Cablevision 2011 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-49

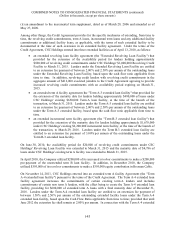

used by Cablevision to repay a portion of the Cablevision floating rate senior notes due April 1, 2009

("April 2009 Notes"). In connection with the issuance of these senior notes, the Company incurred

deferred financing costs of $16,434, which are being amortized to interest expense over the term of the

senior notes.

CSC Holdings 8-5/8% Senior Notes Due 2019

On February 12, 2009, CSC Holdings issued $526,000 aggregate principal amount of 8-5/8% senior notes

due February 15, 2019. These notes are senior unsecured obligations and are not guaranteed by any of

CSC Holdings' subsidiaries. Gross proceeds from the issuance were approximately $500,731 after giving

effect to the original issue discount of approximately $25,269. The proceeds were used in connection

with the February 2009 tender offers discussed below and to repay a portion of the outstanding $500,000

aggregate principal amount of Cablevision's April 2009 Notes. In connection with the issuance of these

senior notes, the Company incurred deferred financing costs of $10,832, which are being amortized to

interest expense over the term of the senior notes.

Cablevision 7-3/4% Senior Notes Due 2018 and 8% Senior Notes Due 2020

On April 15, 2010, Cablevision issued $750,000 aggregate principal amount of 7-3/4% senior notes due

April 15, 2018 and $500,000 aggregate principal amount of 8% senior notes due April 15, 2020 in a

registered public offering. These senior notes are Cablevision's senior unsecured obligations and rank

equally in right of payment with all of Cablevision's other existing and future unsecured and

unsubordinated indebtedness. The Company used the net proceeds of the offering to repurchase the April

2012 Notes (as defined below) in the tender offer Cablevision commenced on April 12, 2010 discussed

below and for general corporate purposes. In connection with the issuance of these senior notes, the

Company incurred deferred financing costs of $26,481, which are being amortized to interest expense

over the term of these senior notes.

Cablevision 8-5/8% Senior Notes Due 2017

On September 23, 2009, Cablevision issued $900,000 aggregate principal amount of 8-5/8% senior notes

due September 15, 2017. These notes are senior unsecured obligations and are not guaranteed by any of

Cablevision's subsidiaries. Gross proceeds from the issuance were approximately $887,364 after giving

effect to the original issue discount of approximately $12,636. The net proceeds were used in connection

with the September 2009 tender offers discussed below. In connection with the issuance of these debt

securities, the Company incurred deferred financing costs of $19,021, which are being amortized to

interest expense over the term of the senior notes.

Bresnan Cable 8% Senior Notes Due 2018

On December 14, 2010, in connection with the financing of the Bresnan acquisition, BBHI

Acquisition LLC issued $250,000 aggregate principal amount of 8% senior notes due December 15, 2018

(the "Bresnan Notes"). The Bresnan Notes are guaranteed by all of Bresnan Cable's (the successor entity

to BBHI Acquisition LLC) existing subsidiaries and will be guaranteed by certain of Bresnan Cable's

future subsidiaries. In connection with the issuance of these senior notes, the Company incurred deferred

financing costs of $5,781, which are being amortized to interest expense over the term of these senior

notes.