Carphone Warehouse 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

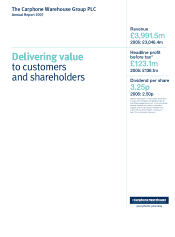

The Carphone Warehouse Group PLC

Annual Report 2007

Delivering value

to customers

and shareholders

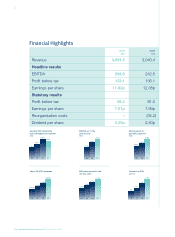

Revenue

£3,991.5m

2006: £3,046.4m

Headline profit

before tax*

£123.1m

2006: £136.1m

Dividend per share

3.25p

2006: 2.50p

*Headline information is shown before amortisation

of acquisition intangibles and goodwill expense,

and before reorganisation costs. A full reconciliation

between Headline and statutory information,

together with an explanation of different terms

used within the Annual Report is provided in

note 10 to the financial statements.

Table of contents

-

Page 1

The Carphone Warehouse Group PLC Annual Report 2007 Revenue £3,991.5m 2006: £3,046.4m Delivering value to customers and shareholders Headline proï¬t before tax* £123.1m 2006: £136.1m Dividend per share 3.25p 2006: 2.50p *Headline information is shown before amortisation of acquisition ... -

Page 2

... 366 new stores opened • Launch of Free Broadband • Acquisition of AOL UK customer base • Number 3 in UK residential telecoms • Major telecoms infrastructure roll-out Find out more about our business at www.cpwplc.com Investor Relations contact Peregrine Riviere Group Director of Corporate... -

Page 3

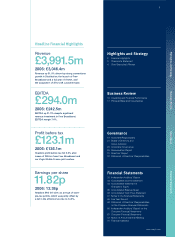

... Chief Executive's Review £3,991.5m 2006: £3,046.4m Revenue up 31.0% driven by strong connections growth in Distribution, the launch of Free Broadband and a full year of Onetel, and the acquisition of AOL's UK customer base. EBITDA Business Review Business Review 10 Operating and Financial... -

Page 4

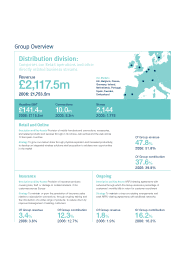

... services through 2,144 stores, call centres and the web across 10 European countries Strategy To grow our market share through physical expansion and increased productivity; to develop an integrated wireless solutions retail proposition to address new opportunities in the market Of Group revenue... -

Page 5

... and Key Assets The Phone House Telecom in Germany, a mobile service provider with 1.5m customers that recruits, bills and manages customers on its own mobile packages, based on wholesale agreements with network operators Strategy To grow the customer base by increasing our store portfolio and third... -

Page 6

...04 05 06 07 05 06 07 05 06 07 Nearly 20,000 employees 19,810 15,263 12,258 10,183 683 stores opened in the last two years 2,144 1,778 1,461 1,214 Dividend up 30% (pence) 3.25 2.5 1.8 1.3 04 05 06 07 04 05 06 07 04 05 06 07 The Carphone Warehouse Group PLC Annual Report 2007 -

Page 7

... Group for their continued efforts. We all share the same dissatisfaction in falling well short of our usual high standards of customer service and are united in our determination to deliver a very positive and consistent customer experience in the years ahead. Governance Financial Statements John... -

Page 8

... retail like-for-like gross proï¬t growth of 5.0% during the period, as the handset market showed further growth, and we took market share through our focus on the widest range of handsets and the best availability on the high street. After last The Carphone Warehouse Group PLC Annual Report 2007 -

Page 9

... network partners and loyalty from our customers comes not just from providing high quality consultancy at the point of sale, but supporting customers through the product life-cycle. Over the years we have been very successful at introducing new services into our retail offering, with our Insurance... -

Page 10

...slow to answer calls in our contact centres and failed to resolve enough of our customers' problems ï¬rst time around. This inevitably led to a poor customer experience and our fair share of negative publicity. We continue to invest substantially The Carphone Warehouse Group PLC Annual Report 2007 -

Page 11

...copper wire that connects houses to the BT local exchange network. Charles Dunstone, Chief Executive Ofï¬cer Migration The process of moving a customer from BT's wholesale products onto our own unbundled lines. Governance MVNO Mobile Virtual Network Operator: a mobile service provider with no... -

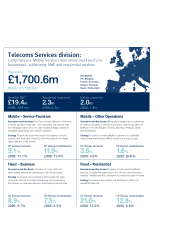

Page 12

... in the right platforms is key to our ability to develop a compelling customer proposition, as it allows us to build scale, and offer greater value and an improved customer experience. The Carphone Warehouse Group PLC Annual Report 2007 PROP OS O Mobile - Service Provision IT I Mobile - Other... -

