Cablevision 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(53)

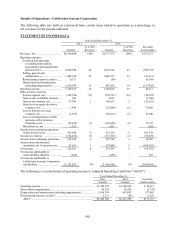

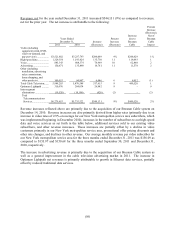

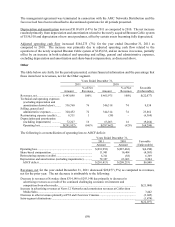

Technical and operating expenses (excluding depreciation, amortization and impairments) in 2011

increased $304,792 (11%) as compared to 2010. The net increase is attributable to the following:

Increase in expenses of the Telecommunications Services segment ..................................................... $314,287

Decrease in expenses of the Other segment ........................................................................................... (9,558)

Inter-segment eliminations .................................................................................................................... 63

$304,792

As a percentage of revenues, technical and operating expenses increased 1% in 2011 as compared to

2010.

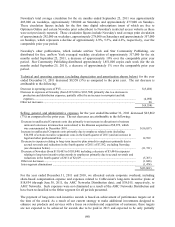

Selling, general and administrative expenses include primarily sales, marketing and advertising expenses,

administrative costs, and costs of customer call centers. Selling, general and administrative expenses

increased $41,613 (3%) for 2011 as compared to 2010. The net increase is attributable to the following:

Increase in expenses of the Telecommunications Services segment .................................................... $ 64,319

Decrease in expenses of the Other segment .......................................................................................... (23,862)

Inter-segment eliminations ................................................................................................................... 1,156

$ 41,613

As a percentage of revenues, selling, general and administrative expenses decreased 1% in 2011 as

compared to 2010.

Depreciation and amortization (including impairments) increased $127,882 (14%) for 2011 as compared

to 2010. The net increase is attributable to the following:

Increase in expenses of the Telecommunications Services segment .................................................... $118,618

Increase in expenses of the Other segment ........................................................................................... 9,264

$127,882

Adjusted operating cash flow increased $171,115 (8%) for the year ended December 31, 2011 as

compared to the same period in 2010. The net increase is attributable to the following:

Increase in AOCF of the Telecommunications Services segment ......................................................... $164,275

Increase in AOCF of the Other segment ................................................................................................ 6,840

$171,115

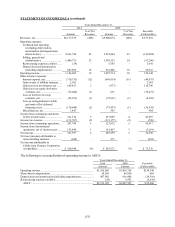

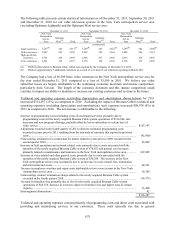

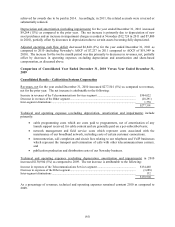

Interest expense, net increased $34,955 (5%) for 2011 as compared to 2010. The net increase is

attributable to the following:

Net increase due to change in average debt balances ........................................................................... $ 36,391

Increase due to higher average interest rates on our indebtedness ........................................................ 9,887

Higher interest income ........................................................................................................................... (339)

Other net decrease (term loan extension fees of $11,034 were included in 2010) ................................ (10,984)

$ 34,955

See "Liquidity and Capital Resources" discussion below for a detail of our borrower groups.

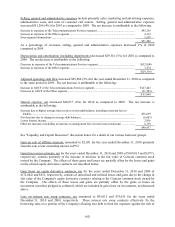

Gain on sale of affiliate interests of $683 and $2,051 for the years ended December 31, 2011 and 2010,

respectively, relate to the installment sale of our ownership interest in PVI Virtual Media Services LLC

("PVI").

Gain on investments, net for the years ended December 31, 2011 and 2010 of $37,384 and $109,813,

respectively, consists primarily of the increase in the fair value of Comcast common stock owned by the

Company. The effects of these gains are partially offset by the losses on the related equity derivative

contracts, net described below.