Cablevision 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(42)

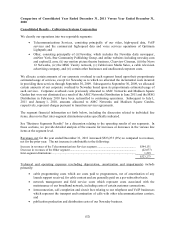

systems. Programming costs are the most significant part of our operating expenses and are expected to

continue to increase primarily as a result of contractual rate increases and additional service offerings.

Additionally, we currently anticipate an increase in our operating expenses as we make additional

investments designed to enhance our products and services with a focus on retention and acquisition of

subscribers.

In 2011, in our New York metropolitan service area, we began offering a free Optimum App for the iPad,

iPod Touch and iPhone, which allows our cable television customers to experience iO TV digital service

on their device in the home. While most programmers have not objected to the inclusion of their

programming in the in-home application, certain programmers have asserted that the application is a

material breach of their affiliation agreements and a copyright violation yielding statutory damages. The

Company has reached satisfactory resolutions of the issues with certain of these programmers. Other

programmers continue to have concerns, but the Company believes it has a strong legal position.

Our cable television service, which accounted for 54% of our consolidated revenues, net of inter-segment

eliminations, for the year ended December 31, 2011, faces competition from video service provided by

incumbent telephone companies, DBS service providers and others. As discussed in greater detail below,

we face intense competition in our New York metropolitan service area from two incumbent telephone

companies Verizon and AT&T, which offer video programming in addition to their voice and high-speed

Internet access services. To the extent the incumbent telephone companies, who have financial resources

that exceed ours, continue to offer promotional packages at prices lower than ours, our ability to maintain

or increase our existing customers and revenue may continue to be negatively impacted. There are two

major providers of DBS service in the United States, DISH Network and DirecTV, each with significantly

higher numbers of subscribers than we have. We compete in our service areas with these DBS

competitors by "bundling" our service offerings with products that the DBS companies cannot efficiently

provide at this time, such as high-speed data service, voice service and interactive services carried over

the cable distribution plant. Historically, we have made substantial investments in the development of

new and innovative programming options and other service offerings for our customers as a way of

differentiating ourselves from our competitors. We currently anticipate a significant increase in our level

of capital expenditures to enhance our product and service offerings.

Verizon and AT&T offer video programming as well as voice and high-speed Internet access services to

residential customers in our New York metropolitan service area. Verizon has constructed fiber to the

home network plant that passes a significant number of households in our New York metropolitan service

area (while difficult to assess, our estimates indicate that Verizon passes more than 45% of these

households, based on currently available information). Verizon has obtained authority to provide video

service for a majority of these homes passed, on a statewide basis in New Jersey, in numerous local

franchises in New York State, including all of New York City, and in a small portion of Connecticut.

AT&T offers video service in competition with us in most of our Connecticut service area. This

competition impacts our video revenue in these areas and may continue to do so in the future.

Our high-speed data services business, which accounted for 20% of our consolidated revenues, net of

inter-segment eliminations, for the year ended December 31, 2011, faces intense competition from other

providers of high-speed Internet access, including Verizon and AT&T in our New York metropolitan

service area and CenturyLink in our Optimum West service area. Due to our high penetration in our New

York metropolitan service area (54.9% of serviceable passings at December 31, 2011) and the impact of

intense competition, our ability to maintain or increase our existing customers and revenue in the future

may continue to be negatively impacted.

Our VoIP offering, which accounted for 13% of our consolidated revenues, net of inter-segment

eliminations, for the year ended December 31, 2011, faces intense competition from other providers of

voice services, including carriers such as Verizon and AT&T in the New York metropolitan service area

and CenturyLink in our Optimum West service area. We compete primarily on the basis of pricing,

where unlimited United States and Canada (including Puerto Rico in the New York metropolitan service