Page 13

... • Acquisition of Alto Hiway, B2B ISP, to support development of corporate broadband services • Build out exchange network to 1,650 TalkTalk and 900 AOL exchanges • Begin process of unifying network infrastructure to a single technological platform Financial Statements • 2.3m UK customers... -

Page 14

.... Pre-pay sales continued the very strong trend from the previous year, with total connections up 27.7%. This performance partly reï¬,ects a buoyant market for pre-pay, and partly our successful strategy of growing our pre-pay market share towards the level of our subscription share. Towards the end... -

Page 15

... into a single support centre and introducing some new senior management. In The Netherlands, the overall market was subdued, but we have also failed to execute consistently. A new management team is producing encouraging early results. Insurance The Group offers a range of insurance products to its... -

Page 16

... the high contact rates created by demand and provisioning problems. We anticipate that unit customer service costs will be in line with our original plan by March 2008, but in the meantime, as previously indicated, we expect to incur additional costs of £10-15m in the coming year as a result of... -

Page 17

... unit operating costs. Initially, progress was slow and the high number of errors resulted in a very poor customer experience. However, towards the year end we saw a signiï¬cant improvement in the reliability of the service, which led to a rapid acceleration in migration rates. As at March 2007... -

Page 18

... Squad, the US home technology support business, to the UK market. This launched in London in March 2007 and we believe it will form an important element in our overall Group strategy over the coming years, as wireless technologies pervade the home and The Carphone Warehouse Group PLC Annual Report... -

Page 19

...of £15-20m in the coming year, as Virgin Mobile continues to invest in building its brand and customer base and the Best Buy ventures move towards critical mass. Acquisitions During the year the Group's principal acquisition was the UK internet access business of AOL, for a gross cash consideration... -

Page 20

...period on Free Broadband and Virgin Mobile France. Assuming a weighted average cost of capital for the period of 6.8% (2006: 6.6%), this represents an economic value added of £56.6m (2006: 69.4m) or 5.4% (2006: 10.3%). Roger Taylor, Chief Financial Ofï¬cer The Carphone Warehouse Group PLC Annual... -

Page 21

... rates Financial results impacted by obsolete retail stock. Reported proï¬ts distorted by exchange rate movements; value of assets and liabilities similarly affected. Fixed line business model compromised by changes to regulated market structure and pricing. Capital invested in new business areas... -

Page 22

... allow Get Connected to help an even greater number of young people throughout the UK by developing an on-line presence and expanding their web-chat service to match the hours of the free phone line service. TreeHouse Autism is a life-long neurological condition affecting basic communication skills... -

Page 23

... 2007 • Large Retailer Of The Year • Highly Commended Customer Service What Mobile 2006 (reader voted) • Best High Street Retailer • Best Online Retailer Mobile Choice 2006 • Best High Street Retailer the timing of the survey so that it is more aligned with the business planning process... -

Page 24

... to make informed decisions. An independent and extensive health fact sheet is available in our stores and on our website. We also continue to list speciï¬c absorption rates for every handset in our Buyers' Guide every month, and on our website. The Carphone Warehouse Group PLC Annual Report 2007 -

Page 25

... Building Society. Andrew Harrison, UK Chief Executive Officer Age 36. Appointed to the Board in April 2006. He joined the Group in July 1995 as Strategy Manager, and became Commercial Director for the UK in 1998. He was appointed Chief Executive Ofï¬cer of the UK business of The Carphone Warehouse... -

Page 26

..., treasury and risk management policies. Strategic and policy issues are reviewed annually at a combined Board and senior executive strategy day. Performance evaluation During the period the balance of skills, knowledge and experience of the Directors was reviewed. The Board, and each individual... -

Page 27

...any formal announcements relating to the Company's ï¬nancial performance, including reviewing signiï¬cant ï¬nancial reporting judgements contained in them; Financial Statements • review the Company's internal ï¬nancial controls and its internal control and risk management systems and to make... -

Page 28

... results announcements) and Company publications. In all such communications, care is taken to ensure that no price sensitive information is released. The Chief Executive Ofï¬cer and Chief Financial Ofï¬cer have lead responsibility for investor relations. They are supported by a dedicated investor... -

Page 29

.... Salaries and benefits Executive Directors' basic salaries are reviewed annually and take into account the roles, responsibilities, performance and experience of the individuals and information obtained from published market data on the salary rates for similar positions in companies of a similar... -

