Dish Network 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-24

securities, we evaluate, among other things, the terms of the underlying instruments, the credit ratings of the issuers,

current market conditions, and other relevant factors. Based on these factors, we assess the risk of realizing

expected cash flows and we apply an observable discount rate that reflects this risk. We may also reduce our

valuations to reflect a liquidity discount based on the lack of an active market for these securities.

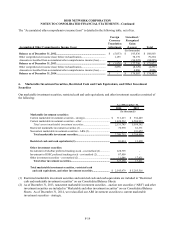

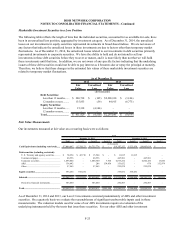

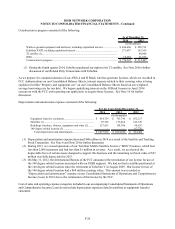

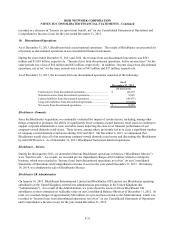

Changes in Level 3 instruments were as follows:

Level 3

Investment

Securities

(In thousands)

Balance as of December 31, 2012............................................................................................... 105,217$

Net realized and unrealized gains (losses) included in earnings................................................... 26,532

Net realized and unrealized gains (losses) included in other comprehensive income (loss)......... 1,926

Purchases...................................................................................................................................... 14,158

Settlements ................................................................................................................................... (1,813)

Issuances....................................................................................................................................... -

Transfers into or out of Level 3..................................................................................................... -

Balance as of December 31, 2013............................................................................................... 146,020$

Net realized and unrealized gains (losses) included in earnings................................................... (6,522)

Net realized and unrealized gains (losses) included in other comprehensive income (loss)......... 8,321

Purchases...................................................................................................................................... -

Settlements ................................................................................................................................... (5,679)

Issuances....................................................................................................................................... -

Transfers into or out of Level 3..................................................................................................... -

Balance as of December 31, 2014............................................................................................... 142,140$

During the years ended December 31, 2014 and 2013, we had no transfers in or out of Level 1 and Level 2 fair

value measurements.

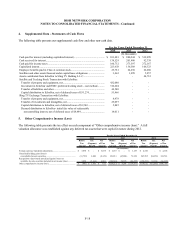

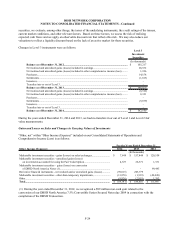

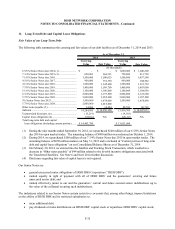

Gains and Losses on Sales and Changes in Carrying Values of Investments

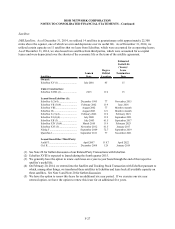

“Other, net” within “Other Income (Expense)” included on our Consolidated Statements of Operations and

Comprehensive Income (Loss) is as follows:

Other Income (Expense): 2014 2013 2012

Marketable investment securities - gains (losses) on sales/exchanges........................... $ 7,649 $ 157,444 $ 120,558

Marketable investment securities - unrealized gains (losses)

on investments accounted for using the Fair Value Option....................................... 4,727 26,371 1,331

Marketable investment securities - gains (losses) on conversion

of DBSD North America Notes (1)........................................................................... - - 99,445

Derivative financial instruments - net realized and/or unrealized gains (losses)............ (59,015) 205,779 -

Marketable investment securities - other-than-temporary impairments.......................... (13,876) (1,919) (49,020)

Other.............................................................................................................................. (8,826) (2,819) 1,383

Total.............................................................................................................................. (69,341)$ 384,856$ 173,697$

For the Years Ended December 31,

(In thousands)

(1) During the year ended December 31, 2012, we recognized a $99 million non-cash gain related to the

conversion of our DBSD North America 7.5% Convertible Senior Secured Notes due 2009 in connection with the

completion of the DBSD Transaction.