Carphone Warehouse 2007 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2007 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We relocated a number of stores to bigger sites

and began work on a new store format providing

an improved environment for customers

Our Dutch and Swiss businesses continued to

underperform, recording connections growth of 5.0%

and a fall of 1.8% respectively. In Switzerland, a year

of underperformance has led to a reorganisation of the

business, consolidating our operations into a single

support centre and introducing some new senior

management. In The Netherlands, the overall market

was subdued, but we have also failed to execute

consistently. A new management team is producing

encouraging early results.

Insurance

The Group offers a range of insurance products to

its retail customers, providing protection for the

replacement cost of a lost, stolen or damaged handset,

as well as cover for any outstanding contractual liability

and the cost of any calls made if a mobile phone falls

into the wrong hands. Insurance is a core element of

the Group’s customer proposition. The main drivers of

the Insurance business are customer numbers, average

premiums, claims costs and operational efficiency.

The customer base rose by 16.2% over the year to

2.23m. Once again, the mix improved, with growth of

18.6% in the high tier base. Insurance revenues were

up 18.1% to £137.0m (2006: £116.1m) driven by the

higher average base. Contribution was up 19.6% to

£54.5m (2006: £45.5m).

The prospects for our Insurance business are good,

given our expectation of continued growth in

subscription connections, the key driver of insurance

policy sales. Customers are wedded to high value

subsidised handsets that are expensive to replace, and

our focus on excellent service and a straightforward

claims process makes the product attractive.

Ongoing

Ongoing revenue represents the share of customer call

spend (or ARPU) we receive as a result of connecting

subscription customers to certain networks. We are

typically entitled to our share of revenue for as long as

a customer is active, so this income stream represents

an important element of our overall commercial

agreement with many networks, and aligns our

interests more closely. Again, the key underlying driver

for Ongoing is our subscription connection sales.

Ongoing revenues grew by 22.7% year-on-year to

£71.7m (2006: £58.4m). This continued strong

performance reflects the sustained strong subscription

connections over the last few years, and we expect

this positive trend to continue.

Contribution from Retail grew by 17.2% to £166.6m

(2006: £142.2m). The contribution margin fell to 8.7%

(2006: 9.0%), as further good like-for-like growth was

offset by continued investment in the store proposition.

Retail direct costs were up 27.1%, reflecting the

expansion of the store portfolio, higher commissions

to sales consultants and ongoing rental inflation.

In the UK, our store portfolio increased from 669

stores to 769 stores. At the same time, we relocated

a number of stores to bigger sites and began work on

a new store format providing an improved environment

for customers and sales consultants. We will continue

to roll out this new format to key locations across the

UK this year. Growth was enhanced by the acquisition

of a portfolio of stores previously trading as The Link,

one of our main independent competitors, after it had

been acquired by Telefonica/O2. Total UK connections

were up 21.6%.

Our Spanish business goes from strength to strength.

We opened 70 stores during the year, taking the

overall base up to 408, and achieved connections

growth of 24.6%. The launch of a fourth network,

Yoigo, and a number of MVNOs, stimulated further

demand. Our growth in Spain has led to long queues

with an impact on conversion rates in a number of our

stores, and we are therefore seeking to locate to larger

premises, where appropriate, to meet demand.

In France, the improving trends of the previous year

continued. We opened 50 stores, taking the total

store count up to 270, and connections growth of

16.1% reflected a stronger market. The launch of

a number of MVNOs, backed by strong consumer

brands, including our own Virgin Mobile joint venture,

contributed to a more vibrant market environment

and a shorter replacement cycle.

With the exception of Switzerland and The

Netherlands, all of our other markets enjoyed a year

of very good growth. In particular, Sweden achieved

connections growth of 36.3%, a notable effort after

a difficult previous 12 months. The performance

reflected our strategy of using a period of tougher

market conditions to improve our retail proposition

and pursue additional distribution channels, with

the result that in a rejuvenated market, we took

considerable market share while competitors had

weakened. Belgium, Germany, Ireland and Portugal

all fared very well, with connections growth above

the Group average and increasing consistency of

execution apparent across the board.

11

Business Review Governance Financial Statements

www.cpwplc.com

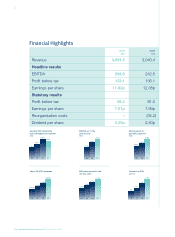

Continued strong LFL

gross prot performance

(%)

14.2

5.0

9.0

5.0

04 05 06 07

Insurance base up 16.2%

(000s)

1,324

1,645

1,921

2,233

04 05 06 07