Cablevision 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(71)

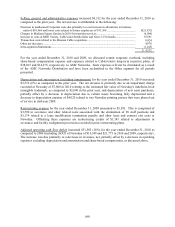

liabilities under derivative contracts. The increase in cash provided by operating activities of $112,479 in

2010 as compared to 2009 resulted from an increase in income from continuing operations before

depreciation and amortization and other non-cash items of $46,613 and an increase of $65,866 resulting

from changes in working capital, including the timing of payments and collections of accounts receivable,

among other items.

Net cash provided by operating activities amounted to $1,247,139 for the year ended December 31, 2009.

The 2009 cash provided by operating activities resulted from $1,040,240 of income before depreciation

and amortization (including impairments), $326,646 of non-cash items and a $6,216 increase in deferred

revenue. Partially offsetting these increases were decreases in cash of $52,408 resulting from a decrease

in liabilities under derivative contracts, a $52,933 decrease in accounts payable, other liabilities and

payables to affiliates, and a $20,622 increase in current and other assets and advances to affiliates.

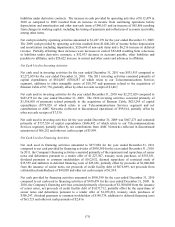

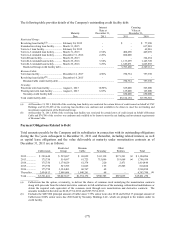

Net Cash Used in Investing Activities

Net cash used in investing activities for the year ended December 31, 2011 was $831,913 compared to

$2,272,029 for the year ended December 31, 2010. The 2011 investing activities consisted primarily of

capital expenditures of $814,807 ($760,287 of which relate to our Telecommunications Services

segment), additions to other intangible assets of $10,797 and payments related to the acquisition of

Bresnan Cable of $7,776, partially offset by other net cash receipts of $1,467.

Net cash used in investing activities for the year ended December 31, 2010 was $2,272,029 compared to

$667,273 for the year ended December 31, 2009. The 2010 investing activities consisted primarily of

$1,356,500 of payments related primarily to the acquisition of Bresnan Cable, $823,245 of capital

expenditures ($779,928 of which relate to our Telecommunications Services segment) and net

contributions to AMC Networks (reflected in discontinued operations) of $99,614, partially offset by

other net cash receipts of $7,330.

Net cash used in investing activities for the year ended December 31, 2009 was $667,273 and consisted

primarily of $737,524 of capital expenditures ($696,492 of which relate to our Telecommunications

Services segment), partially offset by net contributions from AMC Networks (reflected in discontinued

operations) of $66,252 and other net cash receipts of $3,999.

Net Cash Used in Financing Activities

Net cash used in financing activities amounted to $277,868 for the year ended December 31, 2011

compared to net cash provided by financing activities of $950,380 for the year ended December 31, 2010.

In 2011, the Company's financing activities consisted primarily of the repayment and repurchase of senior

notes and debentures pursuant to a tender offer of $1,227,307, treasury stock purchases of $555,831,

dividend payments to common stockholders of $162,032, deemed repurchase of restricted stock of

$35,555 and additions to deferred financing costs of $25,626, partially offset by proceeds of $1,000,000

from the issuance of senior notes, net proceeds of credit facility debt of $676,699, net proceeds from

collateralized indebtedness of $49,850 and other net cash receipts of $1,934.

Net cash provided by financing activities amounted to $950,380 for the year ended December 31, 2010

compared to net cash used in financing activities of $670,478 for the year ended December 31, 2009. In

2010, the Company's financing activities consisted primarily of proceeds of $1,500,000 from the issuance

of senior notes, net proceeds of credit facility debt of $1,037,712, partially offset by the repurchase of

senior notes and debentures pursuant to a tender offer of $1,078,212, treasury stock purchases of

$300,247, dividend payments to common stockholders of $140,734, additions to deferred financing costs

of $65,723 and other net cash payments of $2,416.