Page 30

... year. A UK savings-related share option scheme is open to all eligible employees in the UK, including Executive Directors. No Executive Director currently participates in the scheme. Performance Share Plan In July 2004, senior managers, including Executive Directors, received awards of Performance... -

Page 31

... reviewed annually against published market data. None of the Directors was a member of a deï¬ned beneï¬t pension scheme during the period. Pension entitlements are based on basic salary only. Director 2007 £'000 2006 £'000 J H Dale D Goldie A Harrison G Roux de Bezieux R W Taylor Total Share... -

Page 32

... Report continued Performance Shares* Details of Executive Directors' conditional right to receive nil priced options in the Company are shown in the following table: Granted during the period Type of award 1 April 2006 Number of shares Date of award Share price on date of award 31 March 2007... -

Page 33

...Executive Directors and David Ross have service contracts which are terminable by the Company or the Executive Director with 12 months' notice or less. The dates of each contract are set out below and none speciï¬cally provides for compensation for early termination. External Appointments The Board... -

Page 34

... Carphone Warehouse Group PLC on 1 April 2004 compared with the value of £100 invested in the FTSE 250 Index. The graph shows daily movements in these values over the period. This report was approved by the Board on 4 June 2007. Sir Brian Pitman 4 June 2007 The Carphone Warehouse Group PLC Annual... -

Page 35

... the Annual Report and ï¬nancial statements of The Carphone Warehouse Group PLC for the 52 weeks ended 31 March 2007. Principal activities and review of the business The principal activity of the Group continues to be the provision of mobile communication products and services and ï¬xed line... -

Page 36

... to the Group's ï¬nancial statements since they were initially presented on the website. Legislation in the United Kingdom governing the preparation and dissemination of ï¬nancial statements may differ from legislation in other jurisdictions. The Carphone Warehouse Group PLC Annual Report 2007 -

Page 37

... the accounting policies set out therein. We have also audited the information in the Remuneration Report that is described as having been audited. We have reported separately on the individual Company ï¬nancial statements of The Carphone Warehouse Group PLC for the 52 weeks ended 31 March 2007... -

Page 38

...available-for-sale investments Issue of share capital Net sale (purchase) of own shares Unrealised gain on disposal of subsidiary Net cost of share-based payments Equity dividends At the end of the period The accompanying notes are an integral part of this consolidated statement of changes in equity... -

Page 39

... Share premium reserve Capital redemption reserve Translation reserve Accumulated proï¬ts Funds attributable to equity shareholders The accompanying notes are an integral part of this consolidated balance sheet. The ï¬nancial statements on pages 34 to 64 were approved by the Board on 4 June 2007... -

Page 40

... cash equivalents Cash and cash equivalents at the start of the period Effect of exchange rate ï¬,uctuations Cash and cash equivalents at the end of the period Cash and cash equivalents for the purposes of this statement comprise: Cash and cash equivalents Bank overdrafts 25 94,720 10,410 8,034 65... -

Page 41

... sales related taxes. The following accounting policies are applied to each business segment: Distribution: Distribution revenue comprises revenue generated from the sale of mobile communication products and services, commission receivable on sales less provision for promotional offers and network... -

Page 42

... as Earnings Per Share targets) and a Monte Carlo model for those with external performance criteria (such as Total Shareholder Return targets). For schemes with internal performance criteria, the number of options expected to vest is recalculated at each balance sheet date, based on expectations... -

Page 43

... including acquisition costs associated with the investment. The Group's investments are categorised as available-for-sale and recorded at fair value from this date. Changes in fair value, together with any related taxation, are taken directly to reserves, and recycled to the income statement when... -

Page 44

... best information available to management at the balance sheet date. However, the future costs assumed are inevitably only estimates, which may differ from those ultimately incurred. Sales provisions are based on historic patterns: of redemption for promotions, product return rates for returns and... -

Page 45

... above are based on the Group's internal management and reporting structure in place during the period. Transactions between segments are on an arm's length basis and support costs are allocated to segments based on the extent to which they relate to the relevant business streams. www.cpwplc.com -

Page 46

... at the front of the Annual Report. Results by geographical location are analysed by origin as follows: 2007 £'000 Revenue 2006 £'000 2007 £'000 Capital expenditure* 2006 £'000 2007 £'000 Total assets 2006 £'000 United Kingdom France Germany Spain Other Total Group 2,582,576 238,778 459... -

Page 47

... the Company's accounts represents the fees payable to Deloitte & Touche LLP in respect of the audit of the Company's individual ï¬nancial statements prepared in accordance with UK GAAP and the Group's consolidated ï¬nancial statements prepared in accordance with IFRS. Tax advisory services relate... -

