Carphone Warehouse 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

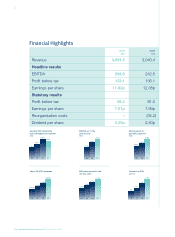

More than 10% share

of UK CPS market

(000s)

385

920

2,570 2,725

04 05 06 07

2007 2006

Headline Financials £m £m

Revenue 1,700.6 1,126.5

Fixed 1,195.8 666.7

Mobile 504.8 459.8

Contribution 149.0 109.5

Fixed 89.0 61.1

Mobile 60.0 48.4

Support costs (50.6) (29.7)

EBITDA 98.4 79.8

Depreciation and amortisation (79.0) (53.4)

EBIT 19.4 26.4

EBIT % 1.1% 2.3%

Telecoms Services Division

The Group’s Telecoms Services operations are split

into two businesses, Fixed and Mobile. The Fixed

business comprises our residential and business-to-

business fixed line operations, predominantly in the

UK. The Mobile business encompasses our German

service provision business, The Phone House

Telecom, and our-wholly owned MVNO and Facilities

Management (“FM”) businesses.

From next year, we will report the Mobile and Non-UK

Fixed Line operations within Distribution, and report

UK Fixed Line as a separate division. This closely

reflects our internal reporting structure going forward

and groups business units more logically with the

assets that support them.

Telecoms Services revenues grew by 51.0%

year-on-year to £1,700.6m (2006: £1,126.5m).

Good underlying growth was supported by a full

year’s contribution from Onetel, which was acquired

in December 2005, and three months’ contribution

from the purchase of AOL’s customer base in the UK.

EBIT fell 26.4% to £19.4m, reflecting a total of £72.0m

in start-up losses relating to the launch of TalkTalk

Free Broadband.

Fixed

Our fixed line operations grew dramatically during

the year, through a combination of strong underlying

growth and the impact of two major acquisitions.

Total revenues were up 79.4% to £1,195.8m

(2006: £666.7m), and contribution was £89.0m

(2006: £61.1m). The contribution figure reflects the

impact of £60.3m of losses relating to the launch

of TalkTalk Free Broadband.

In our UK business, the year was one of considerable

investment in launching our broadband offering: in

customer recruitment, customer services, network

infrastructure and the acquisition of AOL’s UK

customer base. Total UK Fixed Line revenues were

up 91.7% to £1,084.2m (2006: £565.6m), and

contribution rose 55.5% to £81.4m (2006: £52.4m).

The cornerstone of all our UK fixed line operations is

the Opal telecoms network, now re-branded as

The Carphone Warehouse Networks. This year we

successfully undertook a major infrastructure project

with the build-out of our own local loop unbundling

(“LLU”) network. This investment allows us to provide

the full suite of fixed telecoms services – calls, line

rental and broadband – to our customers at a

significantly lower operating cost than we can using

BT’s wholesale products. By March 2007 we had

installed our own equipment in 1,024 exchanges,

covering over 65% of the residential population.

Importantly, our pursuit of a “fully unbundled” strategy,

covering voice as well as broadband, gives us

a material advantage over a partially unbundled

approach, in which only the broadband element is

unbundled. The technical expertise required to create

this network is substantial, and we do not believe that

it will be easily replicated by other market participants.

At the start of the financial year, we launched TalkTalk

Free Broadband, and by March 2007 we had 655,000

customers live on the new service. Customer ARPUs

were ahead of our original plan, at approximately £28

per month, and underlying network costs were in line

with our expectations, giving us great confidence in

the future profitability of the broadband business.

Costs exceeded our plan in two main areas: firstly, in

the rate of migration to our own network, which we

discuss in more detail below; and secondly in relation

to customer service overheads, where we invested in

additional headcount to deal with the high contact

rates created by demand and provisioning problems.

We anticipate that unit customer service costs will be

in line with our original plan by March 2008, but in the

meantime, as previously indicated, we expect to incur

additional costs of £10-15m in the coming year as a

result of these over-runs.

Operating and Financial Performance continued

The Carphone Warehouse Group PLC Annual Report 2007

12