Carphone Warehouse 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

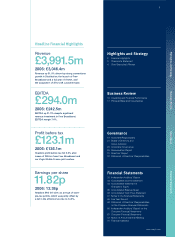

Highlights and Strategy Business Review Governance Financial Statements

Looking forward, we plan to marry physical

expansion with an increased focus on

productivity from our existing estate

allowing seamless connectivity across multiple

platforms and locations. They want their computer to

talk to their television, and to be able to control both

from their mobile device while away from home.

We sell most of the “nuts and bolts” today – mobile

contracts, high-speed data cards, broadband, hand-

held e-mail devices; some of these are our own

products, most of them are third party. Our job will be

to set our customers up with the most appropriate

suite of services and make sure that it all works. The

stores, as ever, will be the primary point of distribution,

but Geek Squad will become an integral part of our

overall value proposition.

Geek Squad, launched with our partners Best Buy, is

a home technology troubleshooting service, developed

to address the increasing technological complexity of

people’s lives. It will allow us to add significant value

to customers by making technology work for them,

and to our network partners by tying their individual

products and services into a unified package.

To support the broadening of our proposition,

which will include the sale of an increasing range

of non-cellular communications products, we are

embarking on a programme of refits and relocations

across a range of our larger stores in prime locations.

We will update investors with progress as our new

strategy evolves.

Becoming the leading alternative fixed line provider

in the UK

Nearly five years ago, when we acquired Opal Telecom

in November 2002, we set ourselves the ambitious goal

of becoming the number one alternative fixed line

telecoms provider in the UK. We believed that the

combination of high consumer prices, a high incumbent

market share, meaningful regulatory change and our

own unique distribution network was a powerful one;

the network infrastructure and telco know-how we

acquired with Opal completed the jigsaw.

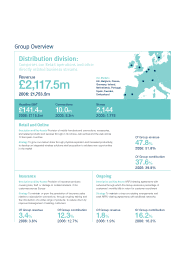

Today, through a combination of strong organic growth

and judicious acquisitions, we have over 10% of the

residential telephony market and approximately 16%

of the broadband market. After the very significant

strides we have made this year, our bold objective

is now clearly within reach.

During the year we made three notable steps forward

and one step back. We announced in November 2005

our plans to invest in local loop unbundling (“LLU”) –

a process in which we install our own exchange

year’s success with the exclusive pink Motorola V3,

this was a particularly creditable performance achieved

across a range of unique handsets rather than from a

single blockbuster product.

During the year we entered our first new market for

over seven years through our link-up in the US with

Best Buy. After a successful trial we are excited about

the rapid roll-out plans and the opportunity to

introduce US consumers to the independent mobile

retail model. Best Buy is the ideal partner and the

relationship between us is highly complementary.

Looking forward, we plan to marry physical expansion

with an increased focus on productivity from our

existing estate. Excluding the US, we see opportunities

to open a further 200-250 stores a year for the next

three years. Just as importantly, we are revisiting

existing sites and assessing the need for additional

headcount and points of sale as we seek to convert

more of our footfall into business. We also have the

opportunity to re-site stores in many major centres

where we have outgrown our current footprint.

Maximising customer lifetime value

We have been focused on maximising customer

lifetime value for almost as long as Carphone

Warehouse has existed. Generating enhanced

value for our network partners and loyalty from our

customers comes not just from providing high quality

consultancy at the point of sale, but supporting

customers through the product life-cycle.

Over the years we have been very successful at

introducing new services into our retail offering, with

our Insurance and Fixed Line services being the

most obvious and successful. However, the quality

of our customer interaction is often demonstrated

in less quantifiable ways – for example, through our

investment in new store formats or our commitment

to live product demonstrations. What all of these

developments have in common, though, is that they

meet the changing needs of the marketplace and

reflect Carphone Warehouse’s ongoing ability to renew

its business model in response to the prevailing

opportunities and risks.

Today, as wireless technologies become more

pervasive and our customers increasingly want

more from us than choice, availability and advice on

a simple mobile contract, we are beginning to adapt

our proposition once more. Customers – and our

network partners – will want integrated solutions,

5

10%

market share of

mobile phone market

3.5m

Broadband customers

by March 2010

1m

Virgin Mobile France

customers by March 2009

www.cpwplc.com

KEY TARGETS