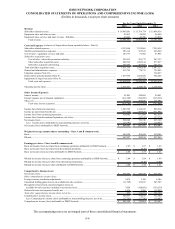

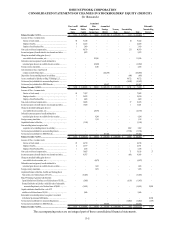

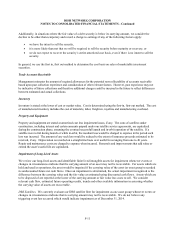

DISH NETWORK CORPORATION

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

(In thousands)

The accompanying notes are an integral part of these consolidated financial statements.

Accumulated

Class A and B Additional Other Accumulated Redeemable

Common Paid-In Comprehensive Earnings Treasury Noncontrolling Noncontrolling

Stock Capital Income (Loss) (Deficit) Stock Interest Total Interests

Balance, December 31, 2011...................................................................... 5,031$ 2,274,005$ 82,043$ (1,211,990)$ (1,569,459)$ 1,367$ (419,003)$ -$

Issuance of Class A common stock:

Exercise of stock awards......................................................................... 50 91,146 - - - 46 91,242 -

Employee benefits.................................................................................... 8 22,272 - - - - 22,280 -

Employee Stock Purchas e Plan ............................................................. 1 3,609 - - - - 3,610 -

Non-cash, stock-based compensation....................................................... - 40,719 - - - 251 40,970 -

Income tax (expense) benefit related to stock awards and other........... - 8,875 - - - - 8,875 -

Change in unrealized holding gains (losses)

on available-for-sale securities , net....................................................... - - 115,546 - - - 115,546 -

Deferred income tax (expense) benefit attributable to

unrealized gains (loss es ) on available-for-sale securities................... - - (12,892) - - - (12,892) -

Foreign currency trans lation....................................................................... - - 4,106 - - - 4,106 -

Cash dividend on Class A and Class B

common s tock ($1.00 per share).............................................................. - - - (452,890) - - (452,890) -

Disposition of noncontrolling interest in s ubsidiary............................... - - - - - (668) (668) -

As s ets contributed by EchoStar to Sling TV Holding L.L.C.................. - - - - - 44,712 44,712 -

Net income (loss) attributable to noncontrolling interests ..................... - - - - - (10,947) (10,947) -

Net income (loss) attributable to DISH Network...................................... - - - 636,687 - - 636,687 -

Balance, December 31, 2012...................................................................... 5,090$ 2,440,626$ 188,803$ (1,028,193)$ (1,569,459)$ 34,761$ 71,628$ -$

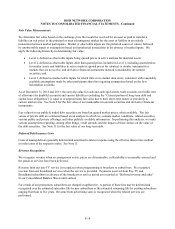

Issuance of Class A common stock:

Exercise of stock awards ........................................................................ 46 71,997 - - - - 72,043 -

Employee benefits.................................................................................... 7 24,223 - - - - 24,230 -

Employee Stock Purchas e Plan.............................................................. 1 4,468 - - - - 4,469 -

Non-cash, stock-based compensation....................................................... - 30,628 - - - 27 30,655 -

Income tax (expense) benefit related to stock awards and other........... - 19,430 - - - 1 19,431 -

Change in unrealized holding gains (losses)

on available-for-sale securities , net....................................................... - - (25,370) - - - (25,370) -

Deferred income tax (expense) benefit attributable to

unrealized gains (loss es ) on available-for-sale securities................... - - 9,284 - - - 9,284 -

Foreign currency trans lation....................................................................... - - 1,155 - - - 1,155 -

Capital distribution to EchoStar.................................................................. - (3,148) - - - - (3,148) -

Noncontrolling interest recognized with

acquisition of a controlling interest in subsidiary............................... - - - - - 2,882 2,882 -

Net income (loss) attributable to noncontrolling interests ..................... - - - - - (17,746) (17,746) -

Net income (loss) attributable to DISH Network...................................... - - - 807,492 - - 807,492 -

Balance, December 31, 2013...................................................................... 5,144$ 2,588,224$ 173,872$ (220,701)$ (1,569,459)$ 19,925$ 997,005$ -$

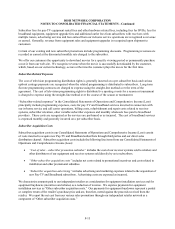

Issuance of Class A common stock:

Exercise of stock awards ........................................................................ 29 44,719 - - - - 44,748 -

Employee benefits.................................................................................... 4 25,777 - - - - 25,781 -

Employee Stock Purchas e Plan.............................................................. 1 6,185 - - - - 6,186 -

Non-cash, stock-based compensation....................................................... - 34,055 - - - 71 34,126 27

Income tax (expense) benefit related to stock awards and other........... - 41,707 - - - (691) 41,016 -

Change in unrealized holding gains (losses)

on available-for-sale securities , net....................................................... - - (4,679) - - - (4,679) -

Deferred income tax (expense) benefit attributable to

unrealized gains (loss es ) on available-for-sale securities................... - - 1,436 - - - 1,436 -

Foreign currency trans lation....................................................................... - - 3,878 - - - 3,878 -

Cap ital distribution to Ech o Star - Satellite and Tracking Stock

Transaction, net of deferred taxes of $31,274.......................................... - (51,466) - - - - (51,466) -

Sling TV Exchange Agreement with EchoStar:

Capital distribution to EchoStar, net of deferred taxes of $3,542......... - (5,845) - - - (6,118) (11,963) -

Deemed distribution to EchoStar - initial fair value of redeemable

noncontrolling interest, net of deferred taxes of $8,489................... - (14,011) - - - - (14,011) 22,500

Capital contribution from EchoStar - sale of T2

satellite net of deferred taxes of $5,554.................................................... - 9,446 - - - - 9,446 -

Redeemable noncontrolling interes t recognized - investment

in Northstar Spectrum and SNR Holdco.................................................. - - - - - - - 20,700

Net income (loss) attributable to noncontrolling interests ..................... - - - - - (14,062) (14,062) (1,729)

Net income (loss) attributable to DISH Network...................................... - - - 944,693 - - 944,693 -

Balance, December 31, 2014...................................................................... 5,178$ 2,678,791$ 174,507$ 723,992$ (1,569,459)$ (875)$ 2,012,134$ 41,498$