Page 48

... following assets: £'000 Billing infrastructure and customer management systems Other 8,908 4,049 12,957 Both these items are expected to attract tax relief at 30% and accordingly a deferred tax asset of £10.6m was recognised at 1 April 2006. The Carphone Warehouse Group PLC Annual Report 2007 -

Page 49

... due from a Director of the Company. 6 Share-based payments The Group issues equity settled share-based payments to certain employees, through the following schemes: a) Performance Share Plan: During the period the Group made awards of nil cost options under a Performance Share Plan. These awards... -

Page 50

... the end of the three or ï¬ve year period at a subscription price not less than 80% of the middle market quotation on the date of grant. In addition, options were granted to UK employees at the time of the Group's admission to the London Stock Exchange. The following table summarises the number and... -

Page 51

... 6 Share-based payments continued e) Fair value models: Nil cost options with internal performance targets are valued using the market price of a share at the date of grant, discounted for expected future dividends to the date of exercise. The fair values of other options with internal performance... -

Page 52

...-sale investments 7,834 (3,535) (1,094) 3,205 3,703 15,820 74 19,597 The following are the major deferred tax assets and liabilities recognised by the Group and movements thereon during the period: Acquisition intangibles £'000 Share-based payments £'000 Timing differences on capitalised costs... -

Page 53

... statements. The expected cost of the proposed ï¬nal dividend for the period ended 31 March 2007 reï¬,ects the fact that the Group's Employee Share Ownership Trust has agreed to waive its rights to receive dividends (see note 24). 10 Reconciliation of Headline information to statutory information... -

Page 54

... £0.5m (2006 - £1.8m) has been recognised in the period in relation to historical acquisitions. 568,630 90,953 (8,884) (2,416) (529) (8,802) 638,952 642,264 (3,312) 638,952 452,023 119,105 (4,531) (1,825) 3,858 568,630 571,413 (2,783) 568,630 The Carphone Warehouse Group PLC Annual Report 2007 -

Page 55

... rates and expected changes to selling prices and direct costs during the period, all of which are based on historical patterns and expectations of future market developments. Management estimates discount rates using pre-tax rates that reï¬,ect current market assessments of the time value of money... -

Page 56

...) (193,332) 58,041 52,736 39,564 40,644 89,630 65,173 53,465 38,458 1,044 1,209 241,744 198,220 The Carphone Warehouse Group PLC Annual Report 2007 -

Page 57

... GmbH TalkTalk Telecom Limited* CPW Broadband Services (UK) Limited* Onetel Telecommunications Limited* New Technology Insurance The Phone House Holdings (UK) Limited* *held directly by the Company. England and France Spain England and Germany England and England and England and Ireland England and... -

Page 58

... competitor to TalkTalk in the residential broadband market and the anticipated future operating synergies arising from the combination. The Group's results for the period reï¬,ect revenue from AOL of £106.8m and a loss before taxation of £3.5m. The Carphone Warehouse Group PLC Annual Report 2007 -

Page 59

...future performance and payable over 3 years. Alto Hiway is a business internet service provider. The following table sets out the book values of the identiï¬able assets and liabilities acquired and their provisional fair value to the Group: Book value £'000 Fair value adjustments £'000 Fair value... -

Page 60

... ventures are as follows: Business Interest Principal activities Best Buy Mobile US Geek Squad UK Virgin Mobile France 50.0% 50.0% 48.5% Retail Home technology support services MVNO The Group's share of the results, assets and liabilities of Virgin Mobile France for the period are: £'000 Share... -

Page 61

... revenue in the period, adjusted to take account of the timing of acquisitions, was 57 days (2006 - 53 days). The Directors consider that the carrying amount of trade and other receivables approximates to their fair value. 18 Current asset investments 2007 £'000 2006 £'000 Available-for-sale... -

Page 62

... exercised, the ï¬nal maturity date will be October 2013. The terms of the new facility are similar to the Group's other committed bank facilities, and the covenant package is identical to that in the £450m RCF. 40,000 50,000 230,054 - 320,054 The Carphone Warehouse Group PLC Annual Report 2007 -

Page 63

... Liquidity risk: To ensure the continuity of Group funding whilst also minimising the interest cost, borrowings are spread between long-term committed facilities, short-term uncommitted bank loans and overdrafts with short-term cash surpluses invested overnight. Financial Statements www.cpwplc.com -

Page 64

...-party fund managers. Other fair values have been arrived at by discounting future cashï¬,ows, assuming no early redemption, or by revaluing forward currency contracts to period-end market rates or rates as appropriate to the instrument. Foreign exchange derivatives: The Group uses forward currency... -

