Cablevision 2011 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-72

Previously, Cablevision had an employee stock plan ("1996 Employee Stock Plan") under which it was

authorized to grant incentive stock options, nonqualified stock options, restricted shares, restricted stock

units, stock appreciation rights, and bonus awards and a non-employee director stock plan ("1996 Non-

Employee Director Stock Plan") under which it was authorized to grant options and restricted stock units.

The 1996 Employee Stock Plan expired in February 2006 and the 1996 Non-Employee Director Stock

Plan expired in May 2006. Outstanding options issued pursuant to these plans have expiration dates

through 2015.

Options and stock appreciation rights have typically been scheduled to vest over three years in 33-1/3%

annual increments and expire 10 years from the grant date. Restricted shares have typically been subject

to three or four year cliff vesting. Performance based options were typically subject to approximately two

year or three year cliff vesting, with exercisability subject to performance criteria. Performance based

restricted stock are subject to three year cliff vesting subject to achievement of performance criteria.

Performance based options typically expire 10 years from the date of grant (or up to one additional year in

the case of the death of the holder). Cablevision has 98,752 fully vested stock appreciation rights

outstanding (which include 57,152 held by AMC Networks and Madison Square Garden employees) at

December 31, 2011. Total non-employee director restricted stock units outstanding as of December 31,

2011 were 235,826. There were no stock options or stock appreciation rights granted in 2011.

Since share-based compensation expense is based on awards that are ultimately expected to vest, such

compensation (which includes options, restricted stock, and stock appreciation rights) for the years ended

December 31, 2011, 2010 and 2009 has been reduced for estimated forfeitures. Forfeitures were

estimated based primarily on historical experience. Share-based compensation expense (including

expenses related to AMC Networks and Madison Square Garden share-based awards held by Company

employees) recognized for continuing operations as selling, general and administrative expense for the

years ended December 31, 2011, 2010 and 2009 amounted to $44,536, $50,289 and $49,820 (of which

$44,877, $48,434 and $47,143 related to equity classified awards), respectively. An income tax benefit of

$17,782, $18,142 and $15,467 was recognized in continuing operations resulting from this share-based

compensation expense for the years ended December 31, 2011, 2010 and 2009, respectively.

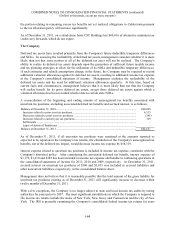

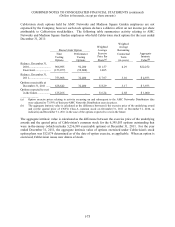

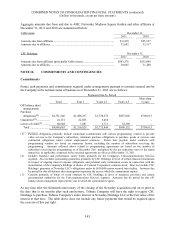

The following table presents the share-based compensation expense (income) for continuing operations

recognized by the Company for the years ended December 31, 2011, 2010 and 2009:

Years Ended December 31,

2011 2010 2009

Stock options (including performance based options) ............. $ 3,931 $ 4,877 $ 6,697

Stock appreciation rights ......................................................... (341) 1,855 2,677

Restricted shares ...................................................................... 40,946 43,557 40,446

Share-based compensation ................................................. $44,536 $50,289 $49,820

Cablevision uses the 'with-and-without' approach to determine the recognition and measurement of excess

tax benefits.

Cash flows resulting from excess tax benefits are classified as cash flows from financing activities.

Excess tax benefits are realized tax benefits from tax deductions for options exercised and restricted

shares issued in excess of the deferred tax asset attributable to stock compensation costs for such awards.

Excess tax benefits of $11,196 were recorded at CSC Holdings for the year ended December 31, 2011.

No excess tax benefits for the years ended December 31, 2011, 2010 and 2009 for Cablevision and for the

years ended December 31, 2010 and 2009 for CSC Holdings were recorded.