Cablevision 2011 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-84

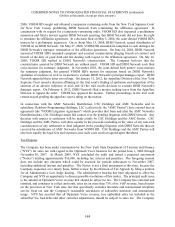

2008, VOOM HD sought and obtained a temporary restraining order from the New York Supreme Court

for New York County prohibiting DISH Network from terminating the affiliation agreement. In

conjunction with its request for a temporary restraining order, VOOM HD also requested a preliminary

injunction and filed a lawsuit against DISH Network asserting that DISH Network did not have the right

to terminate the affiliation agreement. In a decision filed on May 5, 2008, the court denied VOOM HD's

motion for a preliminary injunction. On or about May 13, 2008, DISH Network ceased distribution of

VOOM on its DISH Network. On May 27, 2008, VOOM HD amended its complaint to seek damages for

DISH Network's improper termination of the affiliation agreement. On June 24, 2008, DISH Network

answered VOOM HD's amended complaint and asserted counterclaims alleging breach of contract and

breach of the duty of good faith and fair dealing with respect to the affiliation agreement. On July 14,

2008, VOOM HD replied to DISH Network's counterclaims. The Company believes that the

counterclaims asserted by DISH Network are without merit. VOOM HD and DISH Network each filed

cross-motions for summary judgment. In November 2010, the court denied both parties' cross-motions

for summary judgment, but granted VOOM HD's motion for sanctions based on DISH Network's

spoliation of evidence as well as its motion to exclude DISH Network's principal damages expert. DISH

Network appealed these latter two rulings. On January 31, 2012, the Appellate Division of the New York

Supreme Court issued a decision affirming (i) the trial court's finding of spoliation and imposition of the

sanction of an adverse inference at trial; and (ii) the trial court's decision to exclude DISH Network's

damages expert. On February 6, 2012, DISH Network filed a motion seeking leave from the Appellate

Division to appeal the order. VOOM has opposed the motion. Further proceedings in the trial court

remain stayed pending the appellate court's ruling on the motion.

In connection with the AMC Networks Distribution, CSC Holdings and AMC Networks and its

subsidiary, Rainbow Programming Holdings, LLC (collectively, the "AMC Parties") have entered into an

agreement (the "VOOM Litigation Agreement") which provides that from and after the AMC Networks

Distribution date, CSC Holdings retains full control over the pending litigation with DISH Network. Any

decision with respect to settlement will be made jointly by CSC Holdings and the AMC Parties. CSC

Holdings and the AMC Parties will share equally in the proceeds (including in the value of any non-cash

consideration) of any settlement or final judgment in the pending litigation with DISH Network that are

received by subsidiaries of AMC Networks from VOOM HD. CSC Holdings and the AMC Parties will

also bear equally the legal fees and expenses once such costs reach an agreed-upon threshold.

Tax Disputes

The Company has been under examination by the New York State Department of Taxation and Finance

("NYS") for sales tax with regard to the Optimum Voice business for the period June 1, 2006 through

November 30, 2007. In March 2009, NYS concluded the audit and issued a proposed assessment

("Notice") totaling approximately $16,000, including tax, interest and penalties. The foregoing amount

does not include any amounts which could be assessed for periods subsequent to November 2007,

including additional interest and penalties. The Notice is not a final assessment at this time, because the

Company requested, on a timely basis, further review by the Division of Tax Appeals by filing a petition

for an Administrative Law Judge hearing. The administrative hearing has been adjourned to allow the

Company and NYS an opportunity to discuss possible resolutions of this matter. The principal audit issue

is the amount of Optimum Voice revenue that should be subject to tax. The Company has collected and

remitted, and continues to collect and remit, sales tax on more than 75% of its VoIP revenue, based in part

on the provision of New York state law that specifically excludes interstate and international telephone

service from tax and the Company's reasonable calculation of subscriber interstate and international

usage. NYS has asserted that all Optimum Voice revenue, less embedded sales tax included in the

subscriber fee, bad debts and other customer adjustments, should be subject to sales tax. The Company