Dish Network 2014 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

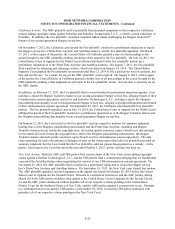

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-65

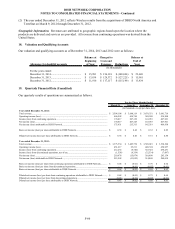

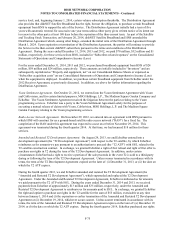

17. Segment Reporting

Operating segments are components of an enterprise for which separate financial information is available and

regularly evaluated by the chief operating decision maker(s) of an enterprise. Operating income is the primary

measure used by our chief operating decision maker to evaluate segment operating performance. We currently

operate two primary business segments, DISH and Wireless. See Note 1 for further discussion.

All other and eliminations primarily includes intersegment eliminations recorded in consolidation.

2014 2013

Total assets:

DISH.......................................................................................................... 21,424,385$ 19,694,655$

Wireless (1)................................................................................................ 7,577,894 4,625,505

Eliminations............................................................................................... (6,894,817) (4,041,934)

Total assets from continuing operations..................................................... 22,107,462 20,278,226

Assets from discontinued operations.......................................................... - 78,204

Total assets................................................................................................. 22,107,462$ 20,356,430$

All

Other & Consolidated

DISH Wireless (2) Eliminations Total

Year Ended December 31, 2014

Total revenue.............................................................................................. 14,643,049$ 410$ (72)$ 14,643,387$

Depreciation and amortization................................................................... 1,006,082 71,854 - 1,077,936

Operating income (loss) ............................................................................ 1,922,363 (97,912) - 1,824,451

Interest income........................................................................................... 376,422 15,384 (329,965) 61,841

Interest expense, net of amounts capitalized.............................................. (821,766) (119,408) 329,965 (611,209)

Other, net.................................................................................................... (9,414) (59,927) - (69,341)

Income tax (provision) benefit, net............................................................. (436,753) 159,913 - (276,840)

Income (loss) from continuing operations.................................................. 1,030,851 (101,949) - 928,902

Year Ended December 31, 2013

Total revenue.............................................................................................. 13,903,091$ 1,774$ -$ 13,904,865$

Depreciation and amortization................................................................... 952,793 101,233 - 1,054,026

Operating income (loss) ............................................................................ 1,938,998 (590,819) - 1,348,179

Interest income........................................................................................... 197,095 99,953 (148,183) 148,865

Interest expense, net of amounts capitalized.............................................. (742,207) (150,961) 148,183 (744,985)

Other, net.................................................................................................... 42,719 342,137 - 384,856

Income tax (provision) benefit, net............................................................. (511,491) 211,665 - (299,826)

Income (loss) from continuing operations.................................................. 925,114 (88,026) - 837,089

Year Ended December 31, 2012

Total revenue.............................................................................................. 13,179,907$ 1,427$ -$ 13,181,334$

Depreciation and amortization................................................................... 922,534 41,950 - 964,484

Operating income (loss)............................................................................. 1,322,474 (64,116) - 1,258,358

Interest income........................................................................................... 148,526 64,576 (114,011) 99,091

Interest expense, net of amounts capitalized.............................................. (534,585) (115,662) 114,011 (536,236)

Other, net.................................................................................................... 172,874 823 - 173,697

Income tax (provision) benefit, net............................................................. (380,758) 48,767 - (331,991)

Income (loss) from continuing operations.................................................. 728,531 (65,612) - 662,919

As of December 31,

(In thousands)

(In thousands)

(1) This increase in assets is primarily related to the acquisition of our H Block wireless spectrum licenses and the

FCC auction deposits. See Note 16 for further discussion.