Carphone Warehouse 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Highlights and Strategy Business Review Governance Financial Statements

Chairman’s Statement

the Onetel integration demonstrates that there is the

necessary quality of operational expertise to support

the strategic vision. Execution will become an ever

more important theme over the next 12 months as

we bed down the AOL business and make further

significant enhancements to the quality of our

broadband service.

However, it is not in the Group’s nature to stand still

for long, and we were very pleased to agree a major

strategic partnership shortly before our year end with

Best Buy Co, Inc., the largest consumer electronics

retailer in the US. After a successful trial in New York,

we are rolling out a mobile retail joint venture to

150-200 stores in the US in the next 18 months.

In addition, we are bringing Best Buy’s Geek Squad

home technology customer service operation to the

UK. The business case for both of these projects is

compelling, and we believe the partnership will create

significant value over the coming years.

This year we have asked more of our people than ever

before, and they have responded to the challenges

we have faced with great commitment, dedication and

patience. I would like to extend the Board’s thanks

and gratitude to everyone in the Group for their

continued efforts. We all share the same

dissatisfaction in falling well short of our usual high

standards of customer service and are united in our

determination to deliver a very positive and consistent

customer experience in the years ahead.

John Gildersleeve,

Chairman

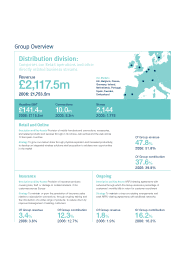

The Group has experienced a year of mixed

fortunes. The Distribution business has once again

exceeded our expectations, continuing to prosper in

an attractive market and taking share from our

competitors. Our fixed line telecoms business has

achieved real scale, with the strong organic growth

stimulated by our Free Broadband proposition

augmented by the acquisition of the UK customer

base of AOL. However, the unprecedented demand

created by our broadband offer led to unacceptable

levels of customer service.

As an organisation that has always sought to put the

customer at the centre of all of our business decisions,

we were very disappointed to have let our customers

down in this way. In response to the problems, we

have dedicated significant additional resource in our

call centres and re-engineered our provisioning and

customer management processes to create a robust

and scaleable platform. It is our aspiration to

differentiate our broadband proposition not only on

value but also on service, and this will be one of the

Group’s key goals for the coming year.

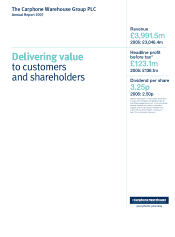

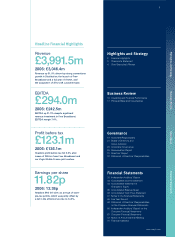

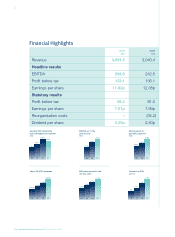

Group revenue for the period was £3,991.5m, a rise

of 31.0% on last year’s figure of £3,046.4m. Headline

pre-tax profit fell by 9.5% from £136.1m to £123.1m,

reflecting, as expected, start-up losses of £80.5m in

the launch of Free Broadband and Virgin Mobile in

France, and a net gain on fixed asset disposals of

£3.7m. Earnings per share on the same basis

decreased by 4.5% from 12.38p to 11.82p. Statutory

profit before tax, after the amortisation of acquisition

intangibles, and reorganisation costs in the prior year,

fell by 15.6% from £81.0m to £68.4m, while statutory

earnings per share decreased by 6.0% from 7.99p to

7.51p. Cash generated from operations increased by

30.5% from £196.4m to £256.3m, reflecting strong

growth in the Group’s underlying business. The Board

is proposing a final dividend of 2.25p, taking the total

for the year to 3.25p. The increase of 30% on last

year’s distribution reflects the Board’s confidence that

the current level of investment will generate significant

long-term value.

As the business grows up, we will increasingly need to

balance its natural dynamism and creativity with a tight

focus on operational efficiency and business

processes. Over the past 18 months, with the

acquisition of Onetel and the AOL base, and the

launch of Free Broadband, the entrepreneurial spirit of

the business has been self-evident. The success of

3

366

new stores opened

17.3%

52 week growth in

subscription connections

31.0%

growth in Group revenue

www.cpwplc.com

KEY ACHIEVEMENTS

As the business grows up,

we will increasingly need to

balance its natural dynamism

with a tight focus on

operational efficiency