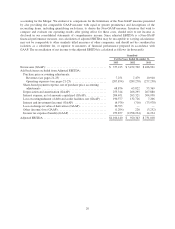

XM Radio 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Goodwill. Goodwill represents the excess of the purchase price over the estimated fair value of net

tangible and identifiable intangible assets acquired in business combinations. Our annual impairment assessment

of our single reporting unit is performed as of the fourth quarter of each year. Assessments are performed at other

times if events or circumstances indicate it is more likely than not that the asset is impaired. Step one of the

impairment assessment compares the fair value of the entity to its carrying value and if the fair value exceeds its

carrying value, goodwill is not impaired. If the carrying value exceeds the fair value, the implied fair value of

goodwill is compared to the carrying value of goodwill; an impairment loss will be recorded for the amount the

carrying value exceeds the implied fair value. At the date of our annual assessment for 2013, the fair value of our

single reporting unit substantially exceeded its carrying value and therefore was not at risk of failing step one of

ASC 350-20, Goodwill. Subsequent to our annual evaluation of the carrying value of goodwill, there were no

events or circumstances that triggered the need for an interim evaluation for impairment. As a result, there were

no impairment charges to our goodwill during the years ended December 31, 2013 or 2012.

Long-Lived and Indefinite-Lived Assets. We carry our long-lived assets at cost less accumulated

amortization and depreciation. We review our long-lived assets for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset is not recoverable. At the time an impairment in the

value of a long-lived asset is identified, the impairment is measured as the amount by which the carrying amount

of a long-lived asset exceeds its fair value.

Our annual impairment assessment of indefinite-lived assets, our FCC licenses and XM trademark, is

performed as of the fourth quarter of each year and an assessment is made at other times if events or changes in

circumstances indicate that it is more likely than not that the asset is impaired. ASU 2012-02, Testing Indefinite-

Lived Intangible Assets for Impairment, establishes an option to first perform a qualitative assessment to

determine whether it is more likely than not that an asset is impaired. If the qualitative assessment supports that it

is more likely than not that the fair value of the asset exceeds its carrying value, a company is not required to

perform a quantitative impairment test. If the qualitative assessment does not support the fair value of the asset,

then a quantitative assessment is performed. During the fourth quarter of 2013, a qualitative impairment analysis

was performed and we determined that the fair value of our FCC licenses and trademark substantially exceeded

the carrying value and therefore was not at risk of impairment. Our qualitative assessment includes the

consideration of our long-term financial projections, current and historical weighted average cost of capital and

liquidity factors, legal and regulatory issues and industry and market pressures. Subsequent to our annual

evaluation of the carrying value of our long-lived assets, there were no events or circumstances that triggered the

need for an impairment evaluation.

There were no changes in the carrying value of our indefinite life intangible assets during the years ended

December 31, 2013 and 2012.

Useful Life of Broadcast/Transmission System. Our satellite system includes the costs of our satellite

construction, launch vehicles, launch insurance, capitalized interest, spare satellites, terrestrial repeater network

and satellite uplink facilities. We monitor our satellites for impairment whenever events or changes in

circumstances indicate that the carrying amount of the asset is not recoverable.

We operate five in-orbit Sirius satellites, FM-1, FM-2, FM-3, FM-5 and FM-6. Our FM-1 and FM-2

satellites were launched in 2000 and reached the end of their depreciable lives in 2013, but are still in operation.

We estimate that our FM-3, FM-5 and FM-6 satellites, launched in 2000, 2009 and 2013, respectively, will

operate effectively through the end of their depreciable lives in 2015, 2024 and 2028, respectively. We operate

five in-orbit XM satellites, XM-1, XM-2, XM-3, XM-4 and XM-5, three of which function as in-orbit spares.

Our XM-1 and XM-2 in-orbit spare satellites launched in 2001 reached the end of their depreciable lives in 2013

and are expected to be removed from orbit in 2014. We estimate that our third in-orbit spare satellite, XM-5,

launched in 2010 and our two other XM satellites, XM-3, launched in 2005, and XM-4, launched in 2006, will

meet their 15-year estimated depreciable lives.

18