Page 65

...but not reported at the balance sheet date. Insurance provisions are expected to be utilised within one year. Reorganisation: Reorganisation provisions at the start of the period relate principally to a store closure programme launched in the period ended 30 March 2002, the costs associated with the... -

Page 66

... (2006 - 14.1m) in the Company for the beneï¬t of the Group's employees. The ESOT has waived its rights to receive dividends and none of its shares has been allocated to speciï¬c schemes. At 31 March 2007 the shares had a carrying value of £16.2m and a market value of £27.1m (2006 - carrying... -

Page 67

... 537,970 The Group has some leases that include revenue related rental payments that are contingent on store performance. The analysis above includes only the minimum rental commitment. 27 Capital commitments 2007 £'000 2006 £'000 Financial Statements Expenditure contracted, but not provided... -

Page 68

... products and services were provided at market rates. 31 Post balance sheet events On 14 May 2007, the Group disposed of 62% of one of its French subsidiaries, The Phone House Services Telecoms SAS, for an initial cash consideration of £11.2m. The Carphone Warehouse Group PLC Annual Report 2007 -

Page 69

...) IFRS 2007 £m IFRS 2006 £m IFRS 2005 £m UK GAAP 2004 £m UK GAAP 2003 £m Headline results Revenue EBITDA PBT Assets employed Non-current assets Net current assets (liabilities) before provisions Provisions Non-current liabilities Total assets and liabilities Financed by Shareholders' funds... -

Page 70

... Warehouse Group PLC for the 52 weeks ended 31 March 2007 which comprise the Balance Sheet and the related notes 1 to 13. These individual Company ï¬nancial statements have been prepared under the accounting policies set out therein. The Corporate Governance statement and the Remuneration Report... -

Page 71

... than one year Net assets Capital and reserves Called-up share capital Share premium Proï¬t and loss account Total capital employed The accompanying notes are an integral part of this balance sheet. The ï¬nancial statements on pages 67 to 71 were approved by the Board on 4 June 2007 and signed on... -

Page 72

...represents a capital contribution, resulting in an addition to investments and a corresponding increase in shareholders' equity (see Share-based payments below). The Carphone Warehouse Group PLC consolidated ï¬nancial statements for the period ended 31 March 2007 contain a consolidated statement of... -

Page 73

... European Venture Capital Association guidelines. Movements in fair value are recognised in reserves. Details of the Company's investments in material subsidiary undertakings are provided in note 14 to the Group's ï¬nancial statements. Financial Statements 5 Current asset investments 2007 £'000... -

Page 74

...000 2006 £'000 Authorised Ordinary shares of 0.1p each Allotted, called-up and fully paid Ordinary shares of 0.1p each Movements in share capital in the period arose from the exercise of share options. 1,500 896 1,500 888 1,500 896 1,500 888 The Carphone Warehouse Group PLC Annual Report 2007 -

Page 75

...payments granted to Group employees whose costs are borne by the Company. The only direct employees of the Company are the Directors detailed on page 21; details of their share options are shown in the Remuneration Report on pages 25 to 30. 12 Reconciliation of movements in shareholders' funds 2007... -

Page 76

... Shares in pursuance of any such contract or contracts. By order of the Board T.S.Morris Company Secretary 4 June 2007 Registered Ofï¬ce 1 Portal Way London W3 6RS Special Resolutions 8. That articles 94.2 to 94.6 (inclusive) of the Company's Articles of Association which relates to the Directors... -

Page 77

.... The authority is limited to the stated upper and lower prices payable for the shares which reï¬,ects the requirements of the UK Listing Authority. As at 4 June 2007 there were 84,010,722 outstanding options granted and unexercised under all share option schemes operated by the Company which, if... -

Page 78

... the hotel staff. 12. Medical care If you need medical attention while attending the Annual General Meeting please contact a member of the hotel staff who will obtain medical assistance. 13. Smoking Smoking will not be permitted in the auditorium. The Carphone Warehouse Group PLC Annual Report 2007 -

Page 79

75 Financial Calendar Key dates Results announcement Ex-dividend date Record date Dividend payment date Interim results announcement 5 June 2007 4 July 2007 6 July 2007 3 August 2007 8 November 2007 Financial Statements Published by Black Sun Plc Printed in England by SVTWO www.cpwplc.com -

Page 80

The Carphone Warehouse Group PLC 1 Portal Way London W3 6RS Tel +44 (0)20 8896 5000 Fax +44 (0)20 8753 8009 Email [email protected] Registered no. 3253714 www.cpwplc.com