Carphone Warehouse 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Review

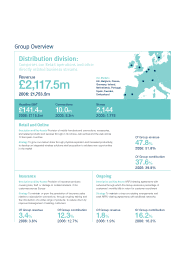

Distribution Division

The Distribution division comprises our Retail

operations and all directly-related business streams.

The key operating assets of the division are our

2,144 stores across 10 European countries and

our Retail and Online brands. Equally important

are our supplier and partner relationships.

Distribution revenues were up 20.8% year-on-year to

£2,117.5m, and the division generated Headline EBIT

of £141.4m, a rise of 22.4%. Growth was strong

across all revenue lines.

From next year the Distribution division will also

incorporate our Mobile operations, as well as our

Dealer and non-UK Fixed Line business operations.

This will more accurately group our future operations

by the key assets that support them.

Retail (including Online)

The Group achieved 10.0m connections during the

year, representing growth of 22.3% over the prior year.

Subscription connections, the key driver of value in

our Distribution business, were up 17.3% to 4.0m.

We continued to operate in an attractive market, with

fashion and technology being the main drivers of an

accelerating handset replacement cycle, and network

operators keen to pursue customer growth.

We executed well on our handset strategy, focusing

on the broadest range and the best availability in

the market, with a number of exclusive products

to stimulate demand and raise footfall. In addition,

we began work on improving retail productivity,

as we seek ways to convert more of our footfall

into revenues. This will be a key operational goal

for the coming year.

Pre-pay sales continued the very strong trend from the

previous year, with total connections up 27.7%. This

performance partly reflects a buoyant market for

pre-pay, and partly our successful strategy of growing

our pre-pay market share towards the level of our

subscription share. Towards the end of the financial

year, pre-pay growth slowed as the market became

more subdued and we came up against very strong

comparable growth figures. SIM-free sales were up

10.7% year-on-year.

Connections

2007 2006

000s 000s

Subscription 4,016 3,423

Pre-pay 5,428 4,252

SIM-free 571 516

Total 10,014 8,191

We opened 444 new stores during the year and

closed 78. The total number of stores increased

from 1,778 at March 2006 to 2,144 by March 2007.

The total includes 194 franchise stores (2006: 140

franchises). Total average selling space excluding

franchises increased by 16.5% to 96,865 sqm

(2006: 83,128 sqm) and sales per square metre

increased by 4.1% to £17,219 (2006: £16,547). Total

average selling space including franchises increased

by 18.9% to 104,452 sqm (2006: 87,871 sqm).

Total Retail revenues (including Online) were up 20.9%

and gross profit by 23.9%. Like-for-like revenue

growth was 6.6% and like-for-like gross profit growth

was 5.0%. The increase in revenues was the result

of strong connections growth, partially offset by a fall

in average revenue per connection from £192.8 to

£190.6 as a result of the higher proportion of pre-pay

sales within the mix.

Average cash gross profit per connection rose from

£54.4 to £55.2. Gross profit per connection on

subscription rose 4.4% to £98.5 and gross profit

per connection on pre-pay rose 1.6% to £26.2.

Operating and Financial Performance

The Carphone Warehouse Group PLC Annual Report 2007

10

52 week Subscription

connections up 17.3%

(000s)

2,413

2,770

3,423

4,016

04 05 06 07

52 week Total connections

up 22.3%

(000s)

5,350

6,503

8,191

10,014

04 05 06 07

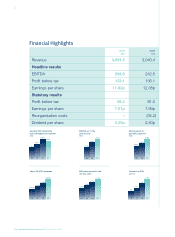

2007 2006

Headline Financials £m £m

Revenue 2,117.5 1,753.5

Retail (inc Online) 1,908.8 1,579.0

Insurance 137.0 116.1

Ongoing 71.7 58.4

Contribution 292.8 246.1

Retail (inc Online) 166.6 142.2

Insurance 54.5 45.5

Ongoing 71.7 58.4

Support costs (96.6) (84.1)

EBITDA 196.2 162.0

Depreciation and amortisation (54.8) (46.5)

EBIT 141.4 115.5

EBIT % 6.7% 6.6%