Carphone Warehouse 2007 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2007 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chief Executive’s Review continued

equipment within BT’s exchange network, enabling

us to take control of the copper wire (or “local loop”)

that connects customers’ houses with their local

exchange. OFCOM, the UK telecoms regulator, had

just finalised its market review, which finally gave

visibility and certainty to LLU. Its attractions for a

telecoms service provider are that it allows us to

provide calls, line rental and broadband services

to our customers at a much lower cost price than

BT’s wholesale product suite.

In April 2006 we announced a revolutionary new

service, TalkTalk Free Broadband, giving free

broadband connectivity to customers who sign up

for our calls and line rental package. At the same time,

we announced a rapid acceleration of our LLU roll-out,

aiming to unbundle 1,000 exchanges over the following

14 months. Demand for the new proposition has been

exceptional, and by March 2007 we had signed up

655,000 live customers. In addition, our engineers at

Carphone Warehouse Networks, the re-branded Opal

network team, completed all of our planned equipment

installation well ahead of schedule, with 1,024

exchanges live by the end of the financial year.

Broadband via LLU is a scale game, with unit costs

falling with every additional customer connected to

an unbundled exchange. As a result, we were

delighted to acquire the customer base of AOL in

the UK in December 2006. This immediately took

our market share to around 16%, and gives us the

scale we need to ensure a significant payback on

our infrastructure investment. In addition, we now

operate with two differentiated brands, allowing us

to address two distinct and valuable segments of

the broadband marketplace.

The one flat note to our broadband launch has been

the impact on customer service levels resulting from

the very strong demand we generated. For much of

the year we were slow to answer calls in our contact

centres and failed to resolve enough of our customers’

problems first time around. This inevitably led to

a poor customer experience and our fair share of

negative publicity. We continue to invest substantially

in improving the provisioning process and providing

high quality support, and are confident that as the

new financial year progresses, we will begin to make

customer service a positive differentiator for the

TalkTalk brand.

Outlook

The outlook for the Group remains positive. The key

drivers of the Distribution division – network appetite

for customers, a vibrant handset market, and our own

physical expansion – all remain firmly in place. As our

strategy evolves, we believe that our opportunities for

growth in the medium term are increasing, both

through the development of our wireless solutions

model, and through the Geek Squad and Best Buy

Mobile ventures. Our ability to achieve continued

growth in sales and profitability stems in no small part

from our historical success in adapting the business

model to address the opportunities and challenges of

a dynamic market.

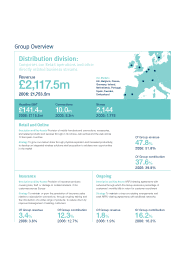

Physical expansion and market share gains remain at

the heart of our strategy, and we plan to open a

further 250 stores this year, in addition to the US roll-

out. Our market share in continental Europe still lags

our UK share, which itself continues to grow: there is

no structural reason why, in time, our market shares

across most of our European markets cannot reach

the 20% level.

We are targeting 15% growth in subscription

connections, a little ahead of our planned space

growth, as we anticipate further growth in this higher

value part of the market and invest in improved store

productivity. The pre-pay market is quieter, after

18 months of very significant growth, and we expect

this to be reflected in our own pre-pay connections

growth during the year. We expect gross profit per

connection, an important KPI for the business, on both

subscription and pre-pay to be stable year-on-year.

Our Ongoing and Insurance revenue streams, key

components of customer lifetime value driven by

subscription connections, are set to rise in line with

mobile subscriptions growth. Progress in our Mobile

businesses will be steady, as our German service

provision business continues to increase customer

numbers, revenues and profits, and our MVNO

operations across Europe start to come out of

their launch phases.

In our UK Fixed Line operations, our broadband and

unbundling strategy will begin to bear fruit, as margins

The Carphone Warehouse Group PLC Annual Report 2007

6

The launch of Free Broadband

changed the face of the UK

broadband market forever

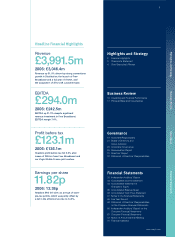

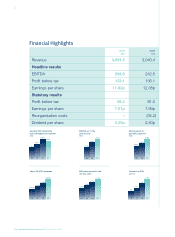

Contribution from recurring

revenues up 28.9%

(£m)

121.4

161.2

213.5

275.1

04 05 06 07

% of contribution from

recurring revenues

(% of total)

57.6 59.4 59.7 62.2

04 05 06 07