Cablevision 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

(55)

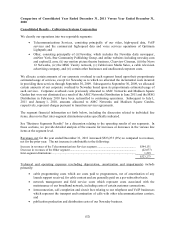

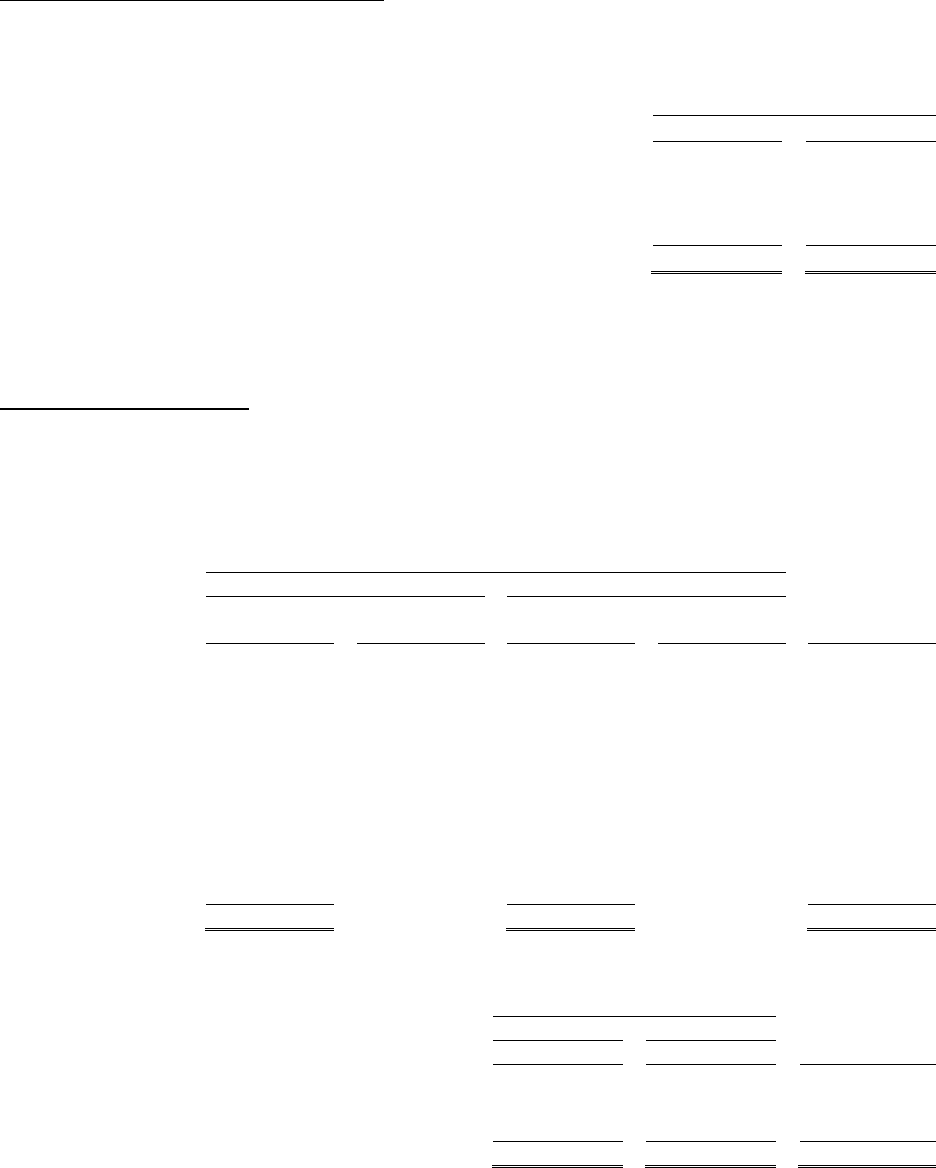

Income (loss) from discontinued operations

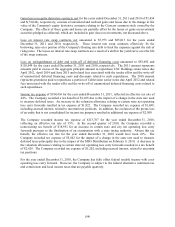

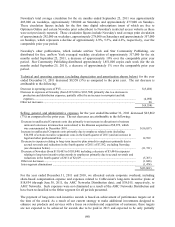

Income (loss) from discontinued operations, net of income taxes, for the years ended December 31, 2011

and 2010 reflects the following items:

Years Ended December 31,

2011 2010

Net operating results of AMC Networks, including transaction costs, net of

income taxes(a) ..................................................................................................... $53,623 $157,970

Net operating results of Madison Square Garden, including transaction costs,

net of income taxes(b) ........................................................................................... - (4,122)

$53,623 $153,848

______________

(a) Includes operating results of AMC Networks through the date of the AMC Networks Distribution.

(b) Includes operating results of the Madison Square Garden segment from January 1, 2010 through the date of the

MSG Distribution.

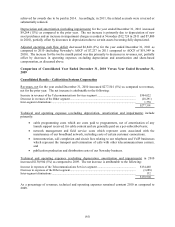

Business Segments Results

Telecommunications Services

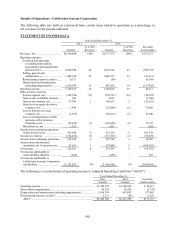

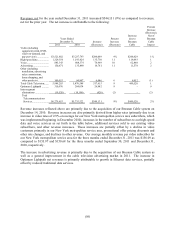

The table below sets forth, for the periods presented, certain historical financial information and the

percentage that those items bear to revenues, net for our Telecommunications Services segment:

Years Ended December 31,

2011 2010

Amount

% of Net

Revenues

Amount

% of Net

Revenues

Favorable

(Unfavorable)

Revenues, net ..................

.

$6,279,653 100% $5,735,522 100% $ 544,131

Technical and operating

expenses (excluding

depreciation and

amortization shown

below) .........................

.

2,648,743 42 2,334,456 41 (314,287)

Selling, general and

administrative

expenses ......................

.

1,167,632 19 1,103,313 19 (64,319)

Depreciation and

amortization ................

.

942,647 15 824,029 14 (118,618)

Operating income ........

.

$1,520,631 24% $1,473,724 26% $ 46,907

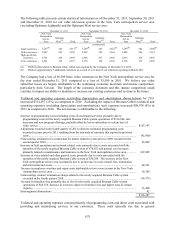

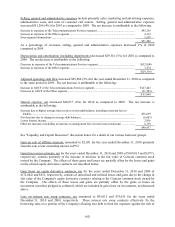

The following is a reconciliation of operating income to AOCF:

Years Ended December 31,

2011 2010 Favorable

Amount Amount (Unfavorable)

Operating income ....................................................................

.

$1,520,631 $1,473,724 $ 46,907

Share-based compensation .......................................................

.

32,635 33,885 (1,250)

Depreciation and amortization .................................................

.

942,647 824,029 118,618

AOCF ...............................................................................

.

$2,495,913 $2,331,638 $164,275