Cablevision 2011 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-61

Subsequent to the utilization of Cablevision's NOLs and tax credit carry forwards, payments for income

taxes are expected to increase significantly.

CSC Holdings

CSC Holdings and its 80% or more owned subsidiaries were included in the consolidated federal income

tax returns of Cablevision for the years presented herein. CSC Holdings was converted to a limited

liability company on November 10, 2009. The income tax provision for CSC Holdings is determined on

a stand-alone basis for all periods presented, including the period subsequent to the LLC conversion, as if

CSC Holdings filed separate consolidated income tax returns.

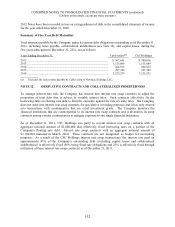

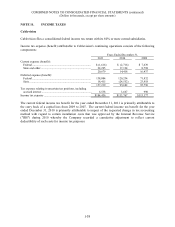

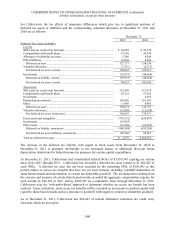

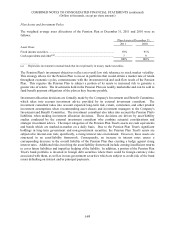

Income tax expense (benefit) attributable to continuing operations consists of the following components:

Years Ended December 31,

2011 2010 2009

Current expense:

Federal ................................................................................. $ (835) $ 6,190 $ 11,174

State and other ...................................................................... 33,491 17,134 8,798

32,656 23,324 19,972

Deferred expense (benefit):

Federal ................................................................................. 210,415 226,188 125,182

State ..................................................................................... 42,989 (2,293) 38,111

253,404 223,895 163,293

Tax expense relating to uncertain tax positions, including

accrued interest .................................................................... 6,538 3,667 990

Income tax expense ................................................................. $292,598 $250,886 $184,255

The current federal income tax benefit for the year ended December 31, 2011 is primarily attributable to

the carry back of a capital loss from 2009 to 2007. The current federal tax expense for the year ended

December 31, 2010 is primarily attributable to the estimated federal income tax liability of CSC Holdings

on a stand-alone basis, partially offset by the impact of the requested change in tax accounting method

with regard to certain installation costs that was approved by the IRS during 2010 whereby the Company

recorded a cumulative adjustment to reflect current deductibility of such costs for income tax purposes.

In connection with the tax allocation policy between CSC Holdings and Cablevision, CSC Holdings has

recorded a payable due to Cablevision and Cablevision has recorded a receivable due from CSC

Holdings, both in the amount of $773, representing the estimated federal income tax liability of CSC

Holdings for the year ended December 31, 2011 as determined on a stand-alone basis as if CSC Holdings

filed separate federal consolidated income tax returns.