Carphone Warehouse 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chief Executive’s Review

This has been another successful year for Carphone

Warehouse, but we faced significant challenges

along the way. Group revenues are up 31.0%, we

have executed very well in our Retail business and

increased our market share, and we have made

significant progress towards our goal of becoming

the leading alternative fixed line telecoms provider

in the UK. The launch of Free Broadband changed

the face of the UK broadband market forever, but

created its own problems: the unexpected level

of demand, combined with the complexity of the

provisioning processes, led to significant customer

service issues.

Last year I underlined our “private company” approach

to investment and growth opportunities. While every

project needs to be financially justified and we have

rigorous hurdle rates for new investment, we tend to

take the long view. As a result, earnings in the short

term can be depressed by our pursuit of long-term

value creation. In such circumstances it is our

responsibility to communicate the scale, timing and

impact of new business initiatives so that investors

can make informed decisions.

This has never been more true than in the past

12 months. We have incurred start-up losses of over

£80m in our launch of Free Broadband and Virgin

Mobile in France. Our total cash commitment in the year

to these new initiatives, and the acquisition of AOL’s UK

customer base, has been nearly £400m. As we manage

the path to profitability and cash generation in these

businesses, we are already committing to a further

exciting growth project, with the roll-out of our retail joint

venture in the US and Geek Squad in the UK. No doubt

further opportunities will arise, and we will continue to

pursue them with commitment and conviction.

Strategic context

Our strategic approach is built on three

primary objectives:

•To continue to grow market share in all our

geographical markets, by investing in new store

openings, achieving increasing productivity from

our existing estate, and developing additional

distribution channels;

•To maximise the lifetime value of our customers, both

by providing a level of service that encourages repeat

business, and by identifying relevant new products

and services where our brand, service and

distribution give us an edge over other suppliers; and

•To become the leading alternative provider of fixed

line telecommunications services in the UK.

Through organic growth and acquisition, we have built

up a unique set of assets: a network of stores that act

as the focal point of our interaction with customers,

both mobile and fixed line; a comprehensive fixed line

telecoms network covering the whole of the UK, with

investment focused on areas of added value; and

significant customer bases, creating valuable annuity

revenue streams to improve the quality of our

earnings. Our strategic objectives aim to leverage

these assets to deliver long-term growth and value

creation to shareholders.

Growing our retail presence

There are two key factors supporting our strategy to

grow our retail presence. Firstly, we believe that we

are under-penetrated in almost all of our geographical

markets, and the dynamics of the industry continue to

be attractive. Secondly, as our market share increases,

our scale delivers operational benefits through

improving terms with network operators and handset

manufacturers alike. Our model of reinvesting these

benefits into the customer proposition, through better

pricing and improved range and availability of

handsets, serves both to defend our market position

by raising the barriers to entry, and to deliver

incremental growth and scale.

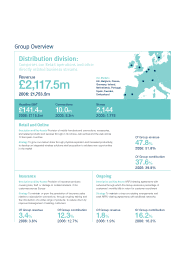

This year we have opened 366 net new stores across

our ten markets, taking the total portfolio to 2,144. Over

the last three years we have opened 930 stores and

grown the estate by 76.6%. During the same period,

connections are up 87.2%, demonstrating our ability

to generate continued growth out of existing sites.

We generated retail like-for-like gross profit growth

of 5.0% during the period, as the handset market

showed further growth, and we took market share

through our focus on the widest range of handsets

and the best availability on the high street. After last

The Carphone Warehouse Group PLC Annual Report 2007

4

The key drivers of the

Distribution division – network

appetite for customers, a

vibrant handset market, and

our own physical expansion –

all remain firmly in place

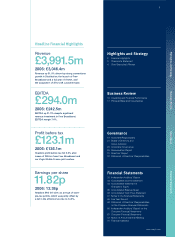

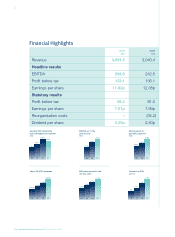

Revenue up 31.0%

(£m)

1,849

2,355

3,046

3,991

04 05 06 07

Headline operating prot

up 5.4%

(£m)

81.1

105.2

141.8 149.5

04 05 06 07